Tesco 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group financial statements continued

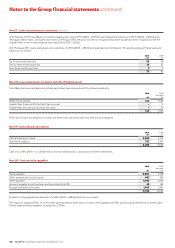

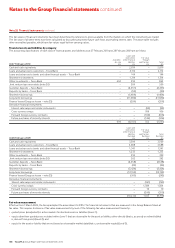

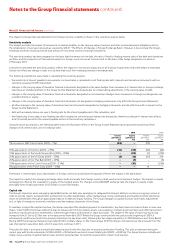

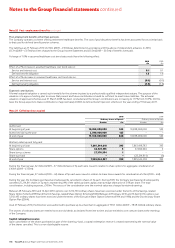

Note 23 Financial risk factors continued

Insurance risk

Tesco Bank is exposed to insurance risk indirectly through its profit sharing commission arrangement with The Royal Bank of Scotland Group PLC.

Insurance risk is the risk of fluctuations in the timing, frequency or severity of insured events, relative to the expectations at the time of underwriting.

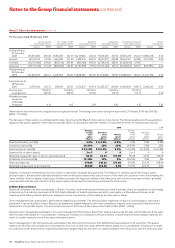

The frequency and severity of claims and the sources of uncertainty for the key classes that Tesco Bank is exposed to are as follows:

Motor insurance

Claims experience is quite variable, due to a wide range of factors, but the principal ones are age, gender and driving experience, type and nature

of vehicle, use of vehicle and area. There are many sources of uncertainty that will affect Tesco Bank’s experience under motor insurance including

operational risk, reserving risk, premium rates not matching claims inflation rates, the weather, the social, economic and legislative environment

and reinsurance failure risk.

Property insurance

The major causes of claims for property insurance are theft, flood, escape of water, fire, storm, subsidence and various types of accidental damage.

The major source of uncertainty is the volatility of weather.

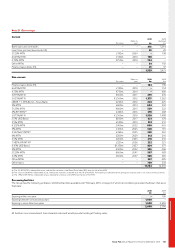

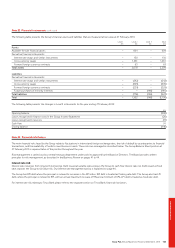

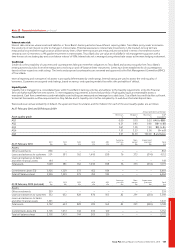

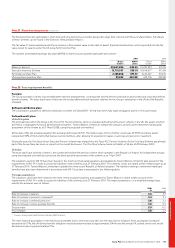

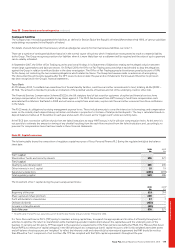

Note 24 Customer deposits

2010 2009

£m £m

Customer deposits 4,357 4,538

Customer deposits are recorded at amortised cost and are repayable on demand.

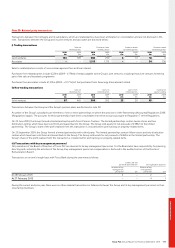

Note 25 Deposits by banks

The Group has deposits by banks with the following maturity:

2010 2009

£m £m

Within three months 30 24

Deposits by banks are recorded at amortised cost.

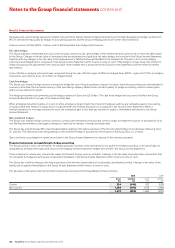

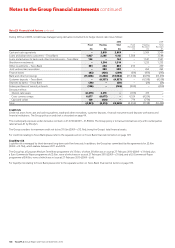

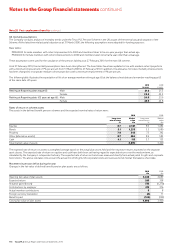

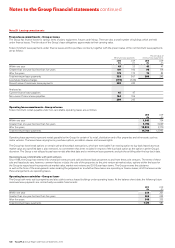

Note 26 Provisions

Property Other

provisions provision Total

£m £m £m

At 23 February 2008 27 – 27

Foreign currency translation 3 – 3

Acquisitions through business combinations (restated) 93 99 192

Amount utilised in the year (12) – (12)

At 28 February 2009 (restated) 111 99 210

Foreign currency translation 12 – 12

Amount provided in the year – 1 1

Amount utilised in the year (12) – (12)

At 27 February 2010 111 100 211

Property provisions comprise future rents payable net of rents receivable on onerous and vacant property leases, provisions for terminal dilapidations and

provisions for future rents above market value on unprofitable stores. The majority of the provision is expected to be utilised over the period to 2020.

The other provision balance relates to a provision for customer redress in respect of potential customer complaints. This is likely to be utilised over several years.

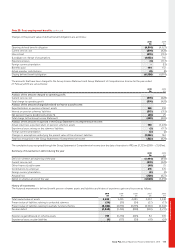

The balances are analysed as follows:

2010 2009

Restated

£m £m

Current 39 10

Non-current 172 200

211 210

110 Tesco PLC Annual Report and Financial Statements 2010