Tesco 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group financial statements continued

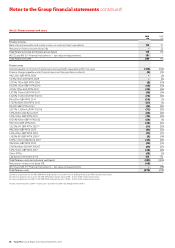

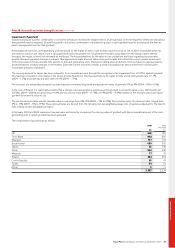

Note 2 Segmental reporting

IFRS 8 requires operating segments to be determined based on the Group’s internal reporting to the Chief Operating Decision Maker (‘CODM’).

The CODM has been determined to be the Executive Committee of the Board of Directors as it is primarily responsible for the allocation of resources

to segments and the assessment of performance of the segments. Previously, segments were determined and presented in accordance with IAS 14

‘Segment Reporting’.

The CODM uses trading profit, as reviewed at monthly Executive Committee meetings as the key measure of the segments’ results as it reflects the

segments’ underlying trading performance for the period under evaluation. Trading profit is a consistent measure within the Group.

Segmental trading profit is an adjusted measure of operating profit, which measures the performance of each segment before exceptional items

(goodwill impairment and restructuring charges), profit arising on property-related items, impact on leases of annual uplifts in rent and rent-free periods,

amortisation charges from intangible assets arising on acquisition, adjustments to fair value of customer loyalty awards and replaces the IAS 19 pension

charge with the ‘normal’ cash contributions for pensions.

On the adoption of IFRS 8, the Group revised its operating and reporting segments. The Group’s operating segments were previously defined

geographically – UK, Rest of Europe, Asia and US. The Group’s operations (retail and retailing services) are managed by geography, with Tesco Bank

as a separate reporting segment because of its different regulatory environment. Accordingly, the segments under IFRS 8 are UK, Rest of Europe (ROE

comprises Republic of Ireland, Hungary, Poland, the Czech Republic, Slovakia and Turkey), Asia (comprising Thailand, South Korea, Malaysia, China,

Japan and India), US and Tesco Bank.

Comparative information has been restated to reflect these new segments.

Segment assets include items directly attributable to a segment as well as those that can be allocated on a reasonable basis. Unallocated is comprised

mainly of derivative receivables, interest-bearing loan receivables and taxation-related assets.

Inter-segment turnover between the operating segments is not material.

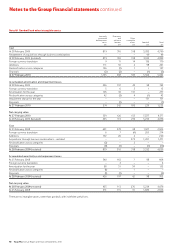

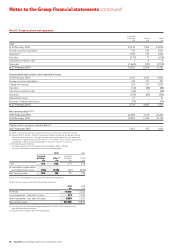

The segment results for the year ended 27 February 2010, for the year ended 28 February 2009 and the reconciliation of the segment measures to the

respective statutory items included in the consolidated financial information are as follows:

Total at Total

Tesco constant Foreign at actual

Year ended 27 February 2010 UK ROE Asia US Bank exchange exchange exchange

At constant exchange rates £m £m £m £m £m £m £m £m

Continuing operations

Sales inc. VAT (excluding IFRIC 13) 42,254 9,979 8,737 324 860 62,154 383 62,537

Revenue (excluding IFRIC 13) 39,104 8,704 8,148 319 860 57,135 367 57,502

Effect of IFRIC 13 (546) (19) (25) – – (590) (2) (592)

Revenue 38,558 8,685 8,123 319 860 56,545 365 56,910

Trading profit/(loss) 2,413 466 422 (151) 250 3,400 12 3,412

Trading margin* 6.2% 5.4% 5.2% (47.3%) 29.1% 5.9% – 5.9%

Total

Tesco at actual

Year ended 27 February 2010 UK ROE Asia US Bank exchange

At actual exchange rates £m £m £m £m £m £m

Continuing operations

Sales inc. VAT (excluding IFRIC 13) 42,254 9,997 9,072 354 860 62,537

Revenue (excluding IFRIC 13) 39,104 8,724 8,465 349 860 57,502

Effect of IFRIC 13 (546) (20) (26) – – (592)

Revenue 38,558 8,704 8,439 349 860 56,910

Trading profit/(loss) 2,413 474 440 (165) 250 3,412

Trading margin* 6.2% 5.4% 5.2% (47.3%) 29.1% 5.9%

Total at Total

Tesco constant Foreign at actual

Year ended 28 February 2009 UK ROE Asia US Bank exchange exchange exchange

At constant exchange rates £m £m £m £m £m £m £m £m

Continuing operations

Sales inc. VAT (excluding IFRIC 13) 41,357 8,373 7,020 181 163 57,094 2,332 59,426

Revenue (excluding IFRIC 13) 38,028 7,335 6,552 179 163 52,257 2,070 54,327

Effect of IFRIC 13 (378) (26) (18) – – (422) (7) (429)

Revenue 37,650 7,309 6,534 179 163 51,835 2,063 53,898

Trading profit/(loss) 2,309 411 345 (123) 68 3,010 76 3,086

Trading margin* 6.1% 5.6% 5.3% (68.7%) 41.7% 5.8% 5.7%

* Trading margin is based on revenue excluding IFRIC 13.

82 Tesco PLC Annual Report and Financial Statements 2010