United Healthcare 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

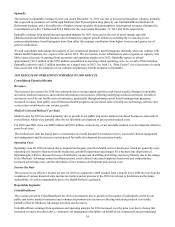

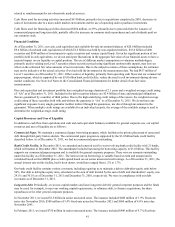

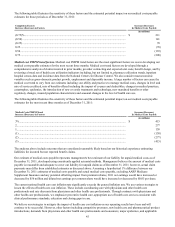

OptumRx

The increase in OptumRx revenues for the year ended December 31, 2011 was due to increased prescription volumes, primarily

due to growth in customers served through Medicare Part D prescription drug plans by our UnitedHealthcare Medicare &

Retirement business, and a favorable mix of higher revenue specialty drug prescriptions. Intersegment revenues eliminated in

consolidation were $16.7 billion and $14.4 billion for the years ended December 31, 2011 and 2010, respectively.

OptumRx earnings from operations and operating margins for 2011 decreased as the mix of lower margin specialty

pharmaceuticals and Medicaid business and investments to support growth initiatives including the in-sourcing of our

commercial pharmacy benefit programs more than offset the earnings contribution from higher revenues and greater use of

generic medications.

We will consolidate and manage the majority of our commercial pharmacy benefit programs internally when our contract with

Medco Health Solutions, Inc. expires at the end of 2012. The investments in our infrastructure and to expand our capacity will

likely cause a decrease in earnings from operations and operating margin as in 2012, OptumRx expects to absorb

approximately $115 million of the $150 million consolidated in-sourcing related operating costs. As a result of this transition,

OptumRx expects to add 12 million members on a staged basis in 2013. See Item 1A, “Risk Factors” for a discussion of certain

risks associated with the transition of our commercial pharmacy benefit programs to OptumRx.

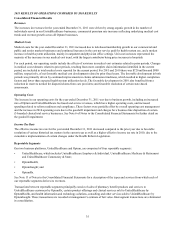

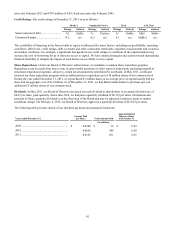

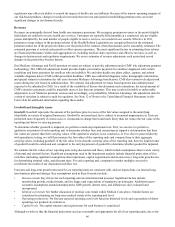

2010 RESULTS OF OPERATIONS COMPARED TO 2009 RESULTS

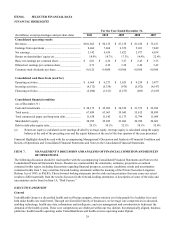

Consolidated Financial Results

Revenues

The increases in revenues for 2010 were primarily due to strong organic growth in risk-based benefit offerings in our public

and senior markets businesses and commercial premium rate increases reflecting underlying medical cost trends. Growth in

customers served by our health services businesses, particularly through pharmaceutical benefit management programs,

increased revenues from public sector behavioral health programs and increased sales of health care technology software and

services also contributed to our revenue growth.

Medical Costs and Medical Care Ratio

Medical costs for 2010 increased primarily due to growth in our public and senior markets risk-based businesses and medical

cost inflation, which were partially offset by net favorable development of prior period medical costs.

For 2010 and 2009, there was $800 million and $310 million, respectively, of net favorable medical cost development related to

prior fiscal years.

The medical care ratio decreased due to a moderation in overall demand for medical services, successful clinical engagement

and management and the increase in prior period favorable development discussed previously.

Operating Costs

Operating costs for 2010 increased due to acquired and organic growth in health services businesses, which are generally more

operating cost intensive than our benefits businesses, goodwill impairment and charges for a business line disposition at

OptumInsight, which is discussed in more detail below, an increase in staffing and selling expenses primarily due to the change

in the Medicare Advantage annual enrollment period, costs related to increased employee headcount and compensation,

increased advertising costs, and the absorption of new business development and start-up costs.

Income Tax Rate

The increase in our effective income tax rate for 2010 as compared to 2009 resulted from a benefit in the 2009 tax rate from the

resolution of various historical state income tax matters and an increase in the 2010 rate related to limitations on the future

deductibility of certain compensation due to the Health Reform Legislation.

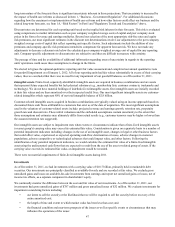

Reportable Segments

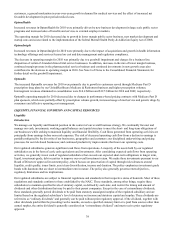

UnitedHealthcare

The revenue growth in UnitedHealthcare for 2010 was primarily due to growth in the number of individuals served by our

public and senior markets businesses and commercial premium rate increases reflecting underlying medical cost trends,

partially offset by Medicare Advantage premium rate decreases.

UnitedHealthcare earnings from operations and operating margins for 2010 increased over the prior year due to factors that

increased revenues described above, continued cost management disciplines on behalf of our commercial and governmental