Vonage 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009

compare

d

to

2008

M

ar

k

et

i

ng

.

T

he decrease in marketing expense of

$

25,380

,

o

r 10%, was primaril

y

related to a decrease in alternative media

o

f

$

8,055, in online advertising of

$

19,831, in retail advertising o

f

$

7

,

030

,

and in direct mail costs of

$

4

,

084. These decrease

s

were offset by an increase in television advertisin

g

of

$

13,919

.

F

or year ended December 31, 2009, we reduced marketin

g

s

pendin

g

as we completed the transition to our new a

g

encie

s

a

nd continued the development of new advertisin

g

and elimi

-

nated inefficient non-media spendin

g

.

D

eprec

i

at

i

on an

dA

mort

i

zat

i

o

n

F

or the Years Ended December 31

,

D

o

ll

ar

C

hang

e

20

1

0

vs.

2009

D

o

ll

ar

C

hang

e

2009

vs.

2008

P

ercent

C

hange

20

1

0

vs

.

2009

P

ercent

C

hang

e

2009

vs.

2008

(

in thousands, except percentages

)

20

1

0 2009 2008

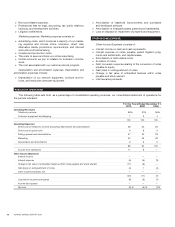

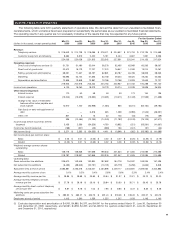

Depreciation and amortization $53,073 $53,391 $48,612 $(318) $4,779 (1%) 10

%

20

1

0

compare

d

to

2009

D

eprec

i

at

i

on an

d

amort

i

zat

i

on

.

Th

e

d

ecrease

i

n

d

eprec

i

a

-

tion and amortization of

$

318, or 1%, was primaril

y

due to lower

impairment charges of

$

2,235, lower depreciation of network

e

quipment, computer hardware, and furniture of

$

1,045, an

d

lower patent amortization of

$

174, partiall

y

offset b

y

an increase

in software amortization of

$

3

,

184.

2009

compare

d

to

2008

D

eprec

i

at

i

on an

d

amort

i

zat

i

on

.

Th

e

i

ncrease

i

n

d

eprec

i

at

i

o

n

a

nd amortization of

$

4,779, or 10%, was primaril

y

due to an

increase in software amortization of

$

6,725, including lowe

r

impairment charges of

$

835. These increases were offset by a

d

ecrease in depreciation of network equipment and computer

e

quipment of

$

449, including higher impairment charges of

$

12

3

a

nd less amortization related to patents of

$

1,496.

Other Income (Expense

)

F

or t

h

e

Y

ears

E

n

d

e

dD

ecem

b

er

3

1

,

D

o

ll

a

r

C

hange

20

1

0

vs

.

2009

D

o

ll

ar

Chang

e

2009

vs.

2008

P

ercent

C

hange

20

1

0

vs

.

2009

P

ercent

Chang

e

2009

vs.

2008

(in thousands, except percentages

)

20

1

0 2009 2008

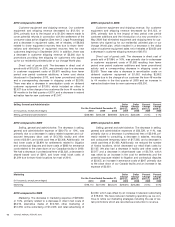

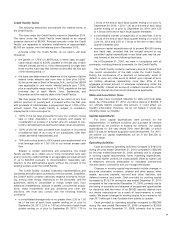

Interest income $ 519 $ 277 $ 3,236 $ 242 $ (2,959) 87% (91%

)

Interest expense (48,541) (54,192) (29,878) 5,651 (24,314) 10% (81%)

C

hange in fair value of embedded features within notes payable an

d

stock warrant

(

99,338

)(

49,933

)

—

(

49,405

)(

49,933

)(

99%

)*

G

ain

(

loss

)

on extin

g

uishment of notes

(

31,023

)

4,041

(

30,570

)(

35,064

)

34,611

(

868%

)

113

%

O

ther income

(

ex

p

ense

)

, net

(

18

)

843

(

247

)(

861

)

1,090

(

102%

)

441

%

$(178,401) $(98,964) $(57,459)

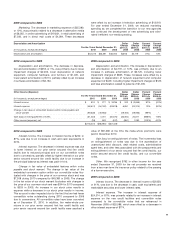

2010 com

p

ared to 2009

I

nt

e

r

es

tin

co

m

e.

