Under Armour 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

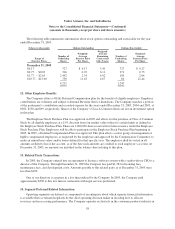

In December 2003, the Company entered into a master loan and security agreement that is subordinate to the

revolving credit facility. Under this agreement the Company borrowed $1,250 for the purchase of qualifying

furniture and fixtures. This agreement bears interest at 6.97% annually, and principal and interest payments are

due monthly through February 2006. At December 31, 2005, the outstanding principal balance was $96 which

will be repaid in 2006. At December 31, 2004, the outstanding principal balance was $733.

In 2001 and again in 2003, the Company entered into subordinated debt agreements, each for $3,000

maturing June 2008 and April 2006, respectively. Interest accrued from 13.5% through 20.0% per year. In

September 2003, the Company repaid all principal and interest due under both of these subordinated debt

agreements with proceeds from the sale of Convertible Common Stock held by Rosewood entities and Series A

Preferred Stock (see note 8).

Interest expense for all debt was $3,188, $1,290 and $2,220 for the years ended December 31, 2005, 2004

and 2003, respectively. During 2005 and 2003, in connection with the repayment of debt, $265 and $99,

respectively, in deferred financing costs were written off and included in interest expense. For the years ended

December 31, 2005, 2004 and 2003 the Company amortized and included in interest expense $57, $48 and $15,

respectively, of deferred financing costs.

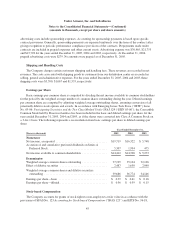

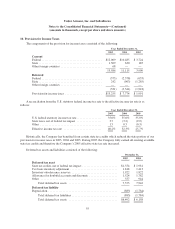

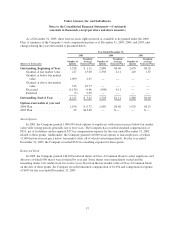

6. Obligations under Capital and Operating Leases

The Company leases warehouse space, office facilities, space for our retail outlet stores and certain

equipment under non-cancelable operating and capital leases. The leases expire at various dates through 2010,

excluding extensions at our option, and certain various provisions for rental adjustments.

The following is a schedule of future minimum lease payments for capital and non-cancelable operating

leases as of December 31, 2005:

Operating Capital

2006 .............................................. $3,604 $ 2,000

2007 .............................................. 3,021 885

2008 .............................................. 2,137 508

2009 .............................................. 666 378

2010 .............................................. 132 99

Total future minimum lease payments .................... $9,560 3,870

Less amount representing interest ....................... (314)

Present value of future minimum capital lease payments ..... 3,556

Less current maturities of obligations under capital leases .... (1,841)

Long term lease obligations ............................ $1,715

Rent expense for the years ended December 31, 2005, 2004 and 2003 was $3,237, $1,881 and $898,

respectively, under the operating lease agreements.

51