Under Armour 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

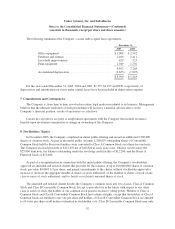

As of December 31, 2005, the Company has available state tax credits of $2,391 that can be carried forward

for thirteen to fourteen year periods.

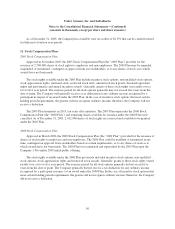

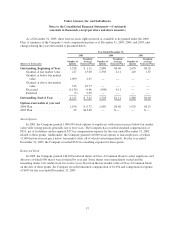

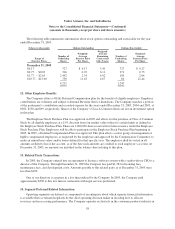

11. Stock Compensation Plans

2005 Stock Compensation Plan

Approved in November 2005, the 2005 Stock Compensation Plan (the “2005 Plan”) provides for the

issuance of 2,700,000 shares of stock rights to employees and non-employees. The 2005 Plan may be amended,

suspended, or terminated, contingent on approval from our stockholders, as to any shares of stock as to which

awards have not been made.

The stock rights available under the 2005 Plan include incentive stock options, non-qualified stock options,

stock appreciation rights, restricted stock, restricted stock units, unrestricted stock grants, dividend equivalent

rights and performance and annual incentive awards. Generally, grants of these stock rights vest ratably over a

two to five year period. The exercise period for all stock options generally may not exceed five years from the

date of grant. The Company will generally receive a tax deduction for any ordinary income recognized by a

participant in respect of an award under the 2005 Plan. In the case of incentive stock options that meet certain

holding period requirements, the grantee will not recognize ordinary income; therefore, the Company will not

receive a deduction.

The 2005 Plan terminates in 2015, ten years after initiation. The 2005 Plan supersedes the 2000 Stock

Compensation Plan (the “2000 Plan”) and remaining shares available for issuance under the 2000 Plan were

cancelled. As of December 31, 2005, 2,442,900 shares of stock rights are reserved and available to be granted

under the 2005 Plan.

2000 Stock Compensation Plan

Approved in March 2000, the 2000 Stock Compensation Plan (the “2000 Plan”) provided for the issuance of

shares of stock rights to employees and non-employees. The 2000 Plan could be modified or terminated at any

time, contingent on approval from stockholders based on certain requirements, as to any shares of stock as to

which awards have not been made. The 2000 Plan was terminated and superseded by the 2005 Plan upon the

Company’s November 2005 initial public offering.

The stock rights available under the 2000 Plan previously included incentive stock options, non-qualified

stock options, stock appreciation rights and restricted stock awards. Generally, grants of these stock rights vested

ratably over a two to five year period. The exercise period for all stock options generally did not exceed five

years from the date of grant. The Company generally did not receive a tax deduction for any ordinary income

recognized by a participant in respect of an award under the 2000 Plan. In the case of incentive stock options that

meet certain holding period requirements, the grantee did not recognize ordinary income; therefore, the Company

did not receive a deduction.

56