TomTom 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

p 20 / TomTom Annual Report and Accounts 2010

Management Board Report

(continued)

Consumer revenue benefited from increased sales of

content and services like map subscriptions and our LIVE

Services. Consumer hardware revenue decreased because

of lower PND unit sales as the size of the market reduced

and a limited decline in our average selling price (ASP). The

effect of the decrease in market size was partly offset by an

increase in our market share. The trend of year on year ASP

decline is clearly flattening and towards the end of 2010

we even saw areas where we strengthened our ASP mainly

as a result of adding features and services to our product

offering.

Automotive revenue nearly doubled in 2010 from

€100 million in the previous year to €179 million in 2010.

Automotive saw strong revenues from hardware as well

as content and services. We sold 584,000 in dash systems

compared with 260,000 in 2009. The increased revenue

resulted from volume shipments to Renault as well as

increased sales to other customers like Fiat, Sony and

Toyota. Our Automotive map revenues also showed

strong growth year on year.

Our Licensing business unit showed a slight revenue

decrease of 2%. The decrease resulted from a decline

in revenues from the PND segment as the total market

volume in the PND segment is down; within this segment

we added the Magellan brand to our customer base.

Our sales to enterprises and governments declined but

the impact was offset by a revenue increase from internet

and wireless customers.

Business Solutions increased revenue by 29% year on year.

The revenue increase came from a strong increase in the

number of WEBFLEET subscriptions, which increased to

134,000 at the end of 2010 from 96,000 in 2009. In 2010

Business Solutions introduced its new PRO range of devices

and expanded into several new geographical markets.

Revenue by geography

In 2010, the group generated revenue in EMEA, North

America and the rest of the world which is mainly Asia

Pacific. The proportion of sales outside EMEA decreased

slightly to 30% in 2010 (2009: 32%) as a result of lower

sales in North America. In EMEA, revenue increased by 6%

to €1.07 billion, up from €1.01 billion in 2009. Sales in

North America decreased by 8% to €380 million in 2010

down from €411 million in 2009. In the rest of the world

sales were up 14% to €70 million from €62 million in 2009.

Gross result

The gross margin was 49% for the year and was the same

as last year (2009: 49%). The gross profit increased to

€744 million, an increase of €13 million or 2% over 2009.

The majority of trade purchases are denominated in US

dollars. During 2010, we were impacted by a strengthening

of the US dollar against the euro. On average, the US dollar

rate strengthened by 4% compared to 2009, which decreased

our gross margin for 2010 by 1 percentage point.

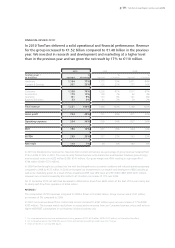

REVENUE 2009 (in € millions)

Consumer 1,205 81%

Automotive 100 7%

Licensing 133 9%

Business Solutions 41 3%

81%

3%

7%

9%

Consumer

Automotive

Licensing

Business Solutions

REVENUE 2010 (in € millions)

Hardware 1,164 77%

Content & Services 357 23%

77%

23%

Hardware

Content & Services

REVENUE 2010 (in € millions)

Consumer 1,158 76%

Automotive 179 12%

Licensing 131 9%

Business Solutions 53 3%

Consumer

Automotive

Licensing

Business Solutions

76%

3%

12%

9%