Vonage 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

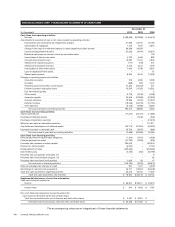

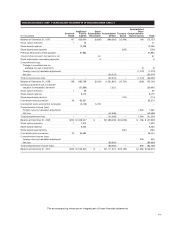

VONAGE HOLDINGS CORP. CONSOLIDATED BALANCE SHEETS

(In thousands, except par value)

D

ecem

b

er

3

1

,

20

1

0

D

ecem

b

er

3

1

,

2009

A

sset

s

C

urrent assets

:

C

ash and cash e

q

uivalents

$

78,934

$

32,213

Accounts receivable, net of allowance of

$

588 and

$

1,432, respectively 15,207 15,053

I

nventory, net of allowance of

$

763 and

$

432, respectively 6,143 7,771

D

eferred customer ac

q

uisition costs, current 6,481 15,99

7

P

re

p

aid ex

p

enses and other current assets

1

7,

231 40

,

425

To

t

a

l

cu

rr

e

nt

asse

t

s

123

,

996 111

,

4

5

9

P

roperty and equipment, net

79

,

0

5

090

,5

48

S

oftware, net

3

5,5

16 3

5,5

40

D

eferred customer ac

q

uisition costs, non-current 1,093 7,07

5

D

ebt related costs, net

5

,

3

7

2

7,

412

Res

tri

c

t

ed cas

h 7,

9

7

843

,7

00

I

ntan

g

ible assets, net

4

,

186

5,

331

O

ther asset

s

3

,

201 12

,

319

T

ota

l

asset

s

$ 260

,

392 $ 313

,

38

4

Liabilities and

S

tockholders’ Deficit

Li

ab

iliti

es

C

urrent liabilities:

A

ccounts payabl

e

$

37,128

$

11,51

2

A

ccrued ex

p

enses

89

,

40

7

69

,

1

7

1

D

eferred revenue, current

p

ortio

n

43

,

39

7 55,

929

C

urrent maturities of capital lease obli

g

ations 1,783 1,50

0

C

urrent portion of notes payable

s

20

,

000 1

,

303

To

t

a

l

cu

rr

e

nt li

ab

iliti

es

191

,7

1

5

139

,

415

Notes payable, net of discount and current maturities 173,004 200,468

E

mbedded features within notes payable, at fair value — 25,05

0

D

eferred revenue, net of current

p

ortion

1

,7

84 8

,

629

C

apital lease obli

g

ations, net of current maturities 17,665 19,448

O

ther liabilities, net of current

p

ortion in accrued ex

p

enses 5,871 12,283

T

ota

lli

a

bili

t

i

e

s

3

90

,

039 405

,

293

C

ommitments and Contingencies

S

tockholders’ Defici

t

Common stock,

p

ar value

$

0.001

p

er share; 596,950 shares authorized at December 31, 2010 an

d

D

ecember 31, 2009; 223,454 and 201,628 shares issued at December 31, 2010 and December 31

,

2

009, respect

i

ve

l

y; 221,566 an

d

199,898 s

h

ares outstan

di

ng at

D

ecem

b

er 31, 2010 an

d

D

ecem

b

er 31, 2009, respect

i

ve

ly

2

23 202

Addi

t

i

ona

l

pa

id

-

i

n cap

i

ta

l

1

,

053

,

805 1

,

008

,

54

7

A

ccumulated de

f

ici

t

(1,171,901) (1,088,236

)

T

reasur

y

stock, at cost, 1,888 shares at December 31, 2010 and 1,730 shares at December 31, 2009 (13,139) (12,878

)

A

ccumu

l

ate

d

ot

h

er compre

h

ens

i

ve

i

ncome 1

,

365 45

6

To

t

a

l

s

t

oc

kh

o

l

de

r

s

’

de

fi

c

i

t

(

129,647

)(

91,909

)

T

otal liabilities and stockholders’ deficit

$

260,392

$

313,384

T

he accompanyin

g

notes are an inte

g

ral part o

f

these

f

inancial statement

s

F

-

4

VO

NA

G

E ANN

U

AL REP

O

RT 2010