Seagate 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

measurementdate.TheCompanycorroboratesthepricesobtainedfromthepricingserviceagainstotherindependentsourcesand,asofJuly1,2016,hasnotfound

itnecessarytomakeanyadjustmentstothepricesobtained.TheCompany'sderivativefinancialinstrumentsarealsoclassifiedwithinLevel2.TheCompany's

derivativefinancialinstrumentsconsistofforeigncurrencyforwardexchangecontractsandtheTRS.TheCompanyrecognizesderivativefinancialinstrumentsin

itsconsolidatedfinancialstatementsatfairvalue.TheCompanydeterminesthefairvalueoftheseinstrumentsbyconsideringtheestimatedamountitwouldpayor

receivetoterminatetheseagreementsatthereportingdate.

AsofJuly1,2016andJuly3,2015,wehadnoLevel3assetsorliabilities.

ItemsMeasuredatFairValueonaNon-RecurringBasis

TheCompanyentersintocertainstrategicinvestmentsforthepromotionofbusinessandstrategicobjectives.Strategicinvestmentsinequitysecuritieswhere

theCompanydoesnothavetheabilitytoexercisesignificantinfluenceovertheinvestees,includedinOtherassets,netintheConsolidatedBalanceSheets,are

recordedatcostandareperiodicallyanalyzedtodeterminewhetherornotthereareindicatorsofimpairment.ThecarryingvalueoftheCompany'sstrategic

investmentsatJuly1,2016andJuly3,2015totaled$113millionand$120million,respectively,andconsistedprimarilyofprivatelyheldequitysecuritieswithout

areadilydeterminablefairvalue.

Duringthefiscalyears2016,2015and2014,theCompanydeterminedthatcertainofitsequityinvestmentsaccountedforunderthecostmethodwereother-

than-temporarilyimpaired,andrecognizedchargesof$13million,$7millionand$2million,respectively,inordertowritedownthecarryingamountofthe

investmentstoitsestimatedfairvalue.TheseamountswererecordedinOther,netintheConsolidatedStatementsofOperations.Sincetherewasnoactivemarket

fortheequitysecuritiesoftheinvestee,theCompanyestimatedfairvalueoftheinvesteebyanalyzingtheunderlyingcashflowsandfutureprospectsofthe

investee.

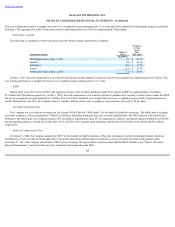

OtherFairValueDisclosures

TheCompany'sdebtiscarriedatamortizedcost.ThefairvalueoftheCompany'sdebtisderivedusingtheclosingpriceofthesamedebtinstrumentsasofthe

dateofvaluation,whichtakesintoaccounttheyieldcurve,interestrates,andotherobservableinputs.Accordingly,thesefairvaluemeasurementsarecategorized

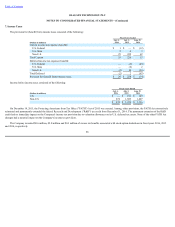

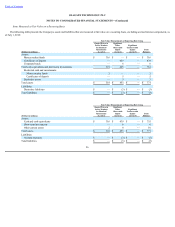

asLevel2.ThefollowingtablepresentsthefairvalueandamortizedcostoftheCompany'sdebtinorderofmaturity:

98

July1,2016 July3,2015

(Dollarsinmillions)

Carrying

Amount

Estimated

FairValue

Carrying

Amount

Estimated

FairValue

3.75%SeniorNotesdueNovember2018 $ 800 $ 804 $ 800 $ 828

7.00%SeniorNotesdueNovember2021 158 164 158 170

4.75%SeniorNotesdueJune2023 990 857 1,000 1,016

4.75%SeniorNotesdueJanuary2025 995 795 1,000 995

4.875%SeniorNotesdueJune2027 698 514 698 675

5.75%SeniorNotesdueDecember2034 489 357 499 491

4,130 3,491 4,155 4,175

Lessshort-termborrowingsandcurrentportionoflong-termdebt — — — —

Long-termdebt,lesscurrentportion $ 4,130 $ 3,491 $ 4,155 $ 4,175