Tesco 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements

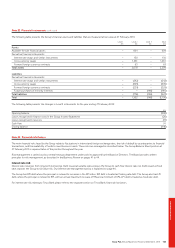

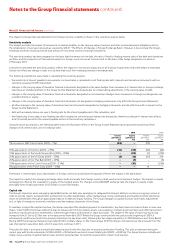

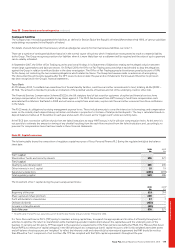

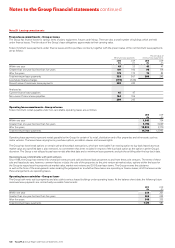

Note 27 Share-based payments

The total Group Income Statement charge for the year recognised in respect of share-based payments is £300m (2009 restated – £246m), which is made

up of share option schemes and share bonus payments. Of this amount £241m (2009 restated – £208m) will be equity-settled and £59m (2009 – £38m)

cash-settled.

a) Share option schemes

The Company had nine share option schemes in operation during the year, all of which are equity-settled schemes:

i) The Savings-related Share Option Scheme (1981) permits the grant to employees of options in respect of ordinary shares linked to a building

society/bank save-as-you-earn contract for a term of three or five years with contributions from employees of an amount between £5 and £250

per four-weekly period. Options are capable of being exercised at the end of the three- or five-year period at a subscription price not less than

80% of the average of the middle-market quotations of an ordinary share over the three dealing days immediately preceding the offer date.

ii) The Irish Savings-related Share Option Scheme (2000) permits the grant to Irish employees of options in respect of ordinary shares linked to a

building society/bank save-as-you-earn contract for a term of three or five years with contributions from employees of an amount between €12

and €320 per four-weekly period. Options are capable of being exercised at the end of the three- or five-year period at a subscription price not less

than 80% of the average of the middle-market quotations of an ordinary share over the three dealing days immediately preceding the offer date.

iii) The Approved Executive Share Option Scheme (1994) was adopted on 17 October 1994. The exercise of options granted under this scheme will

normally be conditional upon the achievement of a specified performance target related to the growth in earnings per share over a three-year

period. No further options will be granted under this scheme and it has been replaced by the Discretionary Share Option Plan (2004). There were

no discounted options granted under this scheme.

iv) The Unapproved Executive Share Option Scheme (1996) was adopted on 7 June 1996. The exercise of options granted under this scheme will

normally be conditional upon the achievement of a specified performance target related to the growth in earnings per share over a three-year

period. No further options will be granted under this scheme and it has been replaced by the Discretionary Share Option Plan (2004). There were

no discounted options granted under this scheme.

v) The International Executive Share Option Scheme (1994) was adopted on 20 May 1994. This scheme permits the grant to selected non-UK

executives of options to acquire ordinary shares on substantially the same basis as their UK counterparts. The exercise of options granted under this

scheme will normally be conditional on the achievement of a specified performance target related to the growth in earnings per share over a three-

year period. No further options will be granted under this scheme and it has been replaced by the Discretionary Share Option Plan (2004). There

were no discounted options granted under this scheme.

vi) The Executive Incentive Plan (2004) was adopted on 5 July 2004. This scheme permits the grant of options in respect of ordinary shares to selected

executives. Options are normally exercisable between three and ten years from the date of grant for nil consideration.

vii) The Performance Share Plan (2004) was adopted on 5 July 2004 and amended on 29 June 2007. This scheme permits the grant of options in

respect of ordinary shares to selected executives. Options granted before 29 June 2007 are normally exercisable between four and ten years from

the date of grant for nil consideration. Options granted after 29 June 2007 are normally exercisable between three and ten years from the date of

grant for nil consideration. The exercise of options will normally be conditional on the achievement of specified performance targets related to the

return on capital employed over a three-year period.

viii) The Discretionary Share Option Plan (2004) was adopted on 5 July 2004. This scheme permits the grant of approved, unapproved and international

options in respect of ordinary shares to selected executives. Options are normally exercisable between three and ten years from the date of grant at

a price not less than the middle-market quotation or average middle-market quotations of an ordinary share for the dealing day or three dealing days

preceding the date of grant. The exercise of options will normally be conditional on the achievement of a specified performance target related to the

annual percentage growth in earnings per share over a three-year period. There will be no discounted options granted under this scheme.

ix) The Group New Business Incentive Plan (2007) was adopted on 29 June 2007. This scheme permits the grant of options in respect of ordinary

shares to selected executives. Options will normally vest in four tranches: four, five, six and seven years after the date of grant and will be exercisable

for up to two years from the vesting dates for nil consideration. The exercise of options will normally be conditional on the achievement of specified

performance targets related to the return on capital employed over the seven-year plan.

