Under Armour 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

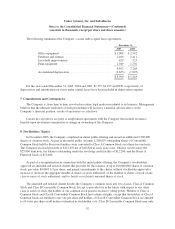

Accounts Receivable

Accounts receivable are recorded at the invoice price net of an allowance for doubtful accounts, discounts,

and reserve for returns, and do not bear interest. The allowance for doubtful accounts is the Company’s best

estimate of the amount of probable credit losses in accounts receivable. The Company reviews the allowance for

doubtful accounts monthly. Receivable balances are written off against the allowance when management believes

it is probable the receivable will not be recovered. The Company does not have any off-balance-sheet credit

exposure related to its customers.

Inventories

Inventories consist of finished goods, raw materials and work-in-process, and are valued at standard costs

which approximate the lower of cost or market, using the first-in, first-out (“FIFO”) method of cost

determination. Costs of finished goods inventories include all costs incurred to bring inventory to its current

condition, including freight-in, duties and other costs. The Company does not include certain costs incurred to

operate its distribution center in cost of goods sold. Historically, such costs have not had a material impact on

inventories, cost of goods sold, or gross profit.

The Company periodically reviews its inventories and makes provisions as necessary for estimated

obsolescence or damaged goods. The amount of such markdown is equal to the difference between cost of

inventory and the estimated market value based upon assumptions about future demands, selling prices, and

market conditions.

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred income tax assets and

liabilities are established for temporary differences between the financial reporting basis and the tax basis of the

Company’s assets and liabilities at tax rates expected to be in effect when such assets or liabilities are realized or

settled. Deferred income tax assets are reduced by a valuation allowance if, in the judgment of the Company’s

management, it is more likely than not that such assets will not be realized.

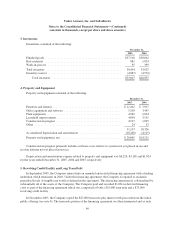

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation and amortization. Depreciation of

property and equipment is provided using the straight-line method over the estimated useful lives of the assets: 3

to 7 years for furniture and fixtures, office equipment and software, and plant equipment and 5 years for

automobiles. Amortization of leasehold improvements is provided over the shorter of the lease term or the

estimated useful lives of the assets. The cost of in-store apparel fixtures are capitalized, included in furniture and

fixtures and depreciated over 3 years.

Upon retirement or disposition of property and equipment, the cost and accumulated depreciation are

removed from the accounts and any resulting gain or loss is reflected in selling, general and administrative

expenses for that period. Major additions and betterments are capitalized to the asset accounts while maintenance

and repairs, which do not improve or extend the lives of assets, are expensed as incurred.

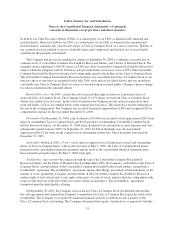

Impairment of Long-Lived Assets

The Company continually evaluates whether events and circumstances have occurred that indicate the

remaining estimated useful life of long-lived assets may warrant revision or that the remaining balance may not

43