Seagate 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

DeterminingFairValueofSeagateTechnologyStockPlans

Valuationandamortizationmethod—TheCompanyestimatesthefairvalueofstockoptionsgrantedusingtheBlack-Scholes-Mertonvaluationmodelanda

singleoptionawardapproach.Thisfairvalueisthenamortizedonastraight-linebasisovertherequisiteserviceperiodsoftheawards,whichisgenerallythe

vestingperiodortheremainingservice(vesting)period.

ExpectedTerm—ExpectedtermrepresentstheperiodthattheCompany'sstock-basedawardsareexpectedtobeoutstandingandwasdeterminedbasedon

historicalexperienceofsimilarawards,givingconsiderationtothecontractualtermsofthestock-basedawards,vestingschedulesandexpectationsoffuture

employeebehaviorasinfluencedbychangestothetermsofitsstock-basedawards.

ExpectedVolatility—TheCompanyusesacombinationoftheimpliedvolatilityofitstradedoptionsandhistoricalvolatilityofitsshareprice.

ExpectedDividend—TheBlack-Scholes-Mertonvaluationmodelcallsforasingleexpecteddividendyieldasaninput.Thedividendyieldisdeterminedby

dividingtheexpectedpersharedividendduringthecomingyearbythegrantdateshareprice.TheexpecteddividendassumptionisbasedontheCompany's

currentexpectationsaboutitsanticipateddividendpolicy.Also,becausetheexpecteddividendyieldshouldreflectmarketplaceparticipants'expectations,the

Companydoesnotincorporatechangesindividendsanticipatedbymanagementunlessthosechangeshavebeencommunicatedtoorotherwiseareanticipatedby

marketplaceparticipants.

Risk-FreeInterestRate—TheCompanybasestherisk-freeinterestrateusedintheBlack-Scholes-Mertonvaluationmodelontheimpliedyieldcurrently

availableonU.S.Treasuryzero-couponissueswithanequivalentremainingterm.WheretheexpectedtermoftheCompany'sstock-basedawardsdonot

correspondwiththetermsforwhichinterestratesarequoted,theCompanyperformedastraight-lineinterpolationtodeterminetheratefromtheavailableterm

maturities.

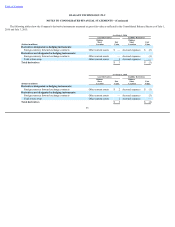

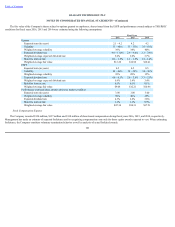

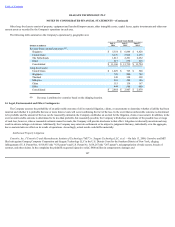

FairValue—ThefairvalueoftheCompany'snonvestedawardsandperformanceawardssubjecttoanAEPSconditionforfiscalyears2016,2015,and2014,

isthepricepershareoftheCompany'scommonstockonthegrantdate.Theweighted-averagegrantdatefairvalueofawardsgrantedareasfollows:

102

FiscalYears

2016 2015 2014

Nonvestedawards:

Weighted-averagefairvalue $ 41.47 $ 58.93 $ 41.18

Performanceawards:

Weighted-averagefairvalue $ 42.09 $ 59.51 $ 48.69