Tesco 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and Financial Statements 2010 41

Our business

Risks and uncertainties

Introduction Risk is an accepted part of doing business. The real

challenge for any business is to identify the principal risks it faces and to

develop and monitor appropriate controls. A successful risk management

process balances risks and rewards and relies on a sound judgement of

their likelihood and consequence. The Board has overall responsibility for

risk management and internal control within the context of achieving the

Group’s objectives. Our process for identifying and managing risks is set

out in more detail from page 49 of the Corporate Governance section of

the Annual Report and Financial Statements. The key risks faced by the

Group and relevant mitigating factors are set out below.

Business strategy If our strategy follows the wrong direction or is not

effectively communicated then the business may suffer. We need to

understand and properly manage strategic risk in order to deliver long-term

growth for the benefit of all our stakeholders. Our strategy is based on

five elements: to become a successful international retailer, to grow the

core UK business, be as strong in non-food as in food, develop retailing

services and put the community at the heart of what we do. Pursuit of this

five-part strategy has allowed the business to diversify and, at a strategic

level, diversification and pursuit of growth in emerging markets have the

effect of reducing overall risk by avoiding reliance on a small number of

business areas. However, by its very nature, diversification also introduces

new risks to be managed in areas of the business that are less mature and

less fully understood.

To ensure the Group continues to pursue the right strategy, the Board

discusses strategic issues at every Board meeting and dedicates two full

days a year to reviewing the Group’s strategy. The Executive Committee

also discusses strategy on a regular basis. We have structured programmes

for engaging with all our stakeholders including customers, employees,

investors, suppliers, government, media and non-governmental

organisations. We also invest significant resources in ensuring our strategy

is communicated well and understood by the parties who are key to

delivering it. The business operates a Steering Wheel (a balanced scorecard

process whereby we set goals for different areas of the business and assess

our overall progress on a quarterly basis) in all countries and significant

business units to help manage performance and deliver business strategy.

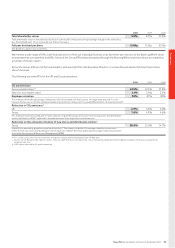

Financial strategy and Group treasury risk The main financial risks of

the Group relate to the availability of funds to meet business needs, the

risk of default by counterparties to financial transactions and fluctuations

in interest and foreign exchange rates. The risks associated with operating

Tesco Bank are covered under Financial services risks below.

The Treasury function is mandated by the Board to manage the financial

risks that arise in relation to underlying business needs. The function has

clear policies and operating parameters, and its activities are routinely

reviewed and audited. The function does not operate as a profit centre and

the undertaking of speculative transactions is not permitted. A description

of the role of the Finance Committee, Internal Audit and External Audit is

set out in the Corporate Governance section on page 50.

Financial services risks Through Tesco Bank, the Group is subject to

certain risks relating to the personal financial services industry in the UK.

Tesco Bank is subject to significant legislative and regulatory oversight.

In particular, Tesco Bank is subject to supervision by the Financial Services

Authority (FSA) which has substantial powers of intervention and requires

it to satisfy certain capital adequacy and liquidity ratios. If Tesco Bank is

unable to or fails to satisfy these ratios in the future it could lose its licence

and, consequently, its ability to transact business.

Tesco Bank became a wholly owned subsidiary of Tesco on 19 December

2008. In preparation for this change its risk management and treasury

capabilities were materially strengthened. All policies pertaining to risk

within the Bank are now subject to Tesco Bank specific governance

procedures which are owned by the Tesco Bank Board.

Tesco Bank has a banking business, predominantly in the UK, with the

three main products being credit cards, unsecured personal loans and

savings. It has also developed a significant insurance business, with motor,

home and pet insurance being the main products.

Tesco Bank is subject to various risks associated with the provision of

financial services. In relation to its insurance business Tesco Bank may

experience a concentration of risks from natural or man-made disasters.

In addition market conditions may not allow it to purchase the amount

of re-insurance it considers necessary on terms it considers acceptable.

Actual claims may exceed the claims provisions that have been made on

the basis of past experience. Tesco Bank’s credit card receivables and

personal loan portfolio may be subject to changes in credit quality, due

to a general deterioration in economic conditions or to failures in its credit

assessment process, which could adversely impact its ability to recover

amounts due. Furthermore, there is significant competition in the financial

services industry which could adversely affect Tesco Bank’s profitability.

Legal developments, changes in legal interpretation or precedent and

changes in public policy may result in new risks emerging in addition to

those anticipated.

Tesco Bank is in the process of building new banking and insurance

systems and until these are complete there is an increased element

of operational risk as most operations are outsourced to Royal Bank of

Scotland. Tesco Bank retains the risk to its insurance activities posed

by external factors, such as a large weather-related event.

Tesco Bank is an FSA-regulated entity and so its treasury function is run

independently from the rest of the Group. Tesco Bank’s treasury risks

include liquidity risk and interest rate risk (in particular, in the interest rate

margin realised between lending and borrowing costs). Tesco Bank

is also subject to the risk of unexpected losses arising from operational

failure, whether as a result of human error, systems failures, fraud or

inadequate controls.

Tesco Bank monitors these risks through its governance structures, assessing

any potential impact and action required to manage them. The work of the

Risk Committee focuses on systemic risks such as funding, credit risk and

risks in the insurance business, while the Tesco Bank Audit Committee

considers internal controls and assurance.

Operational threats and performance risk in the business There is a

risk that our business may not deliver the stated strategy in full, particularly

since, like all retailers, the business is susceptible to economic downturn

that could affect consumer spending. The continuing acquisition and

development of property sites also forms an intrinsic part of our strategy

and this carries inherent risks.