Tesco 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 Tesco PLC Annual Report and Financial Statements 2010

International

continued

Our flagship My Narodni

department store in Prague

reopened in September 2009

after a major refit

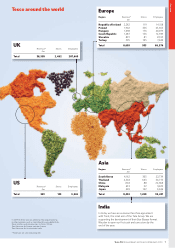

Europe

Europe overall delivered a robust

performance against strong economic

headwinds in the form of a sharp

downturn in economic activity

causing a slow-down in customer

expenditure. Sales growth varied

across the region with a good

contribution from new space helping

sales grow in Poland and Turkey and

stay stable in the Czech Republic and

Hungary. Significant price deflation

and cross-border shopping driven by

rapid movements in exchange rates

resulted in sales declining in Slovakia

and Ireland. Overall, however, the

sales trends are now improving; each

of our European businesses showed

an improvement in like-for-like sales

growth in the fourth quarter.

We have made market share gains

across our Central European markets

by reducing costs and lowering prices

for customers and by continuing to

invest in new space. Profitability in the

region as a whole declined slightly

compared with last year but was

resilient given the severity of recession.

We are continuing to invest in the

region, opening 1.8m sq ft of new

space during the year – less than

originally expected, primarily as a

result of the economic environment.

With the outlook improving we will

be stepping up the rate of opening

with a plan to add 3.1m sq ft of new

space across the region in 2010/11.

Republic of Ireland

In Ireland we have made substantial

changes to our business, which was

facing the dual challenge of a severe

recession and cross-border trading. By

integrating more of our international

brand buying with our UK business we

have been able to reduce the prices

of 12,500 products by an average

of around 20%.

Customers are responding

enthusiastically to our improved

pricing and range; significant uplifts

in volumes have now offset the impact

of lower prices, resulting in positive

like-for-like sales growth in the last

few weeks of the year and a growing

market share. These changes,

combined with a substantial cost

reduction programme, have enabled

Tesco Ireland to deliver a steady

financial performance despite the

economic headwinds and significant

self-imposed price deflation. The

cost of the exceptional restructuring

activities was £33m in total for

the year.

Hungary

Our business in Hungary continues

to perform well – with sales levels

being maintained despite a very weak

economy in which unemployment

levels increased by more than 25%

and consumers were hit with a 5%

increase in sales tax. We are continuing

to execute our strategy of investing

in the shopping trip for customers,

helping our overall market share to

grow again in the last year, further

consolidating our market leadership.

Poland

In Poland, we have had another good

year with strong growth in sales and

profits on a constant exchange rate

basis. A good performance from the

converted Leader Price stores, the

popularity of our Discount Brands –

now in one in three baskets – and

our clothing range, which achieved

like-for-like sales growth of more than

20%, have helped our business

maintain positive ex-petrol like-for-

like sales growth overall. The launch

of Clubcard in August 2009 has been

very well received, with 1.8 million

customers signing up so far.

Czech Republic

In the Czech Republic our strong

new store opening programme has

helped us maintain sales at levels

similar to last year and improve our

share of a market affected by high

unemployment and price deflation.

Our Express and 10,000 sq ft format

stores continue to do well with

positive like-for-like sales growth,

but as in most markets, growth in

the larger stores remains subdued as

customers curtail their spending on

non-food in the current environment.

The outstanding category in non-

food has been clothing with double-

digit sales growth. Our flagship My

Narodni department store in Prague

was reopened after a major refit

project and we are pleased with the

results to date.

The first Tesco

outside the UK

opened just 15 years

ago – in Hungary