Under Armour 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

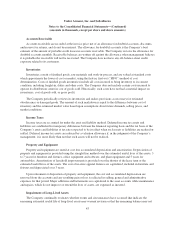

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

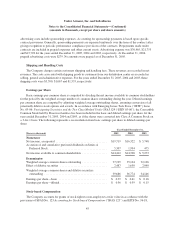

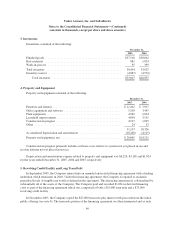

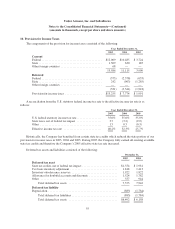

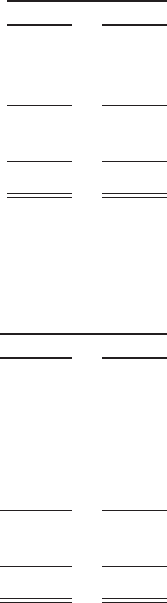

3. Inventories

Inventories consisted of the following:

December 31,

2005 2004

Finished goods .................................................... $57,518 $50,802

Raw materials .................................................... 881 1,824

Work-in-process .................................................. 95 399

Total inventory ................................................... 58,494 53,025

Inventory reserve .................................................. (4,887) (4,970)

Total inventory ............................................... $53,607 $48,055

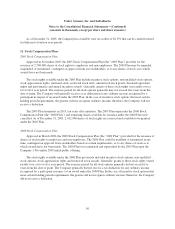

4. Property and Equipment

Property and equipment consisted of the following:

December 31,

2005 2004

Furniture and fixtures .............................................. $12,262 $ 7,017

Office equipment and software ...................................... 5,290 3,447

Plant equipment .................................................. 4,582 2,834

Leasehold improvements ........................................... 4,058 3,151

Construction in progress ........................................... 4,917 1,825

Other .......................................................... 24 52

31,133 18,326

Accumulated depreciation and amortization ............................ (10,268) (4,115)

Property and equipment, net ........................................ $20,865 $14,211

Construction in progress primarily includes software costs relative to systems not yet placed in use and

in-store fixtures not yet placed in service.

Depreciation and amortization expense related to property and equipment was $6,224, $3,165 and $1,024

for the years ended December 31, 2005, 2004 and 2003, respectively.

5. Revolving Credit Facility and Long Term Debt

In September 2005, the Company entered into an amended and restated financing agreement with a lending

institution which terminates in 2010. Under this financing agreement, the Company is required to maintain

prescribed levels of tangible net worth as defined in the agreement. This financing agreement is collateralized by

substantially all of the assets of the Company. The Company paid and recorded $1,061 in deferred financing

costs as part of the financing agreement which was comprised of both a $25,000 term note and a $75,000

revolving credit facility.

In November 2005, the Company repaid the $25,000 term note plus interest with proceeds from the initial

public offering (see note 8). The term note portion of the financing agreement was then terminated and as such

49