Seagate 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

newlyintroducedproductsbecauseoflimitedexperiencewiththoseproductsuponwhichtobaseourwarrantyestimates.

Theactualresultswithregardtowarrantyexpenditurescouldhaveanadverseorfavorableeffectonourresultsofoperationsiftheactualrateofunitfailure,

thecosttorepairaunit,ortheactualcostrequiredtosatisfycustomerclaimsdiffersfromthoseestimatesweusedindeterminingthewarrantyaccrual.Sincewe

typicallyoutsourceourwarrantyrepairs,ourrepaircostissubjecttoperiodicnegotiationswithvendorsandmayvaryfromourestimates.Wealsoexercise

judgmentinestimatingourabilitytosellcertainrepairedproducts.Totheextentsuchsalesfallbelowourforecast,warrantycostwillbeadverselyimpacted.

Wereviewourwarrantyaccrualquarterlyforproductsshippedinpriorperiodsandwhicharestillunderwarranty.Anychangesintheestimatesunderlying

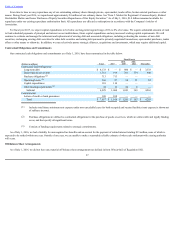

theaccrualmayresultinadjustmentsthatimpactthecurrentperiodgrossmarginsandincome.Infiscalyears2016,2015and2014netchangesinestimatesofprior

warrantyaccrualsasapercentageofrevenuewereimmaterial.Ourtotalwarrantycostwas1.0%,1.1%and1.3%ofrevenueduringfiscalyears2016,2015and

2014,respectively,whilewarrantycostrelatedtonewshipments(exclusiveoftheimpactofre-estimatesofpre-existingliabilities)were1.1%,1.1%and1.3%

respectively,forthesameperiods.Changesinanticipatedfailureratesofspecificproductsandsignificantchangesinrepairorreplacementcostshavehistorically

beenthemajorreasonsforsignificantchangesinpriorestimates.Anyfuturechangesinfailureratesofcertainproducts,aswellaschangesinrepaircostsorthe

costofreplacementparts,mayresultinincreasedordecreasedwarrantyaccruals.

AccountingforIncomeTaxes.WeaccountforincometaxespursuanttoAccountingStandardsCodification("ASC")Topic740("ASC740"),Income

Taxes.Inapplying,ASC740,wemakecertainestimatesandjudgmentsindeterminingincometaxexpenseforfinancialstatementpurposes.Theseestimatesand

judgmentsoccurinthecalculationoftaxcredits,recognitionofincomeanddeductionsandcalculationofspecifictaxassetsandliabilities,whicharisefrom

differencesinthetimingofrecognitionofrevenueandexpensefortaxandfinancialstatementpurposes,aswellastaxliabilitiesassociatedwithuncertaintax

positions.Thecalculationoftaxliabilitiesinvolvesuncertaintiesintheapplicationofcomplextaxrulesandthepotentialforfutureadjustmentofouruncertaintax

positionsbytheInternalRevenueServiceorothertaxjurisdictions.Ifestimatesofthesetaxliabilitiesaregreaterorlessthanactualresults,anadditionaltax

benefitorprovisionwillresult.ThedeferredtaxassetswerecordeachperioddependprimarilyonourabilitytogeneratefuturetaxableincomeintheUnitedStates

andcertainnon-U.S.jurisdictions.Eachperiod,weevaluatetheneedforavaluationallowanceforourdeferredtaxassetsand,ifnecessary,weadjustthevaluation

allowancesothatnetdeferredtaxassetsarerecordedonlytotheextentweconcludeitismorelikelythannotthatthesedeferredtaxassetswillberealized.Ifour

outlookforfuturetaxableincomechangessignificantly,ourassessmentoftheneedforavaluationallowancemayalsochange.

AssessingGoodwillandOtherLong-livedAssetsforImpairment.WeaccountforgoodwillinaccordancewithASCTopic350,Intangibles—Goodwilland

Other.AspermittedbyASC350,weperformaqualitativeassessmentinthefourthquarterofeachyear,ormorefrequentlyifindicatorsofpotentialimpairment

exist,todetermineifanyeventsorcircumstancesexist,suchasanadversechangeinbusinessclimateoradeclineintheoverallindustrythatwouldindicatethatit

wouldmorelikelythannotreducethefairvalueofareportingunitbelowitscarryingamount.Basedonthequalitativeassessment,ifitisnotmorelikelythannot

thatthefairvalueofareportingunitislessthanitscarryingamount,thentheCompanyisnotrequiredtoperformthetwo-stepgoodwillimpairmenttest.Ifitis

determinedinthequalitativeassessmentthatthefairvalueofareportingunitismorelikelythannotbelowitscarryingamount,includinggoodwill,thenwe

performaquantitativetwo-stepimpairmenttest.Thefirststep,identifyingapotentialimpairment,comparesthefairvalueofareportingunitwithitscarrying

amount,includinggoodwill.Ifthecarryingvalueofthereportingunitexceedsitsfairvalue,thesecondstepwouldneedtobeconducted.Thesecondstep,

measuringtheimpairmentloss,comparestheimpliedfairvalueof

59