Under Armour 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

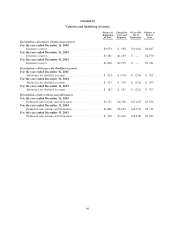

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

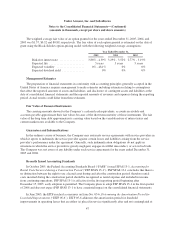

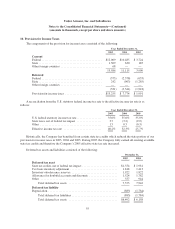

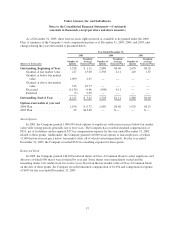

As of December 31, 2005, there were no stock rights reserved or available to be granted under the 2000

Plan. A summary of the Company’s stock compensation plans as of December 31, 2005, 2004, and 2003, and

changes during the years then ended is presented below:

Year Ended December 31,

2005 2004 2003

(Shares in thousands)

Number of

options

Weighted

Average

Exercise Price

Number of

options

Weighted

Average

Exercise Price

Number of

options

Weighted

Average

Exercise Price

Outstanding, Beginning of Year . . 3,528 $ 1.11 2,880 $0.40 2,670 $0.29

Granted, at fair market value . . . 217 13.00 1,338 2.11 210 1.87

Granted, at below fair market

value ................... 1,099 2.65 ————

Granted, at above fair market

value ................... 513 10.77 ————

Exercised .................. (1,139) 0.66 (690) 0.11 — —

Forfeited .................. (3) 2.65 ————

Outstanding, End of Year ........ 4,215 $ 3.42 3,528 $1.11 2,880 $0.40

Options exercisable at year end

2000 Plan ...................... 1,198 $ 0.72 1,689 $0.40 1,929 $0.25

2005 Plan ...................... 45 $13.00 — $ — — $ —

Stock Options

In 2005, the Company granted 1,084,030 stock options to employees with exercise prices below fair market

value with vesting periods generally one to four years. The Company has recorded unearned compensation of

$951, net of forfeitures and recognized $375 in compensation expense for the year ended December 31, 2005,

related to these grants. Additionally, the Company granted 110,000 stock options to non-employees, of which

15,000 had an exercise price below fair market value, all of which vested immediately. For the year ended

December 31, 2005, the Company recorded $322 in consulting expense for these grants.

Restricted Stock

In 2005, the Company granted 140,100 restricted shares of Class A Common Stock to select employees and

directors of which 900 shares were forfeited by year end. Some shares were immediately vested and the

remaining shares vest ratably from two to five years. Based on the fair market value of Class A Common Stock

on the date of these grants, the Company recorded unearned compensation of $1,694 and compensation expense

of $443 for the year ended December 31, 2005.

57