Under Armour 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The offering terminated after the sale of all of the shares registered on the registration statement. The gross

proceeds from the shares of Class A Common Stock sold by us were $123.5 million. The net proceeds to us from

the offering were approximately $112.7 million, after deducting an aggregate of $8.6 million in underwriting

discounts and commissions paid to the underwriters and $2.2 million in other expenses incurred in connection

with the offering. We used $49.2 million of these proceeds to:

• redeem all outstanding shares of our Series A Preferred Stock for an aggregate redemption price of

$12.0 million; and

• repay approximately $25.0 million of term debt and $12.2 million outstanding under our revolving

credit facility.

We intend to use the remaining proceeds, or $63.5 million, for general corporate purposes including capital

investments and working capital.

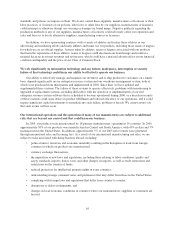

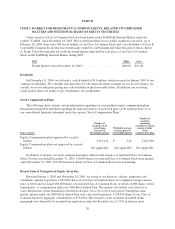

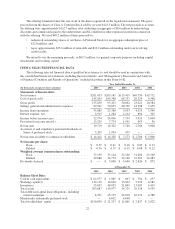

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data is qualified by reference to, and should be read in conjunction with,

the consolidated financial statements, including the notes thereto, and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” included elsewhere in this Form 10-K.

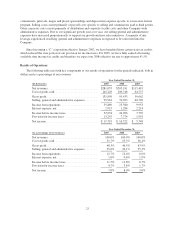

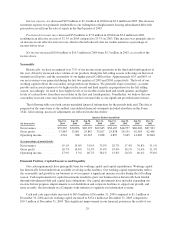

Year Ended December 31,

(In thousands, except per share amounts) 2005 2004 2003 2002 2001

Statements of Income data:

Net revenues ................................... $281,053 $205,181 $115,419 $49,550 $19,732

Cost of goods sold .............................. 145,203 109,748 64,757 26,329 9,348

Gross profit .................................... 135,850 95,433 50,662 23,221 10,384

Selling, general and administrative expenses .......... 99,961 70,053 40,709 18,908 7,035

Income from operations .......................... 35,889 25,380 9,953 4,313 3,349

Interest expense, net ............................. 2,915 1,284 2,214 894 305

Income before income taxes ....................... 32,974 24,096 7,739 3,419 3,044

Provision for income taxes(1) ..................... 13,255 7,774 1,991 653 36

Net income .................................... 19,719 16,322 5,748 2,766 3,008

Accretion of and cumulative preferred dividends on

Series A preferred stock ........................ 5,307 1,994 475 — —

Net income available to common stockholders ........ $ 14,412 $ 14,328 $ 5,273 $ 2,766 $ 3,008

Net income per share:

Basic ..................................... $ 0.39 $ 0.41 $ 0.16 $ 0.09 $ 0.13

Diluted ................................... $ 0.36 $ 0.39 $ 0.15 $ 0.08 $ 0.12

Weighted average common shares outstanding:

Basic ..................................... 37,199 35,124 32,106 31,200 23,160

Diluted ................................... 39,686 36,774 34,146 32,967 24,483

Dividends declared .............................. $ — $ 5,000 $ 3,640 $ 2,826 $ 872

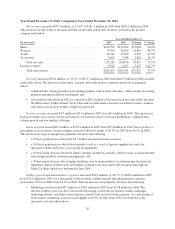

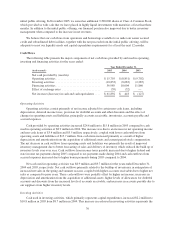

At December 31,

2005 2004 2003 2002 2001

Balance Sheet Data:

Cash & cash equivalents ......................... $ 62,977 $ 1,085 $ 667 $ 794 $ 297

Working capital(2) .............................. 134,118 16,690 13,822 5,296 4,981

Inventories .................................... 53,607 48,055 21,849 13,905 4,419

Total assets .................................... 203,687 110,977 54,725 29,524 9,539

Total debt and capital lease obligations, including

current maturities ............................. 8,391 45,133 22,018 16,976 4,388

Mandatorily redeemable preferred stock ............. — 6,692 4,698 — —

Total stockholders’ equity ........................ $150,830 $ 21,237 $ 11,865 $ 2,827 $ 2,822

22