TomTom 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

p 71 / TomTom Annual Report and Accounts 2010

Notes to the Consolidated Financial Statements

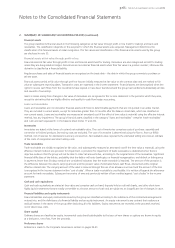

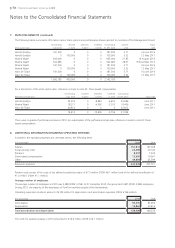

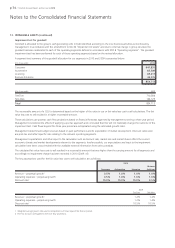

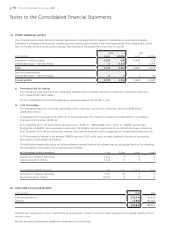

9. FINANCIAL INCOME AND EXPENSES

Financial income and expenses include the following items:

(€ in thousands) 2010 2009

Interest income 977 2,843

Interest expense -36,041 -73,658

Interest result -35,064 -70,815

Other financial result -286 -214

Exchange rate result -15,676 -40,988

Other financial result -15,962 -41,202

The foreign exchange line item is composed of results related to hedging contracts and balance sheet item revaluations. Hedging contracts

are entered to protect the group from adverse exchange rate fluctuations that may result from USD, GBP, AUD, CHF and SEK exposures.

The interest expense relates to interest paid on our borrowings and amortised transaction costs (see note 24).

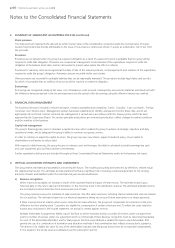

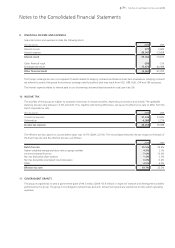

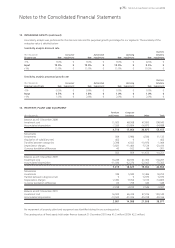

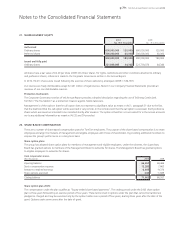

10. INCOME TAX

The activities of the group are subject to corporate income tax in several countries, depending on presence and activity. The applicable

statutory tax rates vary between 12.5% and 41%. This, together with timing differences, can cause the effective tax rate to differ from the

Dutch corporate tax rate.

(€ in thousands) 2010 2009

Current tax expense 31,345 23,809

Deferred tax -4,989 1,279

Income tax expense 26,356 25,088

The effective tax rate, based on income before taxes was 19.7% (2009: 22.5%). The reconciliation between the tax charge on the basis of

the Dutch tax rate and the effective tax rate is as follows:

2010 2009

Dutch tax rate 25.5% 25.5%

Higher weighted average statutory rate on group activities 4.9% 2.7%

Income exempted from tax -7.6% -13.2%

Non tax deductible share options 1.4% 2.1%

Non tax deductible (exempted) result associates 0.0% -0.6%

Other -4.5% 6.0%

Effective tax rate 19.7% 22.5%

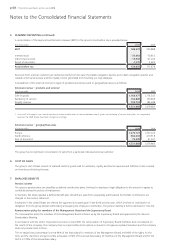

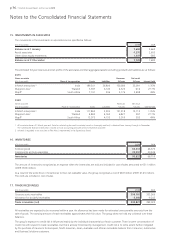

11. GOVERNMENT GRANTS

The group recognised as income a government grant of €9.5 million (2009: €5.9 million) in respect of research and development activities

performed by the group. The group is not obliged to refund these amounts. Government grants are reported as income within operating

expenses.