United Healthcare 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

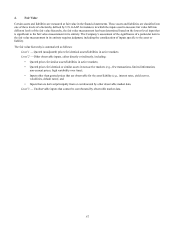

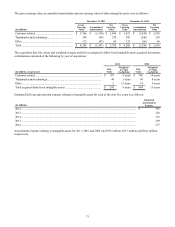

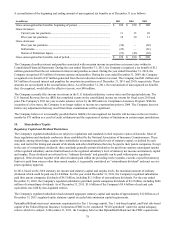

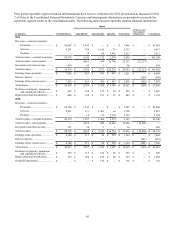

The reconciliation of the tax provision at the U.S. Federal Statutory Rate to the provision for income taxes for the years ended

December 31 is as follows:

(in millions, except percentages)

Tax provision at the U.S. federal statutory rate......................

State income taxes, net of federal benefit...............................

Settlement of state exams, net of federal benefit....................

Tax-exempt investment income..............................................

Non-deductible compensation ................................................

Other, net ................................................................................

Provision for income taxes .....................................................

2011

$ 2,785

136

(29)

(63)

10

(22)

$ 2,817

35.0%

1.7

(0.4)

(0.8)

0.1

(0.2)

35.4%

2010

$ 2,584

129

(3)

(65)

64

40

$ 2,749

35.0%

1.7

—

(0.9)

0.9

0.5

37.2%

2009

$ 2,033

66

(40)

(70)

—

(3)

$ 1,986

35.0%

1.1

(0.7)

(1.2)

—

—

34.2%

The lower effective income tax rates for 2011 and 2009 as compared to 2010 resulted from the favorable resolution of various

tax matters as well as higher effective income tax rates in 2010. The 2010 effective income tax rates were at higher levels due

to the cumulative implementation of changes under the Health Reform Legislation.

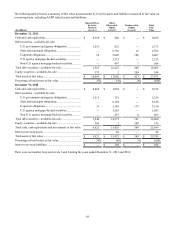

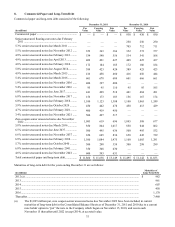

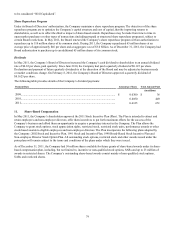

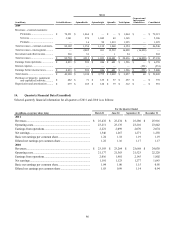

The components of deferred income tax assets and liabilities as of December 31 are as follows:

(in millions)

Deferred income tax assets:

Share-based compensation....................................................................................................

Accrued expenses and allowances ........................................................................................

Net operating loss carryforwards ..........................................................................................

Medical costs payable and other policy liabilities ................................................................

Long term liabilities..............................................................................................................

Unearned revenues................................................................................................................

Unrecognized tax benefits.....................................................................................................

Other......................................................................................................................................

Subtotal.........................................................................................................................................

Less: valuation allowances...........................................................................................................

Total deferred income tax assets..................................................................................................

Deferred income tax liabilities:

Intangible assets....................................................................................................................

Capitalized software development........................................................................................

Net unrealized gains on investments.....................................................................................

Depreciation and amortization..............................................................................................

Prepaid expenses...................................................................................................................

Total deferred income tax liabilities.............................................................................................

Net deferred income tax liabilities ...............................................................................................

2011

$ 417

259

247

166

155

56

44

192

1,536

(184)

1,352

(1,148)

(465)

(275)

(256)

(86)

(2,230)

$(878)

2010

$ 385

233

285

102

147

78

62

215

1,507

(247)

1,260

(1,104)

(450)

(161)

(140)

(92)

(1,947)

$(687)

Valuation allowances are provided when it is considered more likely than not that deferred tax assets will not be realized. The

valuation allowances primarily relate to future tax benefits on certain federal and state net operating loss carryforwards. Federal

net operating loss carryforwards of $151 million expire beginning in 2019 through 2031, and state net operating loss

carryforwards expire beginning in 2012 through 2031.