Seagate 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

thereportingunitgoodwillwiththecarryingamountofthatgoodwill.Anyexcessofthereportingunitgoodwillcarryingvalueoveritsimpliedfairvalueis

recognizedasanimpairmentloss.

InaccordancewithASC360-05-4,ImpairmentorDisposalofLong-livedAssets,wetestotherlong-livedassets,includingproperty,equipmentandleasehold

improvementsandotherintangibleassetssubjecttoamortization,forrecoverabilitywhenevereventsorchangesincircumstancesindicatethatthecarryingvalues

ofthoseassetsmaynotberecoverable.Weassesstherecoverabilityofanassetgroupbydeterminingifthecarryingvalueoftheassetgroupexceedsthesumofthe

projectedundiscountedcashflowsexpectedtoresultfromtheuseandeventualdispositionoftheassetsovertheremainingeconomiclifeoftheprimaryassetinthe

assetgroup.Iftherecoverabilitytestindicatesthatthecarryingvalueoftheassetgroupisnotrecoverable,wewillestimatethefairvalueoftheassetgroupand

compareittoitscarryingvalue.Theexcessofthecarryingvalueoverthefairvalueisallocatedproratatoderivetheadjustedcarryingvalueofeachassetinthe

assetgroup.Theadjustedcarryingvalueofeachassetintheassetgroupisnotreducedbelowitsfairvalue.

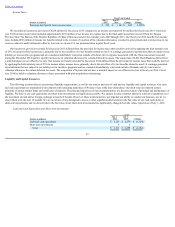

RecentAccountingPronouncements

See"Item8.FinancialStatementsandSupplementaryData—Note1.BasisofPresentationandSummaryofSignificantAccountingPolicies"forinformation

regardingtheeffectofnewaccountingpronouncementsonourfinancialstatements.

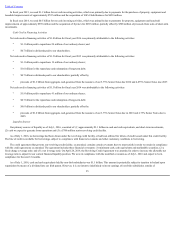

ITEM7A.QUANTITATIVEANDQUALITATIVEDISCLOSURESABOUTMARKETRISK

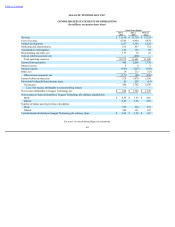

Wehaveexposuretomarketrisksduetothevolatilityofinterestrates,foreigncurrencyexchangerates,equityandbondmarkets.Aportionoftheserisksare

hedged,butfluctuationscouldimpactourresultsofoperations,financialpositionandcashflows.Additionally,wehaveexposuretodowngradesinthecredit

ratingsofourcounterpartiesaswellasexposurerelatedtoourcreditratingchanges.

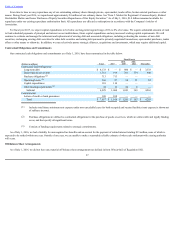

InterestRateRisk.Ourexposuretomarketriskforchangesininterestratesrelatesprimarilytoourinvestmentportfolio.AsofJuly1,2016,theCompany

hadnomaterialavailable-for-salesecuritiesthathadbeeninacontinuousunrealizedlosspositionforaperiodgreaterthan12months.TheCompanydeterminedno

materialavailable-for-salesecuritieswereother-than-temporarilyimpairedasofJuly1,2016.Wecurrentlydonotusederivativefinancialinstrumentsinour

investmentportfolio.

Wehavefixedratedebtobligations.Weenterintodebtobligationsforgeneralcorporatepurposesincludingcapitalexpendituresandworkingcapitalneeds.

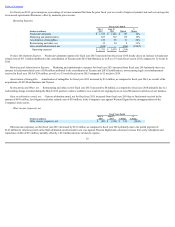

Thetablebelowpresentsprincipalamountsandrelatedweighted-averageinterestratesbyyearofmaturityforourinvestmentportfolioanddebtobligationsas

ofJuly1,2016.

60