Under Armour 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements

(amounts in thousands, except per share and share amounts)

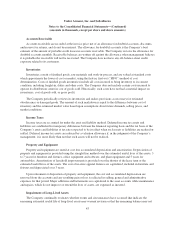

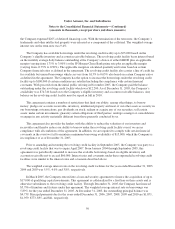

1. Description of the Business

Under Armour, Inc. and Subsidiaries (the “Company”) is a developer, marketer and distributor of branded

performance products for men, women and youth under the label Under Armour®. Sales are targeted to athletes

and teams at the collegiate and professional level as well as consumers with active lifestyles primarily in North

America.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying consolidated financial statements include the accounts of the Company and its wholly

owned subsidiaries. All inter-company balances and transactions have been eliminated. The accompanying

consolidated financial statements were prepared in accordance with accounting principles generally accepted in

the United States of America.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less at

date of inception to be cash equivalents.

Concentration of Credit Risk

Financial instruments that subject the Company to significant concentration of credit risk consist primarily

of accounts receivable. The majority of the Company’s accounts receivable is due from large sporting good

retailers. Credit is extended based on an evaluation of the customer’s financial condition and collateral is not

required. The Company is party to a Credit Approved Receivables Agreement. Under this agreement, the

Company has the ability to transfer credit risk for certain customers approved by the lender. Within these

customers, the Company specifically identifies individual invoices (“Approved Receivables”), up to a customer-

specific maximum amount, for credit risk coverage. The Company incurs a fee for the amount of Approved

Receivables to be covered. Only upon the financial inability of a covered customer to pay such invoices, and

subject to the Company maintaining certain collection and reporting procedures, will the credit risk associated

with the Approved Receivables be transferred to the lender. Historically, the Company has not transferred such

credit risk on any Approved Receivables. As such, no sales of receivables have ever been made to its lender

under the Credit Approved Receivables Agreement.

The Company depends on certain large sporting good retailers for a majority of its net sales, and the loss of,

or a significant reduction in orders from any of these customers would likely significantly reduce revenues.

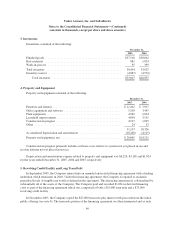

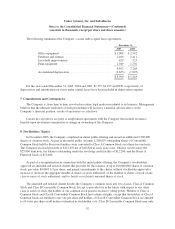

Customers that accounted for more than 10% of net revenues and accounts receivable are as follows:

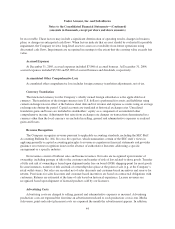

Customer

A

Customer

B

Customer

C

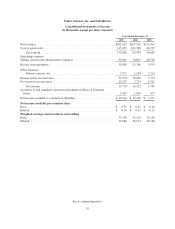

Net revenues

2005 ..................................... 19.6% 16.4% 5.0%

2004 ..................................... 13.3 12.8 10.4

2003 ..................................... 12.6 — —

Accounts receivable

2005 ..................................... 28.7% 19.5% 2.2%

2004 ..................................... 15.5 14.7 16.4

2003 ..................................... 12.8 — 12.2

42