Seagate 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

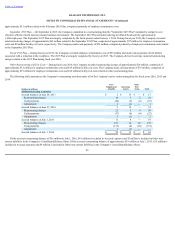

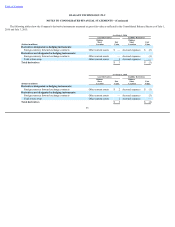

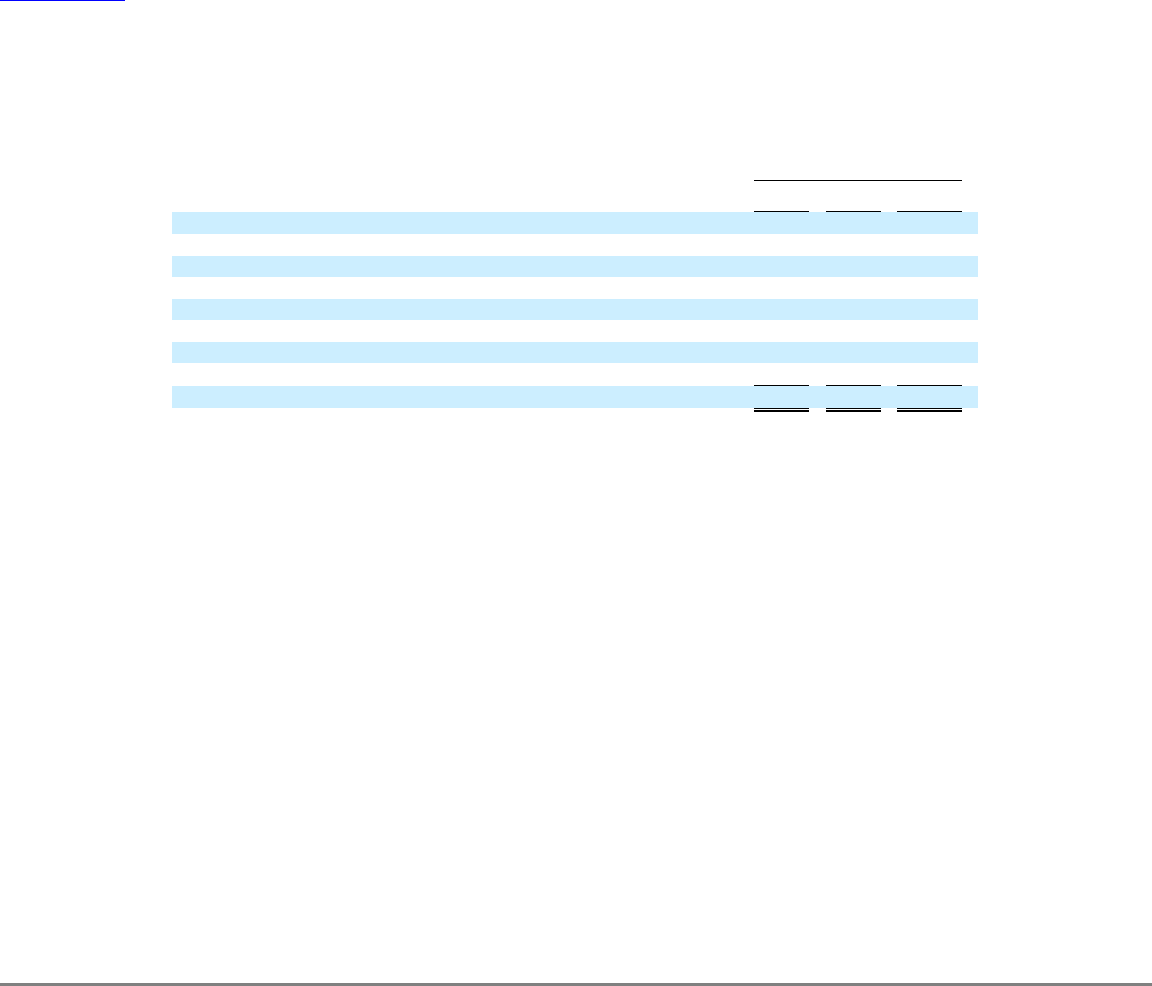

ThefollowingtablesummarizestheactivityrelatedtotheCompany'sgrossunrecognizedtaxbenefits:

