United Healthcare 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

active markets.

Throughout the procedures discussed above in relation to the Company's processes for validating third party pricing

information, the Company validates the understanding of assumptions and inputs used in security pricing and determines the

proper classification in the hierarchy based on that understanding.

Interest Rate Swaps. Fair values of the Company’s interest rate swaps were estimated using the terms of the swaps and publicly

available market yield curves. Because the swaps were unique and not actively traded, the fair values were classified as Level

2.

AARP Program-related Investments. AARP Program-related investments consist of debt and equity securities held to fund

costs associated with the AARP Program and are priced and classified using the same methodologies as the Company’s other

securities.

Senior Unsecured Notes. The fair values of the senior unsecured notes are estimated based on third-party quoted market prices

for the same or similar issues.

AARP Program-related Other Liabilities. AARP Program-related other liabilities consist of liabilities that represent the

amount of net investment gains and losses related to AARP Program-related investments that accrue to the benefit of the AARP

policyholders.

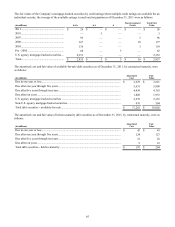

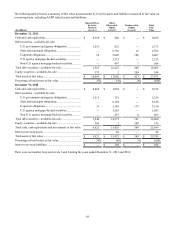

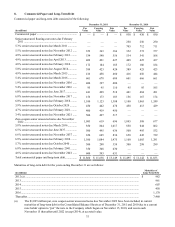

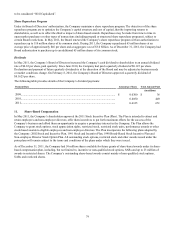

A reconciliation of the beginning and ending balances of assets measured at fair value on a recurring basis using Level 3 inputs

is as follows:

(in millions)

Balance at beginning of period .

Purchases...................................

Sales ..........................................

Settlements................................

Net unrealized (losses) gains in

accumulated other

comprehensive income..........

Net realized (losses) gains in

investment and other income.

Balance at end of period............

December 31, 2011

Debt

Securities

$ 141

92

—

(25)

—

—

$ 208

Equity

Securities

$ 208

35

(17)

(7)

(4)

(6)

$ 209

Total

$ 349

127

(17)

(32)

(4)

(6)

$ 417

December 31, 2010

Debt

Securities

$ 120

43

(4)

(20)

—

2

$ 141

Equity

Securities

$ 312

45

(167)

—

9

9

$ 208

Total

$ 432

88

(171)

(20)

9

11

$ 349

December 31, 2009

Debt

Securities

$ 62

76

—

(12)

—

(6)

$ 120

Equity

Securities

$ 304

25

(3)

—

7

(21)

$ 312

Total

$ 366

101

(3)

(12)

7

(27)

$ 432

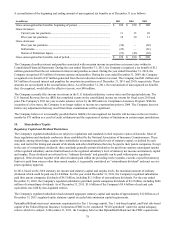

Non-financial assets and liabilities or financial assets and liabilities that are measured at fair value on a nonrecurring basis are

subject to fair value adjustments only in certain circumstances, such as when the Company records an impairment. There were

no significant fair value adjustments for these assets and liabilities recorded during the years ended December 31, 2011, 2010

and 2009.