Vonage 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

In thousands, except per share amounts

)

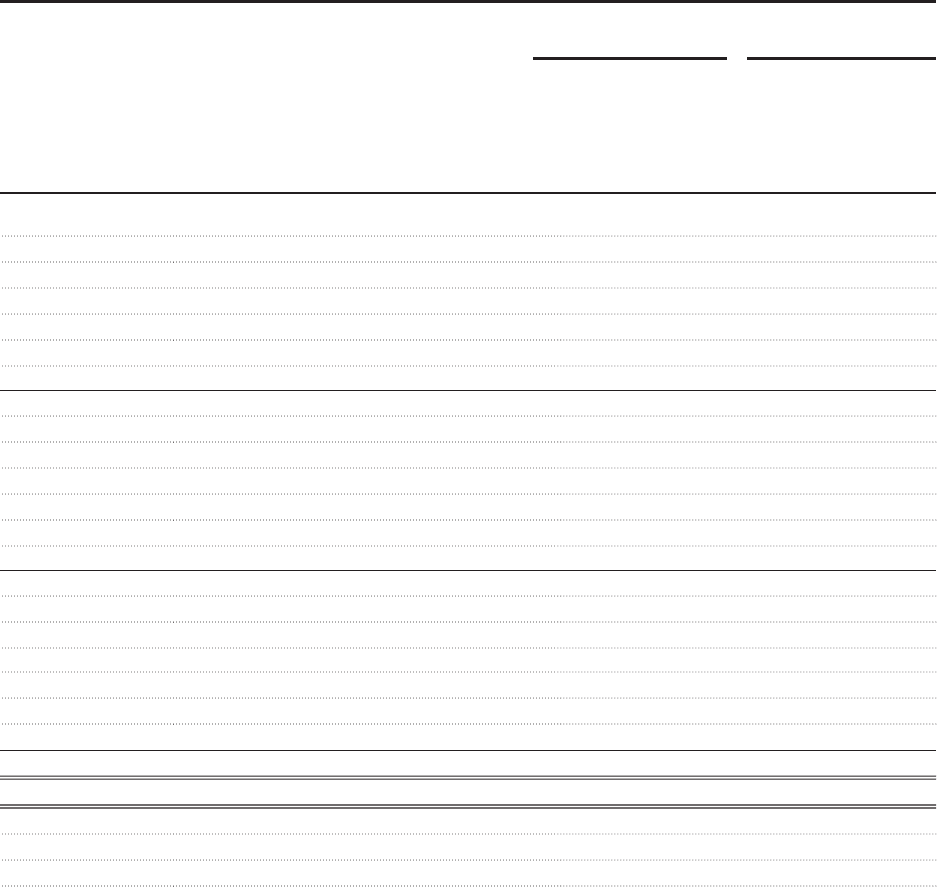

T

he following table summarizes the activity for all awards under both of our

S

tock Incentive Plans

:

S

tock

O

ptions

O

utstandin

g

R

estricted

S

tock and

Restricted

S

tock Unit

s

O

utstandin

g

N

um

b

er o

f

S

hare

s

W

e

i

g

h

te

d

A

verag

e

E

xerc

i

se

P

r

i

ce

P

er

S

hare

N

um

b

er o

f

S

hare

s

W

e

i

g

h

te

d

A

verage

G

ran

t

D

ate

F

a

i

r

M

ar

k

et

V

a

l

u

e

P

er

S

har

e

(

in thousands

)(

in thousands

)

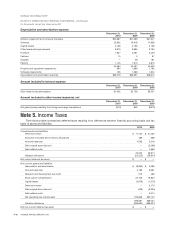

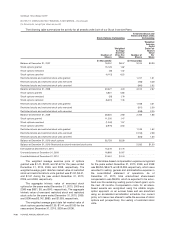

Balance at December 31, 2007 18,257

$

6.47 3,104

$

3.3

3

Stock options granted 15,128 1.6

2

Stock options exercised (46) 1.0

2

S

tock o

p

tions canceled

(

4,112

)

