Vonage 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

OTES TO CONSOLIDATED FINANCIAL STATEMENT

S

(

In thousands, except per share amounts

)

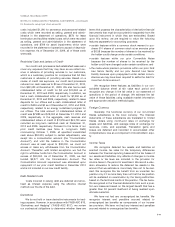

NATURE OF OPERATIONS

Vonage Holdings

C

orp.

(

“Vonage”, “

C

ompany”, “we”,

“our”, “us”

)

is incor

p

orated as a Delaware cor

p

oration. W

e

are a leadin

g

provider of low-cost communications services

connectin

g

people throu

g

h broadband devices worldwide

.

While customers in the United

S

tates re

p

resented 94% of

our subscriber lines at December 31, 2010, we also bil

l

customers in

C

anada and the United Kin

g

dom

.

SIGNIFICANT ACCOUNTING POLICIES

Principles of

C

onsolidation

T

he consolidated

f

inancial statements include th

e

accounts of Vonage and its wholly-owned subsidiaries. Al

l

i

ntercompan

yb

a

l

ances an

d

transact

i

ons

h

ave

b

een e

li

m

i-

nate

di

n conso

lid

at

i

on

.

U

se of Estimates

O

ur consolidated financial statements are

p

re

p

ared i

n

con

f

ormity with accountin

g

principles

g

enerally accepted i

n

t

he United States, which require mana

g

ement to make

estimates and assum

p

tions that a

ff

ect the amounts

r

e

p

orted and disclosed in the consolidated

f

inancial state-

ments and the accompanyin

g

notes. Actual results coul

d

di

ff

er materially

f

rom these estimates

.

On an on

g

oin

g

basis, we evaluate our estimates, includ-

i

ng the

f

ollowing

:

>

t

hose related to the average period o

f

service to a

customer (the “customer life”) used to amortize deferre

d

revenue and de

f

erred customer acquisition costs asso

-

c

i

ate

d

w

i

t

h

customer act

i

vat

i

on

;

>

t

he useful lives of propert

y

and equipment, softwar

e

costs, an

di

ntang

ibl

e assets

;

>

assumptions used for the purpose of determining share-

based compensation and the fair value of our stock war

-

rant using the Black-

S

choles option pricing mode

l

(

“Model”

)

, and various other assumptions that w

e

believed to be reasonable. The ke

y

inputs for this Model

are our stoc

k

pr

i

ce at va

l

uat

i

on

d

ate, exerc

i

se pr

i

ce, t

he

dividend

y

ield, risk-free interest rate, life in

y

ears, and

h

istorical volatilit

y

of our common stock

;

>assum

p

tions used to determine the fair value of th

e

embedded conversion o

p

tion within our

p

rior 20% senior

secured third lien notes due 2015

(

“

C

onvertible Notes”

)

u

sin

g

the Monte

C

arlo simulation model. The key inputs

are maturity date, risk-free interest rate, our stock price a

t

valuation date, and historical volatility of our commo

n

stock; an

d

>

assumptions used to determine the fair value of th

e

embedded make-whole premium feature within our prio

r

senior secured first lien credit facilit

y(

the “First Lie

n

S

enior Facilit

y

”

)

and our prior senior secured second lien

credit facilit

y(

the “

S

econd Lien

S

enior Facilit

y

”

).

W

e

b

ase our est

i

mates on

hi

stor

i

ca

l

exper

i

ence, ava

il

-

able market information, a

pp

ro

p

riate valuation method

-

olo

g

ies, and on various other assumptions that we believed

t

o be reasonable, the results of which form the basis for

makin

g

jud

g

ments about the carryin

g

values of assets and

l

i

ab

iliti

es.

R

evenue

R

ecogn

i

t

i

on

O

perating revenues consist of telephony services

r

evenues and customer equipment

(

which enables our tel-

ephony services

)

and shipping revenues. The point in tim

e

at w

hi

c

h

revenues are recogn

i

ze

di

s

d

eterm

i

ne

di

n accor

d

-

ance with

S

taff Accounting Bulletin No. 104, Revenu

e

Recognition, and Financial Accounting

S

tandards Boar

d

(

“FA

S

B”

)

Accounting

S

tandards

C

odification

(

“A

SC

”

)

605

,

“

R

evenue

R

ecogn

i

t

i

o

n

.

”

Telephon

y

Services Revenu

e

S

ubstantially all of our operatin

g

revenues are teleph-

ony services revenues, which are derived primarily

f

rom

monthly subscription

f

ees that customers are char

g

e

d

under our service plans. We also derive telephony service

s

r

evenues

f

rom

p

er minute

f

ees

f

or international calls i

f

not

covered under a plan and

f

or any callin

g

minutes in excess

o

f

a customer’s monthly plan limits. Monthly subscriptio

n

f

ees are automatically char

g

ed to customers’ credit cards,

debit cards or electronic check payments (“ECP”) i

n

advance and are reco

g

nized over the

f

ollowin

g

month whe

n

s

ervices are provided. Revenues generated

f

rom interna

-

t

ional calls i

f

not covered under a plan and

f

rom customers

excee

di

ng a

ll

ocate

d

ca

ll

m

i

nutes un

d

er

li

m

i

te

d

m

i

nute p

l

an

s

are recogn

i

ze

d

as serv

i

ces are prov

id

e

d

,t

h

at

i

s, as m

i

nutes

are use

d,

an

d

are

bill

e

d

to a customer

’

s cre

di

t car

d

s

,d

e

bit

cards or ECP in arrears. As a result of our multiple billin

g

c

y

cles each month, we estimate the amount o

f

revenues

earned

f

rom international calls i

f

not covered under a pla

n

and from customers exceeding allocated call minutes under

l

imited minute plans but not billed from the end of each bill

-

i

ng cycle to the end of each reporting period and record

th

ese amounts as accounts rece

i

va

bl

e.

Th

ese est

i

mates are

b

ase

d

pr

i

mar

ily

upon

hi

stor

i

ca

l

m

i

nutes an

dh

ave

b

ee

n

cons

i

stent w

i

t

h

our actua

l

resu

l

ts.

F-

8

VO

NA

G

E ANN

U

AL REP

O

RT 2010

N

ote 1

.

Basis of Presentation and

S

ignificant Accounting Policie

s