Tesco 2010 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2010 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and Financial Statements 2010 25

Our business

Retailing

Services

Laying the

foundations for

further growth

Following the announcement in

July 2008 of our intention to take

full ownership of Tesco Bank,

we set a target to grow the

profitability of our Retailing

Services businesses from a little

under £400m in 2007/8 to £1bn.

This year we made good progress

in attracting new customers and

growing sales and profits while

at the same time laying the

foundations for further growth.

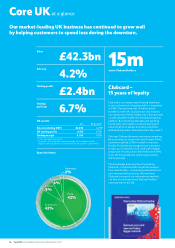

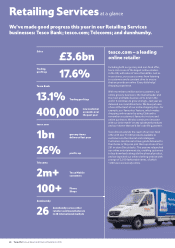

Total Retailing Services sales were

£3.6bn, up 4.2% on last year and

profits were £540m, up 17.6%.

Tesco Bank

Overall, Tesco Bank has delivered a

good performance in a challenging

retail banking market growing profits

by 13% to £250m. Bad debt levels

rose during the year but have now

stabilised and throughout have

remained below industry averages.

We have absorbed additional costs as

we begin the process of moving the

business onto its own infrastructure

and build the team as we prepare the

business for faster growth.

Commercial performance

We grew the number of customer

accounts by more than 400,000 in

the last year – to a total of more than

6.2 million across all products. We

have achieved double-digit customer

growth in our banking products,

including 27% growth in personal

loans. In insurance we held our

number of policies broadly flat in a

very competitive market; the number

of motor insurance policies declined

– partly as a result of a planned

reduction in our exposure to high-risk

drivers – but the number of policies

in home, pet and life insurance

increased. Our 130 in-store travel

bureaux saw an increase in

transactions of more than 80%

and the number of ATMs in our

network grew to over 2,800.

Profit

Gross profit grew 19% to £749m with

a good performance in banking being

partly offset by lower profitability

in insurance, primarily as a result of

lower investment income linked to the

current low interest rate environment.

Trading profit was up 13.1% to £250m

(compared to £221m in 2008/9 on a

pro forma basis). Profit before tax was

£114m – with the primary deduction

from operating profit being the

previously announced £127m non-

cash amortisation of intangibles

arising on acquisition. This profit

performance was achieved after an

increase in operating costs – as a

result of the change of ownership as

the business prepares for expansion

– and against the background of a

32% increase in bad debts – to £177m

which was in part offset by a credit

relating to the unwind of the fair value

adjustment created on acquisition.

Capital and liquidity

The Tier 1 capital ratio at the end

of 2009/10 was 13.0%. The funding

and liquidity position of the business

remained robust throughout the

period with customer deposits in

excess of customer lending. This is

further supported by a high-quality

liquid asset portfolio, net short-term

wholesale cash and investment

grade assets worth £1.3bn.

Management team

During the year good progress

has been made in completing

the recruitment of an experienced

management team in all areas

of the Bank: finance; risk; legal;

commercial; treasury; and IT. All

senior roles have now been filled.

Infrastructure

In September 2009 we entered into

an agreement with Fortis (UK) Ltd to

help us build the operational platform

and technical expertise required

to further develop our insurance

business. We have also selected the

core technology platforms for the

banking products. The migration

programmes for both sides of the

business are progressing well and we

expect to be writing business on the

new systems by the end of 2010/11.

We have secured new premises for

banking and insurance operations in

Glasgow and Newcastle, which will

open in mid 2010, creating 1,800 jobs.

New product development

Subject to regulatory approval we

anticipate launching new savings

products and mortgages by the end

of financial year 2010/11, with current

accounts to follow in the second half

of 2011.

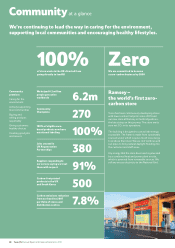

6.2 million Tesco

Bank customers

Double-digit

customer growth

in our banking

products