Under Armour 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

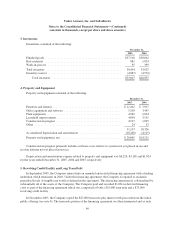

advertising costs include sponsorship expenses. Accounting for sponsorship payments is based upon specific

contract provisions. Generally, sponsorship payments are expensed uniformly over the term of the contract after

giving recognition to periodic performance compliance provisions of the contracts. Prepayments made under

contracts are included in prepaid expenses and other current assets. Advertising expense was $30,465, $21,753

and $13,728 for the years ended December 31, 2005, 2004 and 2003, respectively. At December 31, 2004,

prepaid advertising costs were $279. No amounts were prepaid as of December 31, 2005.

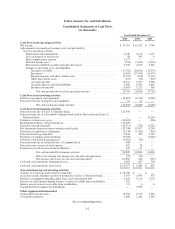

Shipping and Handling Costs

The Company charges certain customers shipping and handling fees. These revenues are recorded in net

revenues. The costs associated with shipping goods to customers from our distribution center are recorded in

selling, general and administrative expenses. For the years ended December 31, 2005, 2004 and 2003, these

shipping costs were $3,590, $1,667 and $1,533, respectively.

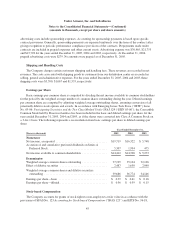

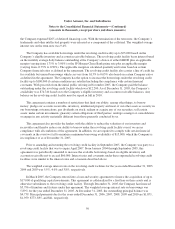

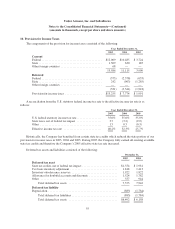

Earnings per Share

Basic earnings per common share is computed by dividing the net income available to common stockholders

for the period by the weighted average number of common shares outstanding during the year. Diluted earnings

per common share are computed by adjusting weighted average outstanding shares, assuming conversion of all

potentially dilutive stock options and awards. In accordance with Emerging Issues Task Force (“EITF”) Issue

No. 03-06: Participating Securities and the Two Class Method Under SFAS 128 (“EITF 03-06”), the Convertible

Common Stock held by Rosewood entities has been included in the basic and diluted earnings per share for the

years ended December 31, 2005, 2004 and 2003, as if the shares were converted into Class A Common Stock on

a 3-for-1 basis. The following represents a reconciliation from basic earnings per share to diluted earnings per

share:

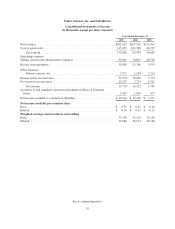

Year Ended December 31,

Shares in thousands 2005 2004 2003

Numerator

Net income, as reported ................................... $19,719 $16,322 $ 5,748

Accretion of and cumulative preferred dividends on Series A

Preferred Stock ........................................ 5,307 1,994 475

Net income available to common shareholders ................. $14,412 $14,328 $ 5,273

Denominator

Weighted average common shares outstanding ................. 37,199 35,124 32,106

Effect of dilutive securities ................................ 2,487 1,650 2,040

Weighted average common shares and dilutive securities

outstanding ........................................... 39,686 36,774 34,146

Earnings per share—basic ................................. $ 0.39 $ 0.41 $ 0.16

Earnings per share—diluted ................................ $ 0.36 $ 0.39 $ 0.15

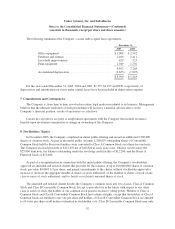

Stock-based Compensation

The Company accounts for grants of stock rights to non-employees at fair value in accordance with the

provisions of SFAS No. 123 Accounting for Stock-based Compensation (“SFAS 123”) and EITF No. 96-18,

45