United Healthcare 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

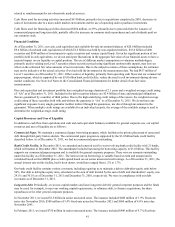

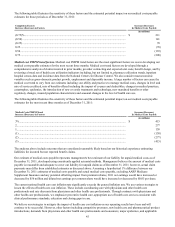

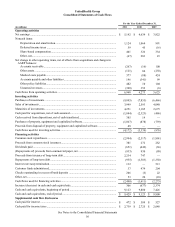

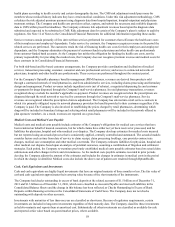

The following tables summarize the impact of hypothetical changes in market interest rates across the entire yield curve by 1%

or 2% as of December 31, 2011 and 2010 on our investment income and interest expense per annum, and the fair value of our

investments and debt (in millions):

Increase (Decrease) in Market Interest Rate

2 % .....................................................................................

1..........................................................................................

(1).......................................................................................

(2).......................................................................................

December 31, 2011

Investment

Income Per

Annum (a)

$ 199

99

(12)

nm

Interest

Expense Per

Annum (a)

$ 28

14

(4)

nm

Fair Value of

Investments (b)

$(1,239)

(622)

586

885

Fair Value of

Debt

$(1,946)

(1,082)

1,086

2,343

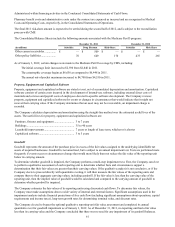

Increase (Decrease) in Market Interest Rate

2 % .....................................................................................

1..........................................................................................

(1).......................................................................................

(2).......................................................................................

December 31, 2010

Investment

Income Per

Annum (a)

$ 182

91

(10)

nm

Interest

Expense Per

Annum (a)

$ 163

82

(21)

nm

Fair Value of

Investments

$(1,177)

(602)

613

1,227

Fair Value of

Debt

$(860)

(471)

560

1,240

nm = not meaningful

(a) Given the low absolute level of short-term market rates on our floating-rate assets and liabilities as of December 31,

2011 and 2010, the assumed hypothetical change in interest rates does not reflect the full 1% point reduction in

interest income or interest expense as the rate cannot fall below zero and thus the 2% point reduction is not

meaningful.

(b) As of December 31, 2011, some of our investments had interest rates below 2% so the assumed hypothetical change in

the fair value of investments does not reflect the full 2% point reduction.

As of December 31, 2011, we had $544 million of investments in equity securities and venture capital funds, a portion of which

were invested in various public and non-public companies concentrated in the areas of health care delivery and related

information technologies. Market conditions that affect the value of health care or technology stocks will impact the value of

our equity investments.