Under Armour 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

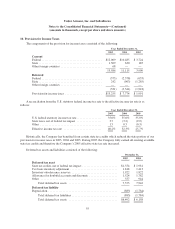

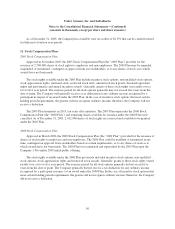

10. Provision for Income Taxes

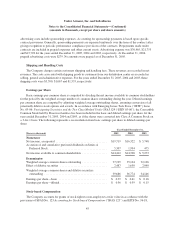

The components of the provision for income taxes consisted of the following:

Year Ended December 31,

2005 2004 2003

Current

Federal ......................................... $12,009 $10,485 $ 3,724

State ........................................... 1,509 630 185

Other foreign countries ............................ 68 — —

13,586 11,115 3,909

Deferred

Federal ......................................... (573) (2,378) (633)

State ........................................... 242 (963) (1,285)

Other foreign countries ............................ — — —

(331) (3,341) (1,918)

Provision for income taxes ......................... $13,255 $ 7,774 $ 1,991

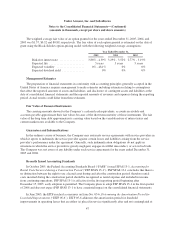

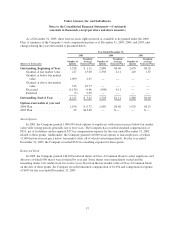

A reconciliation from the U.S. statutory federal income tax rate to the effective income tax rate is as

follows:

Year Ended December 31,

2005 2004 2003

U.S. federal statutory income tax rate ................. 35.0% 35.0% 35.0%

State taxes, net of federal tax impact ................. 3.7 (3.2) (9.0)

Other .......................................... 1.5 0.5 (0.3)

Effective income tax rate .......................... 40.2% 32.3% 25.7%

Historically, the Company has benefited from certain state tax credits which reduced the state portion of our

provision for income taxes in 2005, 2004 and 2003. During 2005, the Company fully earned all existing available

state tax credits and therefore the Company’s 2005 effective state tax rate increased.

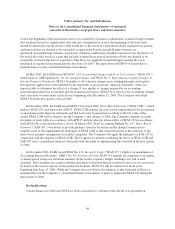

Deferred tax assets and liabilities consisted of the following:

December 31,

2005 2004

Deferred tax asset

State tax credits, net of federal tax impact ........................ $1,554 $ 1,981

Tax basis inventory adjustment ................................ 1,818 1,413

Inventory obsolescence reserves ............................... 1,922 1,822

Allowance for doubtful accounts and discounts ................... 1,524 1,782

Other .................................................... 557 944

Total deferred tax assets ................................. 7,375 7,942

Deferred tax liability

Depreciation ............................................... (883) (1,784)

Total deferred tax liabilities ............................... (883) (1,784)

Total deferred tax assets ................................. $6,492 $ 6,158

55