Under Armour 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

margin is calculated quarterly and varies based on certain of our financial ratios as defined in the agreement. The

revolving credit facility also carries a line of credit fee for available but unused borrowings which can vary from

0.13% to 0.63% based on certain of our ratios as defined in the agreement.

This agreement contains a number of restrictions that limit our ability, among other things, to borrow

money; pledge our accounts receivable, inventory, intellectual property and most of our other assets as security in

our borrowings or transactions; pay dividends on stock; redeem or acquire any of our securities; sell certain

assets; make certain investments; guaranty certain obligations of third parties; undergo a merger or consolidation;

or engage in any activity materially different from those presently conducted by us.

This agreement also provides the lenders with the ability to reduce the valuation of our inventory and

receivables and thereby reduce our ability to borrow under the revolving credit facility even if we are in

compliance with all conditions of the agreement. In addition, we are required to comply with certain financial

covenants in the event we fail to maintain a minimum borrowing availability of $15.0 million. These covenants

may restrict our ability to engage in transactions that would otherwise be in our best interests. Failure to comply

with any of the covenants under our revolving credit facility could result in a default under the facility. This

could cause the lenders to accelerate the timing of payments and exercise their lien on essentially all of our

assets, which would have a material adverse effect on our business, operations, financial condition and liquidity.

In addition, because our revolving credit facility bears interest at variable interest rates, which we do not

anticipate hedging against, increases in interest rates would increase our cost of borrowing, resulting in a decline

in our net income and cash flow, which could cause the price of our Class A Common Stock to decline. We were

in compliance with these covenants as of December 31, 2005.

Subordinated Debt and Lease Obligations

In March 2005, we entered into a loan and security agreement with Sun Trust Bank to finance the

acquisition of up to $17.0 million of qualifying capital investments. This agreement is collateralized by a first

lien on these assets and is otherwise subordinate to the revolving credit facility. Through December 31, 2005, we

have financed $5.8 million of capital investments under this agreement. Interest on outstanding borrowings

accrues at an average rate of 5.9%. At December 31, 2005, the outstanding principal balance was $4.7 million.

In December 2003, we entered into a master loan and security agreement with Wachovia Bank N.A. which

is subordinate to the revolving credit facility. Under this agreement, we borrowed $1.3 million for the purchase

of qualifying furniture and fixtures. This agreement bears interest at 7.0% annually, and principal and interest

payments are due monthly through February 2006. At December 31, 2005, the outstanding principal balance was

$96,000 which has been repaid in 2006.

We continually lease warehouse space, office facilities, space for our retail outlet stores and certain

equipment under non cancelable operating and capital leases.

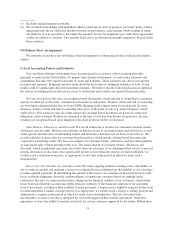

Contractual Commitments and Contingencies

We lease certain buildings and equipment under non-cancelable capital and operating leases. The leases expire

at various dates through 2010, excluding extensions at our option, and contain various provisions for rental

adjustments. The operating leases generally contain renewal provisions for varying periods of time. Our significant

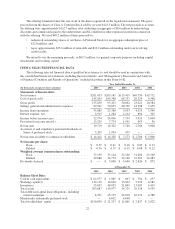

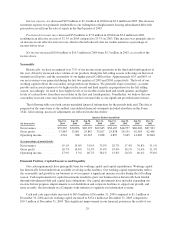

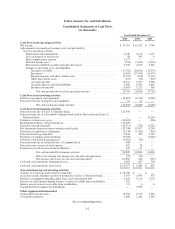

contractual obligations and commitments as of December 31, 2005 are summarized in the following table:

Payments Due by Period

(in thousands) Total

Less Than

1 Year

1to3

Years

3to5

Years 5+ Years

Contractual obligations

Subordinated debt obligations (1) ........................ $ 4,835 $1,967 $2,732 $ 136 $—

Capital lease obligations .............................. 3,556 1,841 1,258 457 —

Operating lease obligations ............................ 9,560 3,604 5,158 798 —

Sponsorships (2) ...................................... 898 579 319 — —

Total contractual obligations ........................... $18,849 $7,991 $9,467 $1,391 $—

32