Qantas 2004 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

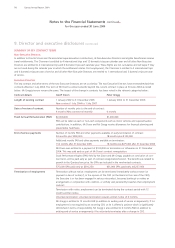

10. International Financial Reporting Standards continued

KEY DIFFERENCES BETWEEN AUSTRALIAN GAAP AND IFRS

The potential implications of the conversion to IFRS on the Qantas Group are outlined below. The summary should not be taken as

an exhaustive list of all the differences between Australian GAAP and IFRS. The impact on future years will depend on the particular

circumstances prevailing in those years. Accordingly, there can be no assurances that the consolidated statements of financial performance

and financial position would not be significantly different if determined in accordance with IFRS.

Frequent Flyer

Qantas is considering the application of AASB 118 “Revenue” to the accounting for the frequent flyer program. Australian GAAP and

IFRS do not specifically address accounting for frequent flyer/loyalty schemes. Under both GAAP’s there are two acceptable accounting

treatments including the Deferral and Incremental Cost approaches.

The Deferral approach results in the deferral of frequent flyer revenue until earned points are redeemed. The Incremental Cost approach

recognises revenue when points are allocated to individuals participating in the scheme, with the recognition of a corresponding provision

for the incremental cost of providing the service at a later date.

Both approaches are used by airlines globally and the most appropriate accounting policy is dependent upon factors such as the size of

the program, the mechanism for managing redemptions and the potential for frequent flyers to displace fare-paying passengers. Under

Australian GAAP, Qantas has adopted the Incremental Cost approach, as historically it has best reflected the commercial operation of

the program.

AASB 1 “First Time Adoption of Australian Equivalents to International Financial Reporting Standards”, requires that all accounting policies

be reconsidered having regard to both their current and future suitability.

As part of the Qantas IFRS transition project, the company is considering changing to the Deferral approach. Future growth in the scheme

and a desire to make redemptions easier, may require changes to the current marginal management of the scheme. Should a decision to

change to the Deferral method be approved, revenue previously recognised would be deferred and retained earnings reduced. In future

periods, deferred revenue would be released to the Statement of Financial Performance as points are redeemed. This treatment would no

longer necessitate the raising of a provision for future incremental costs.

The quantification of the financial impact of the possible change in treatment is complex and requires the calculation of the fair value of

unredeemed frequent flyer points, breakage rates and a detailed analysis of revenues previously brought to account. To date, the financial

effect of the change being considered has not been determined. It is anticipated that should it be adopted, a reduction in retained

earnings will be made. The impact on future profits is largely dependent on the extent to which the program grows and as such cannot

be quantified at this time.

Defined Benefit Superannuation Plans

Qantas is considering the application of AASB 119 “Employee Benefits” to the recognition of the funding surplus or deficit of the Qantas

sponsored defined benefit superannuation plans. Under the requirements of IFRS, any surpluses and deficits in the defined benefit

superannuation plans within the consolidated entity will be recognised in the Statement of Financial Position and movements in the surplus

or deficit recognised in the Statement of Financial Performance.

Actuarial valuations of the Plans will be conducted as at 30 June 2004. The expected impact is likely to be a one-off reduction in retained

earnings and the corresponding recognition of a retirement liability.

Leases

Qantas is considering the application of AASB 117 “Leases” to the classification of lease transactions. Under IFRS some leases currently

classified as operating may require recognition in the Statement of Financial Position. To date the financial effect of the change has not

been determined, however, it is not expected to have a significant impact on the Statement of Financial Performance in future years.

Financial Instruments: Recognition and Measurement

1. Fuel Hedging

Qantas is considering the application of AASB 139 “Financial Instruments: Recognition and Measurement” to aviation fuel hedging

transactions. Extensive hedge effectiveness testing and documentation is required under IFRS in order to apply hedge accounting to

these transactions. The potential application and impact of this accounting standard on aviation fuel hedging has not been determined.

2. Revenue Hedging

Qantas is considering the application of AASB 139 “Financial Instruments: Recognition and Measurement” to revenue hedging

transactions. The potential application and impact of this accounting standard on revenue hedging has not been completed. It is

anticipated that, after initial adoption adjustments are made, the existing accounting treatment will continue under IFRS, although

it will be subject to increased effectiveness testing and documentation requirements.

76 Qantas Annual Report 2004

Notes to the Financial Statements continued

for the year ended 30 June 2004