Seagate 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

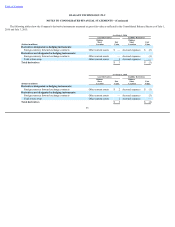

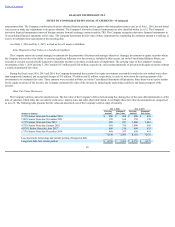

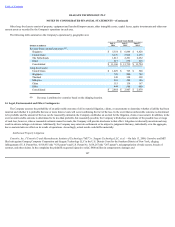

ThefairvalueoftheCompany'ssharesrelatedtooptionsgrantedtoemployees,sharesissuedfromtheESPPandperformanceawardssubjecttoTSR/ROIC

conditionsforfiscalyears2016,2015and2014wereestimatedusingthefollowingassumptions:

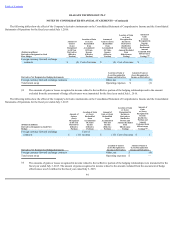

StockCompensationExpense

TheCompanyrecorded$120million,$137millionand$118millionofshare-basedcompensationduringfiscalyears2016,2015,and2014,respectively.

Managementhasmadeanestimateofexpectedforfeituresandisrecognizingcompensationcostsonlyforthoseequityawardsexpectedtovest.Whenestimating

forfeitures,theCompanyconsidersvoluntaryterminationbehavioraswellasanalysisofactualforfeitedawards.

103

FiscalYears

2016 2015 2014

Options

Expectedterm(inyears) 2.1–4.2 4.2 4.2

Volatility 33–48% 33–35% 35–41%

Weighted-averagevolatility 36% 34% 40%

Expecteddividendrate 4.6–11.0% 2.9–4.0% 3.1–3.8%

Weighted-averageexpecteddividendrate 5.6% 3.0% 3.7%

Risk-freeinterestrate 0.6–1.5% 1.1–1.5% 1.2–1.4%

Weighted-averagefairvalue $12.28 $12.98 $10.41

ESPP

Expectedterm(inyears) 0.5 0.5 0.5

Volatility 28–46% 28–29% 34–36%

Weighted-averagevolatility 39% 28% 35%

Expecteddividendrate 4.6–8.3% 3.0–3.8% 3.3–3.5%

Weighted-averageexpecteddividendrate 6.9% 3.4% 3.4%

Risk-freeinterestrate 0.5% 0.1% 0.1%

Weighted-averagefairvalue $9.08 $12.21 $10.46

Performancerestrictedshareawardssubjecttomarketcondition

Expectedterm(inyears) 3.00 3.00 3.00

Weighted-averagevolatility 30% 40% 46%

Expecteddividendrate 4.3% 2.8% 3.8%

Risk-freeinterestrate 1.1% 1.1% 0.9%

Weighted-averagefairvalue $47.34 $58.31 $37.51