Seagate 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

IncomeTaxes

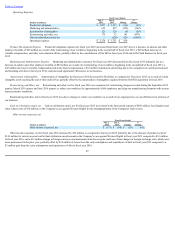

Werecordedanincometaxprovisionof$26millionforfiscalyear2016comparedtoanincometaxprovisionof$228millionforfiscalyear2015.Ourfiscal

year2016incometaxprovisionincludedapproximately$22millionofincometaxbenefitsprimarilyassociatedwiththereleaseoftaxreservesduetothe

expirationofcertainstatutesoflimitation.Ourfiscalyear2015incometaxprovisionincludedapproximately$193millionofnetincometaxexpenseduetothe

finalauditassessmentreceivedfromtheJiangsuProvinceStateTaxBureauofthePeople'sRepublicofChina(Chinaassessment)forcalendaryears2007through

2013.

OurIrishtaxresidentparentholdingcompanyownsvariousU.S.andnon-U.S.subsidiariesthatoperateinmultiplenon-Irishincometaxjurisdictions.Our

worldwideoperatingincomeiseithersubjecttovaryingratesofincometaxorisexemptfromincometaxduetotaxholidayprogramsweoperateunderin

Malaysia,SingaporeandThailand.Thesetaxholidaysarescheduledtoexpireinwholeorinpartatvariousdatesthrough2024.

Ourincometaxprovisionrecordedforfiscalyear2016differedfromtheprovisionforincometaxesthatwouldbederivedbyapplyingtheIrishstatutoryrate

of25%toincomebeforeincometaxes,primarilyduetotheneteffectof(i)taxbenefitsrelatedtonon-U.S.earningsgeneratedinjurisdictionsthataresubjecttotax

holidaysortaxincentiveprogramsandareconsideredindefinitelyreinvestedoutsideofIreland,(ii)taxbenefitsassociatedwiththereversalofpreviouslyrecorded

taxes,and(iii)adecreaseinvaluationallowanceforcertaindeferredtaxassets.TheacquisitionofDotHillSystemCorporationdidnothaveamaterialimpacton

oureffectivetaxrate.Ourincometaxprovisionrecordedforfiscalyear2015differedfromtheprovisionforincometaxesthatwouldbederivedbyapplyingthe

Irishstatutoryrateof25%toincomebeforeincometaxes,primarilyduetotheneteffectof(i)taxbenefitsrelatedtonon-U.S.earningsgeneratedinjurisdictions

thataresubjecttotaxholidaysortaxincentiveprogramsandareconsideredindefinitelyreinvestedoutsideofIreland,(ii)taxexpenseassociatedwiththeChina

assessmentrecordedduringtheDecember2014quarter,and(iii)anincreaseinvaluationallowanceforcertaindeferredtaxassets.TheacquisitionofLSI'sFlash

Businessdidnothaveamaterialimpactonoureffectivetaxrate.

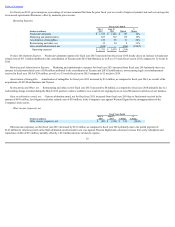

OnDecember18,2015,theProtectingAmericansfromTaxHikes("PATH")Actof2015wasenacted.Among,otherprovisions,thePATHActretroactively

reinstatedandpermanentlyextendedthefederalResearchandDevelopment("R&D")taxcreditfromDecember31,2014.ThepermanentextensionoftheR&D

credithadnoimmediateimpactonourincometaxprovisionduetovaluationallowancesonourU.S.deferredtaxassets.NoneoftheotherPATHActchangeshad

amaterialimpactonourincometaxprovision.

Basedonournon-U.S.ownershipstructureandsubjectto(i)potentialfutureincreasesinourvaluationallowancefordeferredtaxassets;and(ii)afuture

changeinourintentiontoindefinitelyreinvestearningsfromoursubsidiariesoutsideofIreland,weanticipatethatoureffectivetaxrateinfutureperiodswill

generallybelessthantheIrishstatutoryrate.

AtJuly1,2016,ourdeferredtaxassetvaluationallowancewasapproximately$984million.

AtJuly1,2016,wehadnetdeferredtaxassetsof$606million.Therealizationofthesedeferredtaxassetsisprimarilydependentonourabilitytogenerate

sufficientU.S.andcertainnon-U.S.taxableincomeinfutureperiods.Althoughrealizationisnotassured,webelievethatitismorelikelythannotthatthese

deferredtaxassetswillberealized.Theamountofdeferredtaxassetsconsideredrealizable,however,mayincreaseordecreaseinsubsequentperiodswhenwere-

evaluatetheunderlyingbasisforourestimatesoffutureU.S.andcertainnon-U.S.taxableincome.

50

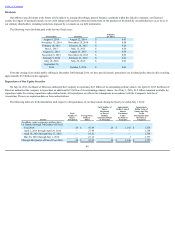

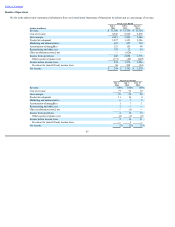

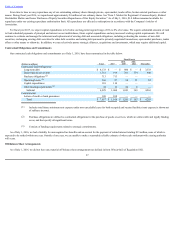

FiscalYearsEnded

(Dollarsinmillions)

July1,

2016

July3,

2015 Change

%

Change

Provisionforincometaxes $ 26 $ 228 $ (202) (89)%