Under Armour 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

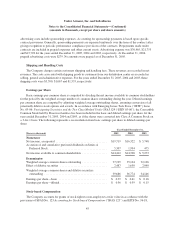

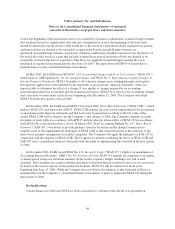

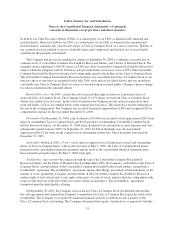

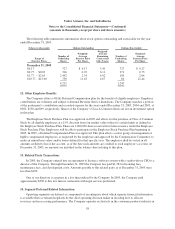

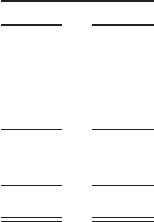

The following summarizes the Company’s assets under capital lease agreements:

December 31,

2005 2004

Office equipment .................................. $1,968 $ 2,542

Furniture and fixtures ............................... 2,106 2,411

Leasehold improvements ............................ 629 523

Plant equipment ................................... 1,949 1,792

6,652 7,268

Accumulated depreciation ........................... (2,653) (1,925)

$ 3,999 $ 5,343

For the years ended December 31, 2005, 2004 and 2003, $1,397, $1,195 and $630, respectively, of

depreciation and amortization on assets under capital leases have been included in depreciation expense.

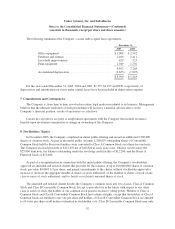

7. Commitments and Contingencies

The Company is, from time to time, involved in routine legal matters incidental to its business. Management

believes that the ultimate resolution of such proceedings will not have a material adverse effect on the

Company’s financial position, results of operations or cash flows.

Certain key executives are party to employment agreements with the Company that include severance

benefits upon involuntary termination or change in ownership of the Company.

8. Stockholders’ Equity

In November 2005, the Company completed an initial public offering and issued an additional 9,500,000

shares of common stock. As part of the initial public offering, 1,208,055 outstanding shares of Convertible

Common Stock held by Rosewood entities were converted to Class A Common Stock on a three-for-one basis.

The Company received proceeds of $112,676 net of $10,824 in stock issue costs, which it used to repay the

$25,000 term note, the balance outstanding under the revolving credit facility of $12,200, and the Series A

Preferred Stock of $12,000.

As part of a recapitalization in connection with the initial public offering, the Company’s stockholders

approved an amended and restated charter that provides for the issuance of up to 100,000,000 shares of common

stock, par value $0.0003 1/3 per share, and permits amendments to the charter without stockholder approval to

increase or decrease the aggregate number of shares of stock authorized, or the number of shares of stock of any

class or series of stock authorized, and to classify or reclassify unissued shares of stock.

The amended and restated charter divides the Company’s common stock into two classes, Class A Common

Stock and Class B Convertible Common Stock. Except as provided for in the future with respect to any other

class or series of stock, the holders of our common stock possess exclusive voting power. Holders of Class A

Common Stock and Class B Convertible Common Stock have identical rights, except that the holders of Class A

Common Stock are entitled to one vote per share and holders of Class B Convertible Common Stock are entitled

to 10 votes per share on all matters submitted to stockholder vote. Class B Convertible Common Stock may only

52