United Healthcare 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

ITEM 9B. OTHER INFORMATION

None.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Pursuant to General Instruction G(3) to Form 10-K and Instruction 3 to Item 401(b) of Regulation S-K, information regarding

our executive officers is provided in Item 1 of Part I of this Annual Report on Form 10-K under the caption “Executive Officers

of the Registrant.”

The remaining information required by Items 401, 405, 406 and 407(c)(3), (d)(4) and (d)(5) of Regulation S-K will be included

under the headings “Corporate Governance,” “Election of Directors” and “Section 16(a) Beneficial Ownership Reporting

Compliance” in our definitive proxy statement for our 2012 Annual Meeting of Shareholders, and such required information is

incorporated herein by reference.

ITEM 11. EXECUTIVE COMPENSATION

The information required by Items 402, 407(e)(4) and (e)(5) of Regulation S-K will be included under the headings “Executive

Compensation” and “Compensation Committee Interlocks and Insider Participation” in our definitive proxy statement for our

2012 Annual Meeting of Shareholders, and such required information is incorporated herein by reference.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

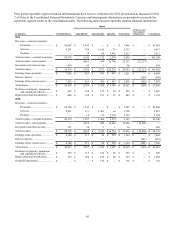

Equity Compensation Plan Information

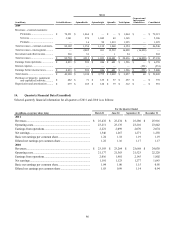

The following table sets forth certain information, as of December 31, 2011, concerning shares of common stock authorized for

issuance under all of our equity compensation plans:

Plan Category

Equity compensation plans approved by

shareholders (1) ............................................................

Equity compensation plans not approved by

shareholders (2) ............................................................

Total (2) ........................................................................

(a)

Number of securities

to be issued upon

exercise of

outstanding

options, warrants

and rights (3)

(in millions)

77

—

77

(b)

Weighted-average

exercise

price of

outstanding

options, warrants

and rights (3)

$ 39

—

$ 39

(c)

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

(in millions)

72

—

72

(4)

(1) Consists of the UnitedHealth Group Incorporated 2011 Stock Incentive Plan, as amended, and the UnitedHealth Group

1993 Employee Stock Purchase Plan, as amended. Includes 0.4 million options to acquire shares of common stock that

were originally issued under the United HealthCare Corporation 1998 Broad-Based Stock Incentive Plan, as amended,

which was not approved by the Company's shareholders, but the shares issuable under the 1998 Broad-Based Stock

Incentive Plan were subsequently included in the number of shares approved by the Company's shareholders when

approving the 2011 Stock Incentive Plan.

(2) Excludes 0.3 million shares underlying stock options assumed by us in connection with our acquisition of the companies

under whose plans the options originally were granted. These options have a weighted-average exercise price of $30 and

an average remaining term of approximately 2.7 years. The options are administered pursuant to the terms of the plan

under which the option originally was granted. No future awards will be granted under these acquired plans.

(3) Excludes stock appreciation rights (SARs) to acquire 14 million shares of common stock of the Company with exercise

prices above $50.68, the closing price of a share of our common stock as reported on the NYSE on December 31, 2011.

(4) Includes 22 million shares of common stock available for future issuance under the Employee Stock Purchase Plan as of

December 31, 2011, and 50 million shares available under the 2011 Stock Incentive Plan as of December 31, 2011.