United Healthcare 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

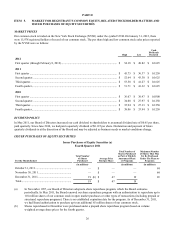

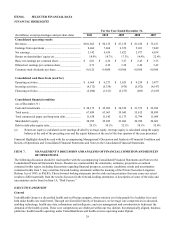

ITEM 6. SELECTED FINANCIAL DATA

FINANCIAL HIGHLIGHTS

(In millions, except percentages and per share data)

Consolidated operating results

Revenues............................................................................

Earnings from operations ..................................................

Net earnings.......................................................................

Return on shareholders' equity (a).....................................

Basic net earnings per common share ...............................

Diluted net earnings per common share............................

Common stock dividends per share...................................

Consolidated cash flows from (used for)

Operating activities............................................................

Investing activities.............................................................

Financing activities............................................................

Consolidated financial condition

(As of December 31)

Cash and investments ........................................................

Total assets.........................................................................

Total commercial paper and long-term debt......................

Shareholder's equity ..........................................................

Debt to debt-plus-equity ratio............................................

For the Year Ended December 31,

2011

$101,862

8,464

5,142

18.9%

$ 4.81

4.73

0.6125

$ 6,968

(4,172)

(2,490)

$ 28,172

67,889

11,638

28,292

29.1%

2010

$ 94,155

7,864

4,634

18.7%

$ 4.14

4.10

0.4050

$ 6,273

(5,339)

(1,611)

$ 25,902

63,063

11,142

25,825

30.1%

2009

$ 87,138

6,359

3,822

17.3%

$ 3.27

3.24

0.0300

$ 5,625

(976)

(2,275)

$ 24,350

59,045

11,173

23,606

32.1%

2008

$ 81,186

5,263

2,977

14.9%

$ 2.45

2.40

0.0300

$ 4,238

(5,072)

(605)

$ 21,575

55,815

12,794

20,780

38.1%

2007

$ 75,431

7,849

4,654

22.4%

$ 3.55

3.42

0.0300

$ 5,877

(4,147)

(3,185)

$ 22,286

50,899

11,009

20,063

35.4%

(a) Return on equity is calculated as net earnings divided by average equity. Average equity is calculated using the equity

balance at the end of the preceding year and the equity balances at the end of the four quarters of the year presented.

Financial Highlights should be read with the accompanying Management's Discussion and Analysis of Financial Condition and

Results of Operations and Consolidated Financial Statements and Notes to the Consolidated Financial Statements.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

The following discussion should be read together with the accompanying Consolidated Financial Statements and Notes to the

Consolidated Financial Statements thereto. Readers are cautioned that the statements, estimates, projections or outlook

contained in this report, including discussions regarding financial prospects, economic conditions, trends and uncertainties

contained in this Item 7, may constitute forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995, or PSLRA. These forward-looking statements involve risks and uncertainties that may cause our actual

results to differ materially from the results discussed in the forward-looking statements. A description of some of the risks and

uncertainties can be found in Item 1A, “Risk Factors.”

EXECUTIVE OVERVIEW

General

UnitedHealth Group is a diversified health and well-being company, whose mission is to help people live healthier lives and

help make health care work better. Through our diversified family of businesses, we leverage core competencies in advanced,

enabling technology; health care data, information and intelligence; and care management and coordination to help meet the

demands of the health system. These core competencies are deployed within our two distinct, but strategically aligned, business

platforms: health benefits operating under UnitedHealthcare and health services operating under Optum.