T

he increase in interest income of $242, o

r

87

%

, was due to an increase in cash and cash e

q

uivalents i

n

2010

.

I

nterest ex

p

ense

.

The decrease in interest ex

p

ense was du

e

to lower interest on our

p

rior senior secured

f

irst lien credit

f

acility due to reduced principal and on our convertible note

s

d

ue to conversions, partially o

ff

set by hi

g

her interest on our prior

senior secured second lien credit

f

acilit

y

due to an increase in

t

h

epr

i

nc

i

pa

lb

a

l

ance as

i

nterest was pa

id

-

i

n-

ki

n

d.

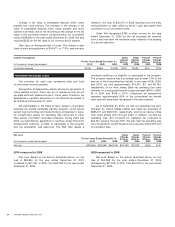

Change in fair value of embedded features within notes

p

aya

bl

ean

d

stoc

k

warran

t

.

The change in

f

air value o

f

th

e

e

mbedded conversion option within our convertible notes

f

luc

-

tuated with changes in the price o

f

our common stock and was

$

7,308 during 2010 compared to

$

49,380 in 2009. The chang

e

in the fair value of our stock warrant fluctuates with changes i

n

the price of our common stock and was

$

344 in 2010 compared

to

$

553 in 2009. An increase in our stock price results i

n

e

xpense w

hil

ea

d

ecrease

i

n our stoc

k

pr

i

ce resu

l

ts

i

n

i

ncome.

This account is also impacted due to the fact that we had fewer

c

onvert

ibl

e notes outstan

di

ng

d

ur

i

ng 2010 compare

d

to 200

9

d

ue to convers

i

ons.

All

convert

ibl

e notes

h

ave

b

een converte

d

a

s of December 31, 2010. In addition, the make-whole pre

-

m

iums in our prior senior secured first lien credit facilit

y

an

d

prior senior secured second lien credit facilit

y

were ascribed a

value of $91,686 at the time the make-whole

p

remiums wer

e

p

aid in December 2010

.

Gain (loss) on extin

g

uishment of notes. Th

e

in

c

r

e

m

e

nt

a

ll

oss

o

n extin

g

uishment o

f

notes was due to the acceleration o

f

u

namortized debt discount, debt related costs, administrative

ag

ent

f

ees, and other

f

ees associated with the prepayments an

d

e

xtin

g

uishment o

f

our senior secured

f

irst lien credit

f

acility, ou

r

senior secured second lien credit

f

acility, and our convertible

no

t

es

.

Other. We reco

g

nized $792 in other income for the yea

r

ended December 31, 2009

f

or the net proceeds we received

f

rom a key-man term li

f

e insurance policy related to the passin

g

o

f

a

f

ormer executive

.

2009 com

p

ared to 2008

I

nt

e

r

es

tin

co

m

e.

T

he decrease in interest income of $2,959,

or 91

%

, was due to the decrease in cash, cash e

q

uivalents an

d

m

a

rk

e

t

ab

l

e secu

riti

es a

n

d

l

o

w

e

r int

e

r

es

tr

a

t

es.

I

nterest ex

p

ense

.

T

he increase in interest ex

p

ense o

f

$

24,314, or 81%, was primarily related to an increase in interest

e

x

p

ense on the new credit

f

acilities and convertible note

s

c

om

p

ared to the convertible notes that we re

f

inanced i

n

November 2008 of $25,088, which was offset by a decrease in

o

ther interest ex

p

ense of $774

.

3

3