TomTom 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

p 68 / TomTom Annual Report and Accounts 2010

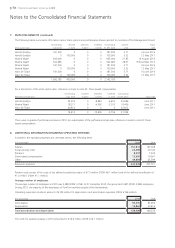

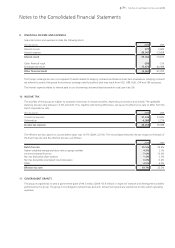

5. SEGMENT REPORTING (continued)

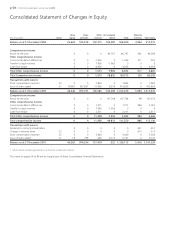

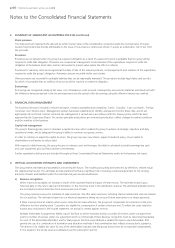

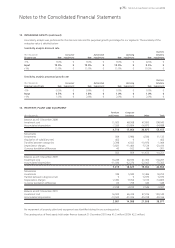

A reconciliation of the segments performance measure (EBIT) to the group’s result before tax is provided below.

(€ in thousands) 2010 2009

EBIT 186,322 220,888

Interest result -35,064 -70,815

Other finance result -15,962 -41,202

Result of associates -1,270 2,603

Result before tax 134,026 111,474

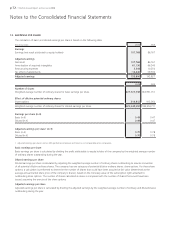

Revenues from external customers are derived primarily from the sale of portable navigation devices and in-dash navigation systems and

related content and services and the royalty income generated from licensing our map database.

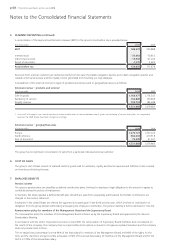

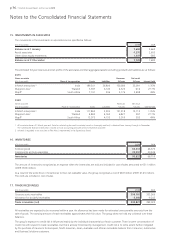

A breakdown of the external revenue to types of products and services and to geographical areas is as follows:

External revenue – products and services1

(€ in thousands) 2010 2009

Sale of goods 1,164,477 1,174,543

Rendering of services 162,882 120,469

Royalty revenue 193,724 184,648

1,521,083 1,479,660

1 As a result of changes in our internal reporting structure a reallocation of revenue between sale of goods and rendering of services took place. For comparative

purposes the 2009 figures have been changed accordingly.

External revenue – geographical areas

(€ in thousands) 2010 2009

Europe 1,070,127 1,007,205

North America 380,463 410,918

Rest of the world 70,493 61,537

1,521,083 1,479,660

The group has no significant concentration of sales from a particular individual external customer.

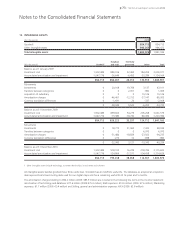

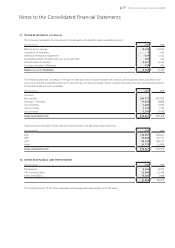

6. COST OF SALES

The group’s cost of sales consists of material costs for goods sold to customers, royalty and license expenses and fulfilment costs incurred

on inventory sold during the year.

7. EMPLOYEE BENEFITS

Pension scheme

The group’s pension plans are classified as defined contribution plans, limiting the employer’s legal obligation to the amount it agrees to

contribute during the period of employment.

In Germany Tele Atlas operates a defined benefit plan. Benefits are paid from a separately administered fund whilst contributions are

charged to the income statement.

Employees in the United States are offered the opportunity to participate in the 401K pension plan, which involves no contribution or

obligation from the group besides withholding and paying the employee contribution. The pension liability is further disclosed in note 28.

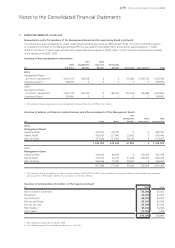

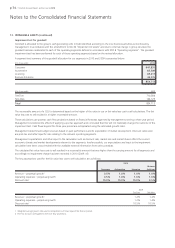

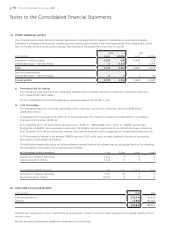

Remuneration policy for members of the Management Board and the Supervisory Board

The remuneration policy for members of the Management Board is drawn up by the Supervisory Board and approved by the General

Shareholders Meeting.

In accordance with the Dutch Corporate Governance Code 2009, the remuneration of Supervisory Board members does not depend on

the results of the company. The company does not grant either stock options or shares to its Supervisory Board members and the company

does not provide loans to them.

The on-target bonus percentage is set at 64% of the base salary for members of the Management Board and 80% of the salary for the

CEO, and the maximum annual incentive achievable is 96% of the annual base salary for members of the Management Board and for the

CEO it is 120% of the annual base salary.

Notes to the Consolidated Financial Statements