Under Armour 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

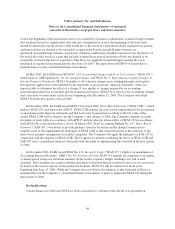

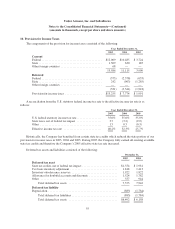

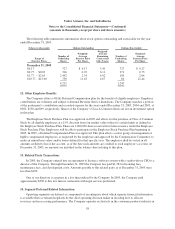

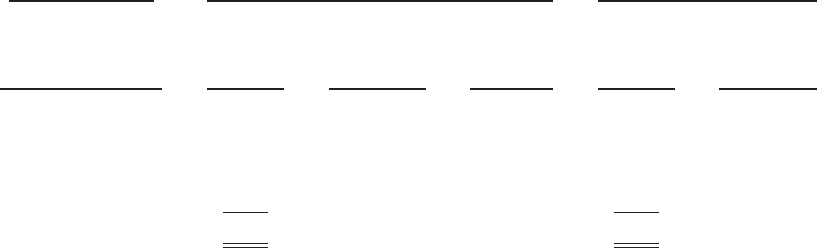

The following table summarizes information about stock options outstanding and exercisable for the year

ended December 31, 2005:

(Shares in thousands) Options Outstanding Options Exercisable

Range of

Exercise Prices

Number of

Underlying

Shares

Weighted-

Average

Exercise Price

Per Share

Weighted-

Average

Remaining

Contractual

Life (Years)

Number of

Underlying

Shares

Weighted-

Average

Exercise Price

Per Share

December 31, 2005

$0.17 727 $ 0.17 5.41 727 $ 0.17

$0.75 - $0.83 316 0.76 6.11 271 0.75

$1.77 - $2.65 2,442 2.34 4.92 185 2.04

$10.77 - $13.00 730 11.43 4.67 60 12.44

4,215 1,243

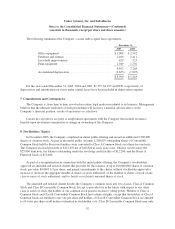

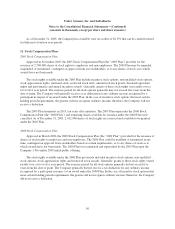

12. Other Employee Benefits

The Company offers a 401(k) Deferred Compensation plan for the benefit of eligible employees. Employee

contributions are voluntary and subject to Internal Revenue Service limitations. The Company matches a portion

of the participant’s contribution and recorded expense for the years ended December 31, 2005, 2004 and 2003, of

$382, $130 and $99, respectively. Shares of the Company’s Class A Common Stock are not an investment option

in this plan.

The Employee Stock Purchase Plan was approved in 2005 and allows for the purchase of Class A Common

Stock by all eligible employees at a 15% discount from fair market value subject to certain limits as defined in

the Employee Stock Purchase Plan. There are 1,000,000 shares reserved for future issuance under the Employee

Stock Purchase Plan. Employees will be able to participate in the Employee Stock Purchase Plan beginning in

2006. In 2005, a Deferred Compensation Plan was approved. This plan allows a select group of management or

highly compensated employees, as requested by the employee and approved by the Compensation Committee, to

make an annual base salary and/or bonus deferral for that specific year. The employee shall be vested in all

amounts credited to his or her account, as of the date such amounts are credited to such employee’s account. At

December 31, 2005, no amounts are included on the balance sheet relating to this plan.

13. Related Party Transactions

In 2005, the Company entered into an agreement to license a software system with a vendor whose CEO is a

director of the Company. Through December 31, 2005 the Company has paid $1,383 in licensing fees,

maintenance fees, and development costs. Amounts payable to this related party as of December 31, 2005 were

less than $100.

One of our directors is a partner in a law firm utilized by the Company. In 2005, the Company paid

approximately $330 to this law firm in connection with legal services performed.

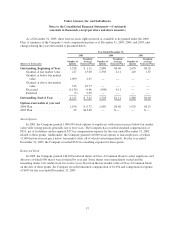

14. Segment Data and Related Information

Operating segments are defined as components of an enterprise about which separate financial information

is available that is evaluated regularly by the chief operating decision maker in deciding how to allocate

resources and in accessing performance. The Company operates exclusively in the consumer products industry in

58