United Healthcare 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

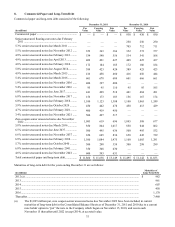

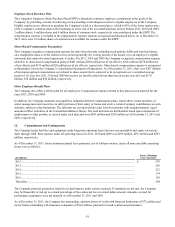

Employee Stock Purchase Plan

The Company's Employee Stock Purchase Plan (ESPP) is intended to enhance employee commitment to the goals of the

Company, by providing a means of achieving stock ownership at advantageous terms to eligible employees of the Company.

Eligible employees are allowed to purchase the Company's stock at a discounted price, which is 85% of the lower market price

of the Company's common stock at the beginning or at the end of the six-month purchase period. During 2011, 2010 and 2009,

3 million shares, 4 million shares and 4 million shares of common stock, respectively, were purchased under the ESPP. The

compensation expense is included in the compensation expense amounts recognized and discussed below. As of December 31,

2011, there were 22 million shares of common stock available for issuance under the ESPP.

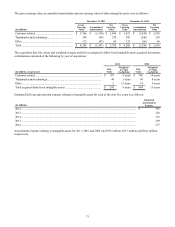

Share-Based Compensation Recognition

The Company recognizes compensation expense for share-based awards, including stock options, SARs and restricted shares,

on a straight-line basis over the related service period (generally the vesting period) of the award, or to an employee’s eligible

retirement date under the award agreement, if earlier. For 2011, 2010 and 2009 the Company recognized compensation expense

related to its share-based compensation plans of $401 million ($260 million net of tax effects), $326 million ($278 million net

of tax effects) and $334 million ($220 million net of tax effects), respectively. Share-based compensation expense is recognized

in Operating Costs in the Company’s Consolidated Statements of Operations. As of December 31, 2011, there was $387 million

of total unrecognized compensation cost related to share awards that is expected to be recognized over a weighted-average

period of 1.0 year. For 2011, 2010 and 2009 the income tax benefit realized from share-based award exercises was $170

million, $78 million and $94 million, respectively.

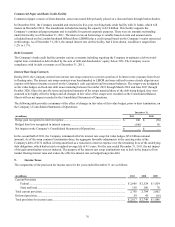

Other Employee Benefit Plans

The Company also offers a 401(k) plan for all employees. Compensation expense related to this plan was not material for the

years 2011, 2010 and 2009.

In addition, the Company maintains non-qualified, unfunded deferred compensation plans, which allow certain members of

senior management and executives to defer portions of their salary or bonus and receive certain Company contributions on such

deferrals, subject to plan limitations. The deferrals are recorded within Long-Term Investments with an approximately equal

amount in Other Liabilities in the Consolidated Balance Sheets. The total deferrals are distributable based upon termination of

employment or other periods, as elected under each plan and were $281 million and $258 million as of December 31, 2011 and

2010, respectively.

12. Commitments and Contingencies

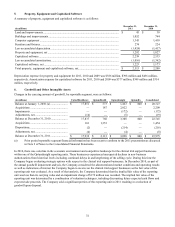

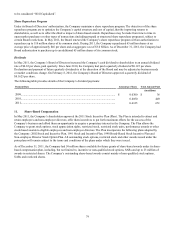

The Company leases facilities and equipment under long-term operating leases that are non-cancelable and expire on various

dates through 2028. Rent expense under all operating leases for 2011, 2010 and 2009 was $295 million, $297 million and $303

million, respectively.

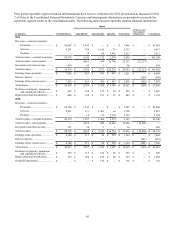

As of December 31, 2011, future minimum annual lease payments, net of sublease income, under all non-cancelable operating

leases were as follows:

(in millions)

2012..............................................................................................................................................................

2013..............................................................................................................................................................

2014..............................................................................................................................................................

2015..............................................................................................................................................................

2016..............................................................................................................................................................

Thereafter .....................................................................................................................................................

Future Minimum

Lease Payments

$ 279

243

212

174

129

564

The Company provides guarantees related to its performance under certain contracts. If standards are not met, the Company

may be financially at risk up to a stated percentage of the contracted fee or a stated dollar amount. Amounts accrued for

performance guarantees were not material as of December 31, 2011 and 2010.

As of December 31, 2011, the Company has outstanding, undrawn letters of credit with financial institutions of $72 million and

surety bonds outstanding with insurance companies of $316 million, primarily to bond contractual performance.