Vonage 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

In thousands, except per share amounts

)

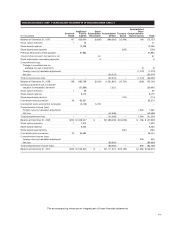

We have net losses for financial reporting purposes.

Recognition of deferred tax assets will require generatio

n

o

ff

u

t

u

r

e

t

a

x

ab

l

e

in

co

m

e

.Th

e

r

eca

n

be

n

o assu

r

a

n

ce

th

at

we will

g

enerate sufficient taxable income in future years

.

T

herefore

,

we established a valuation allowance on net

deferred tax assets of

$

415

,

903 as of December 31

,

2010

and

$

385,941 as of December 31, 2009

.

The com

p

onents of income

(

loss

)

before income tax ex

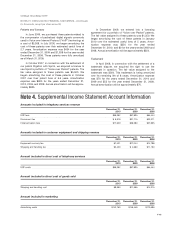

p

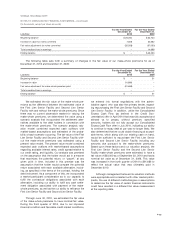

ense are as follows:

F

or t

h

e

Y

ears

E

n

d

e

dD

ecem

b

er

3

1

,

20

1

0 2009 2008

U

nited

S

tate

s

$

(86,030) $(41,761) $(59,475

)

F

ore

i

g

n

2,683 (1) (4,423

)

$(

83,347

)$(

41,762

)$(

63,898

)

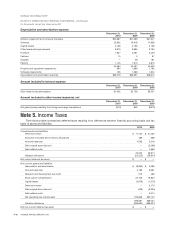

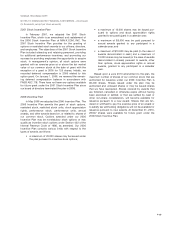

The com

p

onents of the income tax ex

p

ense are as follows

:

For the Years Ended December 31

,

2

0

1

0

2

009

2

008

C

urrent:

S

tate and local taxes

$(

304

)$(

836

)$(

678

)

Forei

gn

(

14

)

—

—

Fede

r

al

———

$(318) $(836) $(678

)

De

f

erred

:

S

tate and local taxes

$

—

$

—

$

—

Forei

gn

———

Fede

r

al

———

$

—

$

—

$

—

$(318) $(836) $(678

)

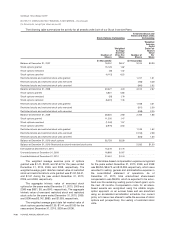

The reconciliation between the United

S

tates statutor

y

federal income tax rate and the effective rate is as follows

:

For the Years Ended December 31

,

20

1

0

2

009

2

008

U.

S

. Federal statutory tax rate

(

34%

)(

34%

)(

34%

)

P

e

rm

a

n

e

nt it

e

m

s

2

%

35

%

0

%

S

tate and local taxes, net of federal benefit 0% 2%

(

4%

)

S

ale of net operatin

g

loss carryforwards 0% 0%

(

1%

)

Va

l

ua

ti

o

nr

ese

rv

e

f

o

rin

co

m

e

t

a

x

es

3

2%

(

1%

)

40

%

Eff

ec

tiv

e

t

a

xr

a

t

e

0

%

2

%

1

%

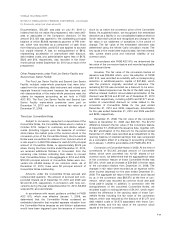

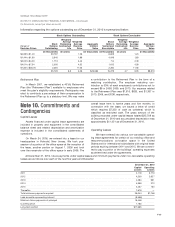

As of December 31, 2010, we had net operatin

g

loss

carry forwards for United

S

tates federal and state ta

x

p

urposes of

$

885,431 and

$

849,567, respectively, expir-

i

n

g

at various times from years endin

g

2012 throu

g

h2030

.

In addition, we had net operatin

g

loss carry forwards fo

r

C

anadian tax purposes of

$

42,457 expirin

g

throu

g

h 2027

.

We also had net operatin

g

loss carry

f

orwards

f

or Unite

d

Kin

g

dom tax purposes of

$

40,335 with no expiration date

.

No

p

rovision has been made

f

or income taxes on the

undistributed earnin

g

so

f

our

f

orei

g

n subsidiaries o

f

$

18,389 at December 31, 2010 as we intend to indefinitely

r

einvest such earnin

g

s.

U

nder Section 382 of the Internal Revenue Code, if

a

corporation under

g

oes an “ownership chan

g

e” (

g

enerall

y

defined as a

g

reater than 50% chan

g

e (by value) in it

s

equity ownership over a three-year period), the corporation’

s

ability to use its pre-chan

g

eo

f

control net operatin

g

los

s

carry

f

orward and other pre-chan

g

e tax attributes a

g

ainst it

s

post-chan

g

e income may be limited. The Section 382 limi

-

t

ation is applied annually so as to limit the use o

f

ou

r

pre-chan

g

e net operatin

g

loss carry

f

orwards to an amount

t

hat

g

enerally equals the value o

f

our stock immediately

be

f

ore the ownership chan

g

e multiplied by a desi

g

nated

f

ederal lon

g

-term tax-exemp

t

r

a

t

e

.D

ue

t

o

th

ecu

m

u

l

a

tiv

e

i

mpact o

f

our equity issuances over the three year period

ended April 2005, a chan

g

eo

f

ownership occurred upon th

e

i

ssuance of our previously outstandin

g

Series E Preferred

Stock at the end of A

p

ril 2005. As a result, $171,147 of th

e

t

otal United States net operatin

g

losses were subject to a

n

annual base limitation of $39

,

374

.

F

-

17