ItistheCompany'spolicytoincludeinterestandpenaltiesrelatedtounrecognizedtaxbenefitsintheprovisionforincometaxesontheConsolidated

StatementsofOperations.Duringfiscalyear2016,theCompanyrecognizednetincometaxbenefitforinterestandpenaltiesof$8millionascomparedtonet

incometaxexpenseof$26millionduringfiscalyear2015,andincometaxexpenseof$8millionduringfiscalyear2014.AsofJuly1,2016,theCompanyhad

$12millionofaccruedinterestandpenaltiesrelatedtounrecognizedtaxbenefitscomparedto$20millioninfiscalyear2015.

Duringthe12monthsbeginningJuly2,2016,theCompanyexpectsthatitsunrecognizedtaxbenefitscouldbereducedbyapproximately$16millionasa

resultoftheexpirationofcertainstatutesoflimitation.

TheCompanyissubjecttotaxationinmanyjurisdictionsgloballyandisrequiredtofileU.S.federal,U.S.stateandnon-U.S.incometaxreturns.OnApril4,

2016,theIRSapprovedtheauditsettlementreachedinDecember2015regardingalldisputedissuesassociatedwiththeCompany'sU.S.federalincometaxreturns

forfiscalyears2008,2009and2010.ThisauditsettlementdidnothaveamaterialimpactontheCompany'sfinancialstatements.

TheCompanyisnolongersubjecttoexaminationofitsU.S.federalincometaxreturnsforyearspriortofiscalyear2013.WithrespecttoU.S.stateandnon-

U.S.incometaxreturns,theCompanyisgenerallynolongersubjecttotaxexaminationforyearsendingpriortofiscalyear2005.

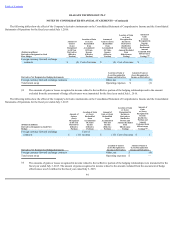

8.DerivativeFinancialInstruments

TheCompanyisexposedtoforeigncurrencyexchangerate,interestrate,andtoalesserextent,equitypricerisksrelatingtoitsongoingbusinessoperations.

TheCompanyentersintoforeigncurrencyforwardexchangecontractsinordertomanagetheforeigncurrencyexchangerateriskonforecastedexpenses

denominatedinforeigncurrenciesandtomitigatetheremeasurementriskofcertainforeigncurrencydenominatedliabilities.TheCompany'saccountingpolicies

fortheseinstrumentsarebasedonwhethertheinstrumentsareclassifiedasdesignatedornon-designatedhedginginstruments.TheCompanyrecordsall

derivativesintheConsolidatedBalanceSheetsatfairvalue.Thechangesinthefairvalueoftheeffectiveportionsofdesignatedcashflowhedgesarerecordedin

Accumulatedothercomprehensivelossuntilthehedgeditemisrecognizedinearnings.Derivativesthatarenotdesignatedashedginginstrumentsandthe

ineffectiveportionsofcashflowhedgesareadjustedtofairvaluethroughearnings.Theamountofnet

91

FiscalYearsEnded

(Dollarsinmillions)

July1,

2016

July3,

2015

June27,

2014

Balanceofunrecognizedtaxbenefitsatthebeginningoftheyear $ 83 $ 115 $ 157

Grossincreasefortaxpositionsofprioryears 12 12 10

Grossdecreasefortaxpositionsofprioryears (8) (4) (64)

Grossincreasefortaxpositionsofcurrentyear 11 9 13

Grossdecreasefortaxpositionsofcurrentyear — — —

Settlements — (45) —

Lapseofstatutesoflimitation (27) (3) (3)

Non-U.S.exchange(gain)/loss (1) (1) 2

Balanceofunrecognizedtaxbenefitsattheendoftheyear $ 70 $ 83 $ 115