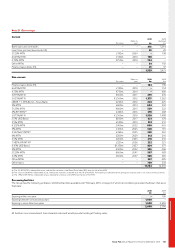

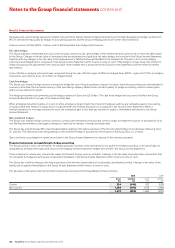

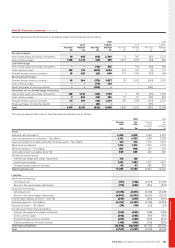

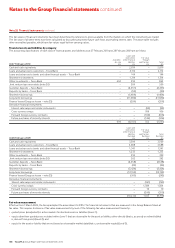

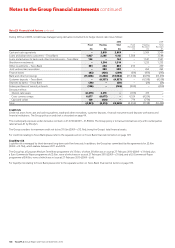

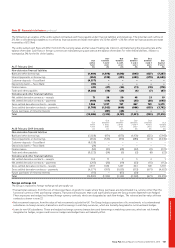

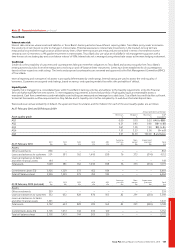

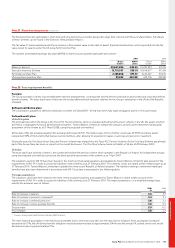

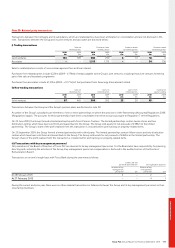

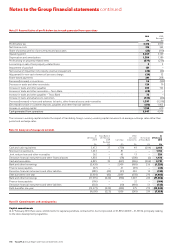

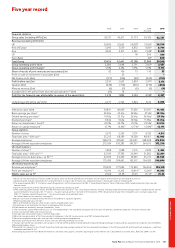

The following tables reconcile the number of share options outstanding and the weighted average exercise price (WAEP):

For the year ended 27 February 2010

Savings-related Irish savings-related Approved Unapproved International executive Nil cost

share option scheme share option scheme share option scheme share option scheme share option scheme share options

Options WAEP Options WAEP Options WAEP Options WAEP Options WAEP Options WAEP

Outstanding at

28 February

2009 142,810,097 306.21 5,418,903 315.67 15,868,920 350.56 81,299,884 339.97 43,898,205 366.61 14,323,708 0.00

Granted 38,117,516 328.00 1,752,363 328.00 2,844,857 338.40 26,542,534 338.42 19,097,981 338.82 3,093,147 0.00

Forfeited (9,476,452) 315.43 (873,617) 314.96 (581,769) 409.75 (3,213,394) 409.29 (2,147,644) 403.74 (2,299,256) 0.00

Exercised (33,216,641) 257.20 (842,581) 270.60 (3,581,117) 286.54 (18,721,402) 273.16 (5,967,794) 291.66 (5,932,144) 0.00

Outstanding at

27 February

2010 138,234,520 323.37 5,455,068 326.70 14,550,891 361.57 85,907,622 351.46 54,880,748 363.64 9,185,455 0.00

Exercisable as at

27 February

2010 6,287,764 266.10 369,370 282.75 5,868,560 282.29 32,430,807 280.29 15,277,598 289.05 – –

Exercise price 195.00 to 195.00 to 197.50 to 197.50 to 197.50 to

range (pence) 307.00 307.00 388.75 415.50 318.60 –

Weighted average

remaining

contractual

life (years) 0.18 0.15 4.26 4.53 4.75 –

Tesco PLC Annual Report and Financial Statements 2010 111