Under Armour 2005 Annual Report Download - page 40

Download and view the complete annual report

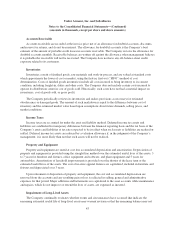

Please find page 40 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.customers, we specifically identify individual invoices (“Approved Receivables”), up to a customer-specific

maximum amount, for credit risk coverage. We incur a fee for the amount of Approved Receivables to be

covered. Only upon the financial inability of a covered customer to pay such invoices, and subject to us

maintaining certain collection and reporting procedures, will the credit risk associated with the Approved

Receivables be transferred to the lender. Historically, we have not transferred such credit risk on any Approved

Receivables. As such, no sales of receivables have ever been made to our lender under the Credit Approved

Receivables Agreement.

Inventory Valuation and Reserves We value our inventory at standard costs which approximates the lower

of cost or market, using the first-in, first-out method of cost determination. Market value is estimated based upon

assumptions made about future demand and retail market conditions. If we determine that the estimated market

value of our inventory is less than the carrying value of such inventory, we provide a reserve for such difference

as a charge to cost of goods sold. If actual market conditions are more or less favorable than those projected by

us, further adjustments may be required that would decrease or increase, as applicable, our cost of goods sold in

the period in which they were recorded.

Long-Lived Assets The acquisition of long-lived assets, including furniture and fixtures, office equipment

and software, plant equipment, leasehold improvements, computer hardware and software and in-store fixtures, is

recorded at cost and this cost is depreciated over the asset’s estimated useful life. We continually evaluate

whether events and circumstances have occurred that indicate the remaining estimated useful life of long-lived

assets may warrant revision or that the remaining balance may not be recoverable. These factors may include a

significant deterioration of operating results, changes in business plans or changes in anticipated cash flows.

When factors indicate that an asset should be evaluated for possible impairment, we review long-lived assets to

assess recoverability from future operations using discounted cash flows. Impairments are recognized in earnings

to the extent that the carrying value exceeds fair value.

Income Tax Provision We estimate what our effective tax rate will be for the full year and record a quarterly

income tax provision in accordance with the anticipated effective annual tax rate. As the year progresses, we

continually refine our estimate based upon actual events and earnings by jurisdiction during the year. This

continual process periodically results in a change to our expected effective tax rate for the year. When this

occurs, we adjust the income tax provision during the quarter in which the change in estimate occurs so that the

year-to-date provision equals the expected annual rate.

Stock-Based Compensation We have not elected the provisions of Statement of Financial Accounting

Standards (“SFAS”) No. 123, Accounting for Stock-Based Compensation (“SFAS 123”) as amended by SFAS

No. 148, Accounting for Stock-based Compensation Transition and Disclosure, (“SFAS 148”), for stock-based

compensation granted to employees and directors. We apply Accounting Principles Board (“APB”) Opinion

No. 25, Accounting for Stock Issued to Employees (“APB 25”) and related interpretations in accounting for

stock-based compensation to employees and directors. In accordance with APB 25, we do not recognize

compensation expense for grants of stock rights to employees with exercise prices equal to or greater than the fair

market value of common stock at the date of the grant. Compensation expense associated with grants of stock

rights with fair market value in excess of the exercise price is recognized in selling, general and administrative

expenses ratably over the vesting period in accordance with Financial Interpretation Number (“FIN”) 28,

Accounting for Stock Appreciation Rights and Other Variable Stock Option or Award Plans (“FIN 28”). We

recognized approximately $855,000 in compensation expense under APB 25 for the year ended December 31,

2005. We account for grants of stock rights to non-employees at fair value in accordance with the provisions of

SFAS No. 123 and Emerging Issues Task Force (“EITF”) No. 96-18, Accounting for Equity Instruments That are

Issued to Other Than Employees for Acquiring, or in Conjunction with Selling Goods or Services (“EITF

96-18”). For the year ended December 31, 2005,we recognized consulting expense of approximately $322,000

related to grants of stock rights to non-employees. No compensation or consulting expense was recognized for

grants of stock rights to non-employees or employees during the years ended December 31, 2004 or 2003.

34