United Healthcare 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

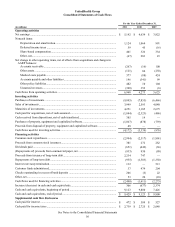

Administered within financing activities in the Condensed Consolidated Statements of Cash Flows.

Pharmacy benefit costs and administrative costs under the contract are expensed as incurred and are recognized in Medical

Costs and Operating Costs, respectively, in the Consolidated Statements of Operations.

The final 2011 risk-share amount is expected to be settled during the second half of 2012, and is subject to the reconciliation

process with CMS.

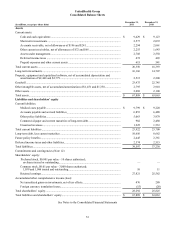

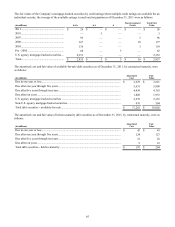

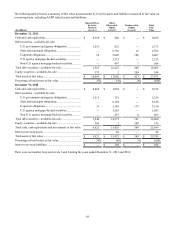

The Consolidated Balance Sheets include the following amounts associated with the Medicare Part D program:

(in millions)

Other current receivables ................

Other policy liabilities.....................

December 31, 2011

Subsidies

$ —

70

Drug Discount

$ 509

649

Risk-Share

$ —

170

December 31, 2010

Subsidies

$ —

475

Risk-Share

$ —

265

As of January 1, 2012, certain changes were made to the Medicare Part D coverage by CMS, including:

The initial coverage limit increased to $2,930 from $2,840 in 2011.

The catastrophic coverage begins at $6,658 as compared to $6,448 in 2011.

The annual out-of-pocket maximum increased to $4,700 from $4,550 in 2011.

Property, Equipment and Capitalized Software

Property, equipment and capitalized software are stated at cost, net of accumulated depreciation and amortization. Capitalized

software consists of certain costs incurred in the development of internal-use software, including external direct costs of

materials and services and payroll costs of employees devoted to specific software development. The Company reviews

property, equipment and capitalized software for events or changes in circumstances that would indicate that it might not

recover their carrying value. If the Company determines that an asset may not be recoverable, an impairment charge is

recorded.

The Company calculates depreciation and amortization using the straight-line method over the estimated useful lives of the

assets. The useful lives for property, equipment and capitalized software are:

Furniture, fixtures and equipment............................

Buildings ..................................................................

Leasehold improvements..........................................

Capitalized software.................................................

3 to 7 years

35 to 40 years

7 years or length of lease term, whichever is shorter

3 to 5 years

Goodwill

Goodwill represents the amount of the purchase price in excess of the fair values assigned to the underlying identifiable net

assets of acquired businesses. Goodwill is not amortized, but is subject to an annual impairment test. Tests are performed more

frequently if events occur or circumstances change that would more likely than not reduce the fair value of the reporting unit

below its carrying amount.

To determine whether goodwill is impaired, the Company performs a multi-step impairment test. First, the Company can elect

to perform a qualitative assessment of each reporting unit to determine whether facts and circumstances support a

determination that their fair values are greater than their carrying values. If the qualitative analysis is not conclusive, or if the

Company elects to proceed directly with quantitative testing, it will then measure the fair values of the reporting units and

compare them to their aggregate carrying values, including goodwill. If the fair value is less than the carrying value of the

reporting unit, then the implied value of goodwill would be calculated and compared to the carrying amount of goodwill to

determine whether goodwill is impaired.

The Company estimates the fair values of its reporting units using discounted cash flows. To determine fair values, the

Company must make assumptions about a wide variety of internal and external factors. Significant assumptions used in the

impairment analysis include financial projections of free cash flow (including significant assumptions about operations, capital

requirements and income taxes), long-term growth rates for determining terminal value, and discount rates.

The Company elected to bypass the optional qualitative reporting-unit fair value assessment and completed its annual

quantitative test for goodwill impairment as of January 1, 2012. As of December 31, 2011, no reporting unit had a fair value

less than its carrying value and the Company concluded that there was no need for any impairment of its goodwill balances.