TomTom 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

p 67 / TomTom Annual Report and Accounts 2010

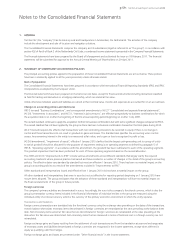

Notes to the Consolidated Financial Statements

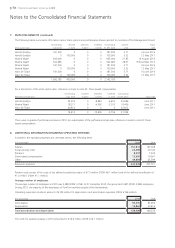

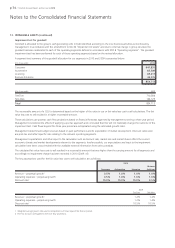

4. CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS (continued)

b) Impairment of non-financial assets

The group reviews impairment of non-financial assets at least on an annual basis. This requires an estimation of the fair value of the

cash-generating units to which the non-financial assets are allocated. Estimating the fair value amount requires management to make

an estimate of the expected future cash flows from the cash-generating unit and also to determine a suitable discount rate in order to

calculate the present value of those cash flows. For additional information on goodwill impairment test refer to note 13.

c) Stock compensation plan

In order to calculate the charge for share-based compensation as required by IFRS 2, the group makes estimates, principally relating

to the assumptions used in its models to calculate the stock compensation expenses as set out in note 22.

d) Provisions

For our critical accounting estimates and judgements on provisions, refer to note 26.

e) Capitalised databases and tools

Internally generated databases and tools are capitalised in accordance with IAS 38. Assumptions are made regarding the estimated

level of completion. At the point where activities no longer relate to development but to maintenance, capitalisation is discontinued.

Management are also required to make judgements in respect of developed software tools. For additional information refer to note 13.

f) Income taxes

Deferred tax assets are recognised for all unused tax losses to the extent that it is probable that taxable profit will be available against

which the losses can be utilised. Significant management judgement is required to determine the amount of deferred tax assets that

can be recognised, based upon the likely timing and level of future taxable profits together with future tax planning strategies.

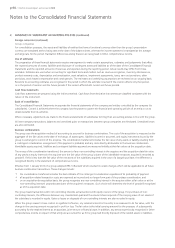

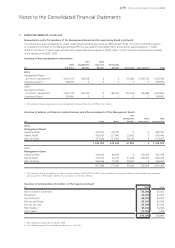

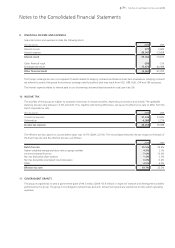

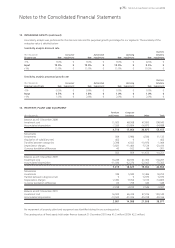

5. SEGMENT REPORTING

The operating segments are identified and reported on the basis of internal reports about components of the group that are regularly

reviewed by the Management Board to assess the performance of the segments.

Internal management reporting is based upon four main segments (Consumer, Automotive, Licensing and Business Solutions) which are

presented as reportable segments in these financial statements. As part of the integration of the former Tele Atlas operation certain

activities, like navigation content production, have been restructured among the business units within the group. The segment information

reported and the comparative information reflect these changes and are therefore not necessarily comparable with the previously reported

segment information.

Management assesses the performance of segments based on the measures of revenue and earnings before interest and taxes (EBIT),

whereby the EBIT measure includes allocations of expenses from supporting functions within the group. Such allocations have been

determined based on relevant measures which reflect the level of benefits of these functions to each of the operating segments. The

effects of non-recurring items such as impairment (if any) are excluded from management’s measurement basis. Interest income and

expenses and tax are not allocated to the segments.

(€ in thousands) 2010 2009

Revenue

Consumer 1,158,002 1,205,362

Automotive 179,470 100,495

Licensing 130,767 133,157

Business Solutions 52,844 40,646

Total 1,521,083 1,479,660

EBIT

Consumer 187,329 246,572

Automotive 1,868 -14,267

Licensing 281 -5,481

Business Solutions 13,131 9,791

Unallocated -16,287 -15,727

Total 186,322 220,888

IFRS 8 has been amended so that a measure of segment (non-current) assets is only required to be disclosed if the measure is regularly

provided to the chief operating decision-maker. The amendment is effective for periods beginning on or after 1 January 2010. In

accordance with this amendment, no measure of segment assets is reported.