Seagate 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

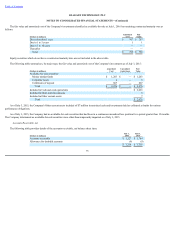

Cashequivalentsarecarriedatcost,whichapproximatesfairvalue.TheCompany'sshort-terminvestmentsareprimarilycomprisedofmoneymarketfunds,

certificatesofdeposits,andotherinterest-bearingbankdeposits.TheCompanyhasclassifieditsmarketablesecuritiesasavailable-for-saleandtheyarestatedat

fairvaluewithunrealizedgainsandlossesincludedinAccumulatedothercomprehensiveincome(loss),whichisacomponentofShareholders'Equity.The

Companyevaluatestheavailable-forsalesecuritiesinanunrealizedlosspositionforother-than-temporaryimpairment.Realizedgainsandlossesareincludedin

Other,net.Thecostofsecuritiessoldisbasedonthespecificidentificationmethod.

RestrictedCashandInvestments.Restrictedcashandinvestmentsrepresentcashandcashequivalentsandinvestmentsthatarerestrictedastowithdrawal

oruseforotherthancurrentoperations.

AllowancesforDoubtfulAccounts.TheCompanymaintainsanallowanceforuncollectibleaccountsreceivablebaseduponexpectedcollectability.This

reserveisestablishedbaseduponhistoricaltrends,globalmacroeconomicconditionsandananalysisofspecificexposures.Theprovisionfordoubtfulaccountsis

recordedasachargetoMarketingandadministrativeexpense.

Inventory.Inventoriesarevaluedatthelowerofcost(usingthefirst-in,first-outmethod)ormarket.Marketvalueisbaseduponanestimatedaverage

sellingpricereducedbyestimatedcostofcompletionanddisposal.

Property,EquipmentandLeaseholdImprovements.Property,equipmentandleaseholdimprovementsarestatedatcost.Equipmentandbuildingsare

depreciatedusingthestraight-linemethodovertheestimatedusefullivesoftheassets.Leaseholdimprovementsareamortizedusingthestraight-linemethodover

theshorteroftheestimatedlifeoftheassetortheremainingtermofthelease.Thecostsofadditionsandsubstantialimprovementstoproperty,equipmentand

leaseholdimprovements,whichextendtheeconomiclifeoftheunderlyingassets,arecapitalized.Thecostofmaintenanceandrepairstoproperty,equipmentand

leaseholdimprovementsareexpensedasincurred.

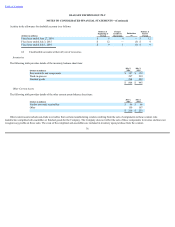

AssessmentofGoodwillandOtherLong-livedAssetsforImpairment.TheCompanyaccountsforgoodwillinaccordancewithAccountingStandards

Codification("ASC")Topic350("ASC350"),Intangibles—GoodwillandOther.Duringfiscalyear2012,theCompanyadoptedAccountingStandardUpdate

("ASU")No.2011-08,Intangibles—GoodwillandOther(ASCTopic350)—TestingGoodwillforImpairment.TheCompanyperformsaqualitativeassessmentin

thefourthquarterofeachyear,ormorefrequentlyifindicatorsofpotentialimpairmentexist,todetermineifanyeventsorcircumstancesexist,suchasanadverse

changeinbusinessclimateoradeclineintheoverallindustrythatwouldindicatethatitwouldmorelikelythannotreducethefairvalueofareportingunitbelow

itscarryingamount,includinggoodwill.Ifitisdeterminedinthequalitativeassessmentthatthefairvalueofareportingunitismorelikelythannotbelowits

carryingamount,includinggoodwill,thentheCompanyperformsaquantitativetwo-stepimpairmenttest.Thefirststep,identifyingapotentialimpairment,

comparesthefairvalueofareportingunitwithitscarryingamount,includinggoodwill.Ifthecarryingvalueofthereportingunitexceedsitsfairvalue,thesecond

stepwouldneedtobeconducted.Thesecondstep,measuringtheimpairmentloss,comparestheimpliedfairvalueofthereportingunitgoodwillwiththecarrying

amountofthatgoodwill.Anyexcessofthereportingunitgoodwillcarryingvalueoveritsimpliedfairvalueisrecognizedasanimpairmentloss.

TheCompanytestsotherlong-livedassets,includingproperty,equipmentandleaseholdimprovementsandotherintangibleassetssubjecttoamortization,for

recoverabilitywhenevereventsorchangesincircumstancesindicatethatthecarryingvalueofthoseassetsmaynotberecoverable.TheCompanyperformsa

recoverabilitytesttoassesstherecoverabilityofanassetgroup.Iftherecoverabilitytestindicatesthatthecarryingvalueoftheassetgroupisnotrecoverable,the

Companywillestimatethe

69