United Healthcare 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

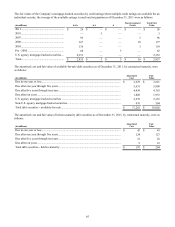

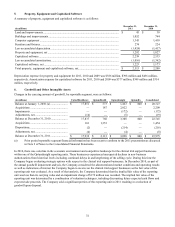

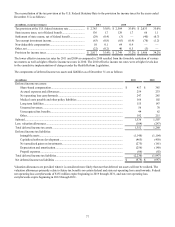

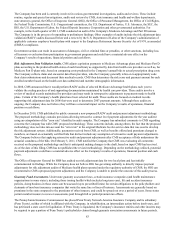

The gross carrying value, accumulated amortization and net carrying value of other intangible assets were as follows:

(in millions)

Customer-related.....................................................

Trademarks and technology....................................

Other .......................................................................

Total........................................................................

December 31, 2011

Gross

Carrying

Value

$ 3,766

368

112

$ 4,246

Accumulated

Amortization

$(1,310)

(98)

(43)

$(1,451)

Net

Carrying

Value

$ 2,456

270

69

$ 2,795

December 31, 2010

Gross

Carrying

Value

$ 3,623

505

132

$ 4,260

Accumulated

Amortization

$(1,038)

(246)

(66)

$(1,350)

Net

Carrying

Value

$ 2,585

259

66

$ 2,910

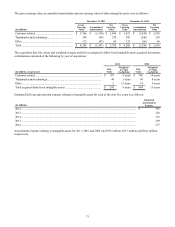

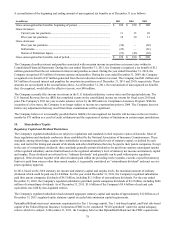

The acquisition date fair values and weighted-average useful lives assigned to finite-lived intangible assets acquired in business

combinations consisted of the following by year of acquisition:

(in millions, except years)

Customer-related.............................................................................................

Trademarks and technology............................................................................

Other ...............................................................................................................

Total acquired finite-lived intangible assets...................................................

2011

Fair

Value

$ 187

49

5

$ 241

Weighted-

Average

Useful Life

9 years

5 years

15 years

9 years

2010

Fair

Value

$ 786

94

14

$ 894

Weighted-

Average

Useful Life

14 years

8 years

9 years

13 years

Estimated full year amortization expense relating to intangible assets for each of the next five years is as follows:

(in millions)

2012................................................................................................................................................................

2013................................................................................................................................................................

2014................................................................................................................................................................

2015................................................................................................................................................................

2016................................................................................................................................................................

Estimated

Amortization

Expense

$ 361

328

316

299

277

Amortization expense relating to intangible assets for 2011, 2010 and 2009 was $361 million, $317 million and $241 million,

respectively.