United Healthcare 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

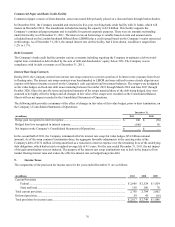

Commercial Paper and Bank Credit Facility

Commercial paper consists of short-duration, senior unsecured debt privately placed on a discount basis through broker-dealers.

In December 2011, the Company amended and renewed its five-year revolving bank credit facility with 21 banks, which will

mature in December 2016. The amendment included increasing the capacity to $3.0 billion. This facility supports the

Company’s commercial paper program and is available for general corporate purposes. There were no amounts outstanding

under this facility as of December 31, 2011. The interest rate on borrowings is variable based on term and amount and is

calculated based on the London Interbank Offered Rate (LIBOR) plus a credit spread based on the Company’s senior unsecured

credit ratings. As of December 31, 2011, the annual interest rate on this facility, had it been drawn, would have ranged from

1.2% to 1.7%.

Debt Covenants

The Company’s bank credit facility contains various covenants including requiring the Company to maintain a debt-to-total-

capital ratio, calculated as debt divided by the sum of debt and shareholders’ equity, below 50%. The Company was in

compliance with its debt covenants as of December 31, 2011.

Interest Rate Swap Contracts

During 2010, the Company entered into interest rate swap contracts to convert a portion of its interest rate exposure from fixed

to floating rates. The interest rate swap contracts were benchmarked to LIBOR and were utilized to more closely align interest

expense with interest income received on the Company's cash equivalent and investment balances. The swaps were designated

as fair value hedges on fixed-rate debt issues maturing between November 2012 through March 2016 and June 2017 through

October 2020. Since the specific terms and notional amounts of the swaps matched those of the debt being hedged, they were

assumed to be highly effective hedges and all changes in fair value of the swaps were recorded on the Consolidated Balance

Sheets with no net impact recorded in the Consolidated Statements of Operations.

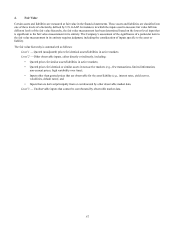

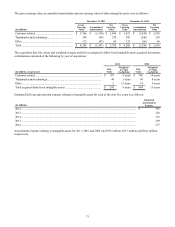

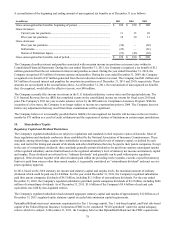

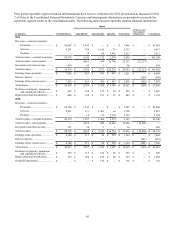

The following table provides a summary of the effect of changes in fair value of fair value hedges, prior to their termination, on

the Company’s Consolidated Statements of Operations:

(in millions)

Hedge gain recognized in interest expense...............................................................................

Hedged item loss recognized in interest expense......................................................................

Net impact on the Company’s Consolidated Statements of Operations...................................

December 31,

2011

$ 190

(190)

$ —

2010

$(58)

58

$ —

In the second half of 2011, the Company terminated all of its interest rate swap fair value hedges ($5.4 billion notional

amount). As of the swap contracts' termination dates, the aggregate favorable adjustments to the carrying value of the

Company's debt of $132 million is being amortized as a reduction to interest expense over the remaining lives of the underlying

debt obligations, which had in total a weighted-average life of 4.1 years. For the year ended December 31, 2011, the net impact

of the gain amortization was not material. The purpose of the interest rate swap terminations was to lock-in the impact of low

market floating interest rates and reduce the effective interest rate on hedged long-term debt.

9. Income Taxes

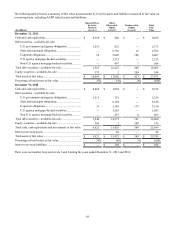

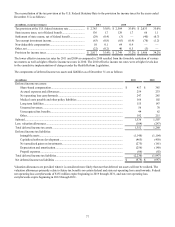

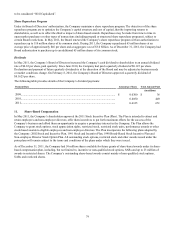

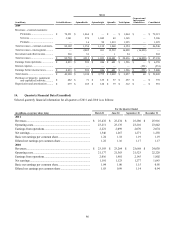

The components of the provision for income taxes for the years ended December 31 are as follows:

(in millions)

Current Provision:

Federal ......................................................................................................................................

State and local...........................................................................................................................

Total current provision.....................................................................................................................

Deferred provision ...........................................................................................................................

Total provision for income taxes......................................................................................................

2011

$ 2,608

150

2,758

59

$ 2,817

2010

$ 2,524

180

2,704

45

$ 2,749

2009

$ 1,924

78

2,002

(16)

$ 1,986