Under Armour 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

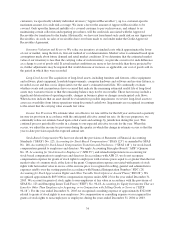

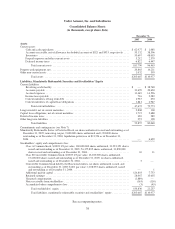

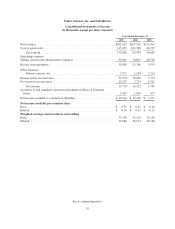

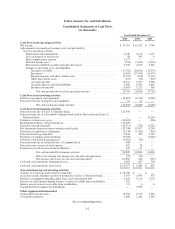

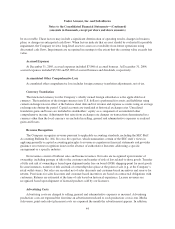

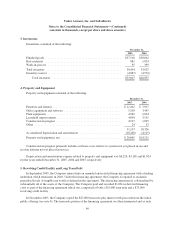

Under Armour, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(in thousands)

Year Ended December 31,

2005 2004 2003

Cash flows from operating activities

Net income ............................................................... $ 19,719 $ 16,322 $ 5,748

Adjustments to reconcile net income to net cash provided by

(used in) operating activities

Depreciation and amortization ............................................ 6,546 3,174 1,171

Loss on disposal of fixed assets ........................................... 58 591 8

Stock compensation expense ............................................. 1,177 — —

Deferred income taxes .................................................. (331) (3,341) (1,918)

Provision for doubtful accounts and other allowances .......................... 3,150 4,610 6,361

Changes in operating assets and liabilities:

Accounts receivable ................................................ (17,552) (18,811) (15,579)

Inventories ....................................................... (5,669) (27,195) (10,679)

Prepaid expenses and other current assets ............................... (2,723) (615) (1,111)

Other non-current assets ............................................. (157) (69) (310)

Accounts payable .................................................. 11,074 9,747 3,358

Accrued expenses and other liabilities .................................. 1,990 5,504 2,691

Income taxes payable ............................................... (1,487) 1,232 558

Net cash provided by (used in) operating activities .................... 15,795 (8,851) (9,702)

Cash flows from investing activities

Purchase of property and equipment ........................................... (10,887) (8,724) (2,285)

Proceeds from sale of property and equipment ................................... 54 41 —

Net cash used in investing activities ................................ (10,833) (8,683) (2,285)

Cash flows from financing activities

Proceeds from sale of Class A Common Stock ................................... 123,500 — —

Proceeds from sale of Convertible Common Stock held by Rosewood and Series A

Preferred Stock .......................................................... — — 12,000

Payments of stock issue costs ................................................. (10,824) — (366)

Redemption of Series A Preferred Stock ........................................ (12,000) — —

Payments on long-term debt .................................................. (26,711) (524) (6,011)

Net (payments) proceeds from revolving credit facility ............................. (13,748) 19,457 8,250

Payments on capital lease obligations .......................................... (2,330) (1,424) (518)

Proceeds from long-term debt ................................................ 3,944 450 2,145

Payments of common stock dividends .......................................... (5,000) — (3,640)

Payments of deferred financing costs ........................................... (1,061) (50) —

Proceeds from sale of restricted Class A Common Stock ........................... 498 — —

Proceeds from exercise of stock options ........................................ 492 78 —

Payments received on notes from stockholders ................................... 229 17 —

Net cash provided by financing activities ............................ 56,989 18,004 11,860

Effect of exchange rate changes on cash and cash equivalents ........... (59) (52) —

Net increase (decrease) in cash and cash equivalents ................... 61,892 418 (127)

Cash and cash equivalents beginning of year ..................................... 1,085 667 794

Cash and cash equivalents end of year .......................................... $ 62,977 $ 1,085 $ 667

Non-cash financing and investing activities

Transfer of revolving credit facility to term debt .................................. $ 25,000 $ — $ —

Accretion of and cumulative preferred dividends on Series A Preferred Stock ........... 5,307 1,994 475

Purchase of equipment through capital leases and subordinated debt .................. 2,103 5,156 1,176

Exercise of stock options though issuance of notes receivable from stockholders ........ 262 — —

Interest earned on notes receivable from stockholders .............................. 12 6 6

Unpaid declared common stock dividends ....................................... — 5,000 —

Other supplemental information

Cash paid for income taxes ................................................... 15,204 9,775 3,350

Cash paid for interest ....................................................... 2,866 1,281 2,365

See accompanying notes.

41