6.2

5

Restricted stocks and restricted stock units

g

ranted 1,747 1.9

1

Restricted stocks and restricted stock units exercised (786) 3.2

8

Restricted stocks and restricted stock units canceled (960) 2.9

2

B

a

l

ance at

D

ecem

b

er 31

,

2008 29

,

227 4.00 3

,

105 2.67

S

tock options

g

ranted 5,631 0.83

S

tock o

p

tions exercised

(

33

)

1.76

Stock options canceled (6,291) 7.4

6

R

estr

i

cte

d

stoc

k

san

d

restr

i

cte

d

stoc

k

un

i

ts grante

d

1,188 0.5

1

Restricted stocks and restricted stock units exercised

(

971

)

2.5

9

Restricted stocks and restricted stock units canceled

(

536

)

2.25

Balance at December 31, 2009 28,534 2.68 2,786 1.86

Stock options granted 11,205 1.47

Stock options exercised (1,040) 1.5

7

S

tock o

p

tions canceled

(

2,970

)

3.53

Restricted stocks and restricted stock units

g

ranted 1,199 1.5

2

Restricted stocks and restricted stock units exercised

(

1,150

)

2.3

8

Restricted stocks and restricted stock units canceled (503) 1.55

Balance at December 31, 2010-stock options 35,729 $2.26

Balance at December 31

,

2010-Restricted stock and restricted stock units 2

,

332 $1.5

0

Exercisable at December 31

,

2010 15

,

278

$

1.75

Unvested shares at December 31, 2009 16,669

$

1.67

Unvested shares at December 31

,

2010 20

,

451 $1.44

T

he wei

g

hted avera

g

e exercise price o

f

option

s

g

ranted was $1.47, $0.83, and $1.62 for the years ended

December 31, 2010, 2009, and 2008, respectively. The

wei

g

hted avera

g

e

g

rant date

f

air market value o

f

restricte

d

s

tock and restricted stock units

g

ranted was $1.52, $0.51,

and $1.91 durin

g

the year ended December 31, 2010

,

2009, and 2008, respectively

.

T

he aggregate intrinsic value of exercised stoc

k

options for the

y

ears ended December 31, 2010, 2009 an

d

2008 was

$

851,

$

5, and

$

43, respectively. The aggregat

e

i

ntrinsic value of exercised restricted stock and restricte

d

s

tock units for the

y

ears ended December 31, 2010, 2009,

and 2008 was

$

2,142,

$

880, and

$

1,059, respectivel

y

.

T

he wei

g

hted avera

g

e

g

rant date

f

air market value o

f

s

tock options

g

ranted was $1.35, $1.44, and $1.85 for th

e

y

ears ended December 31, 2010, 2009 and 2008.

T

ota

l

s

h

are-

b

ase

d

compensat

i

on expense recogn

i

ze

d

f

or the

y

ears ended December 31, 2010, 2009, and 200

8

was $8,255, $8,473, and $12,238, respectivel

y

, which were

recor

d

e

d

to se

lli

ng, genera

l

an

d

a

d

m

i

n

i

strat

i

ve expense

i

n

t

he consolidated statement o

f

operations. As o

f

D

ecem

b

er 31

,

2010

,

tota

l

unamort

i

ze

d

s

h

are-

b

ase

d

compensation was

$

9,879, which is expected to be amor-

t

ized over the remaining vesting period of each grant, up to

t

he next 48 months.

C

ompensation costs for all share

-

b

ase

d

awar

d

s are recogn

i

ze

d

us

i

ng t

h

e rata

bl

es

i

ng

l

e-

opt

i

on approac

h

on an accrua

lb

as

i

san

d

are amort

i

ze

d

u

sing an accelerated amortization schedule.

O

ur curren

t

polic

y

is to issue new shares to settle the exercise of stock

options and prospectively, the vesting of restricted stock

u

n

i

ts

.

F-26

VO

NA

G

E ANN

U

AL REP

O

RT 2010