Qantas 2004 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Qantas Annual Report 2004 1Spirit of Australia

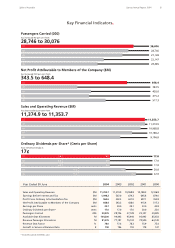

Qantas achieved a record profit in 2003/04. The Company

reported a profit before tax of $964.6 million, an increase of

92 per cent on last year’s result of $502.3 million. Net profit

after tax was $648.4 million, up 88.8 per cent from last year.

Revenue for the year totalled $11.4 billion, a decrease

of $21.2 million or 0.2 per cent. Total expenditure, including

borrowing costs, fell $483.5 million to $10.4 billion.

This excellent result was achieved in improving, but still

difficult, industry conditions.

Capitalising on a gradual recovery in both international and

domestic flying, Qantas realised a 92.8 per cent increase in

earnings before interest and tax on total international flying

to $398.9 million and a 141.8 per cent increase on total

domestic flying to $539.3 million. This outcome was

supported by substantial investment in product, on-time

performance and training that raised service standards across

the Company. Frequent Flyer and co-branded credit and

charge card areas continued to grow.

Cost and efficiency savings of $512 million offset a flat

revenue line still recovering from the effects of the war in

Iraq and SARS. Continuation of a successful fuel hedging

program partly offset rising jet fuel prices, which were

14.1 per cent higher than the previous year.

The Directors declared a fully franked final dividend of nine

cents per share, bringing total fully franked dividends for the

year to 17 cents per share.

Strategic Approach

Going forward, Qantas will strive for greater efficiency,

continue to invest in new aircraft and product, grow

operations and job opportunities and protect its reputation

as Australia’s national carrier and one of the world’s leading

airlines. We aim to compete effectively across all sectors of

the aviation marketplace and in a growing number of

markets.

The Qantas Group will invest more than $6 billion

in additional new aircraft and product over the next

three years.

Fifteen new aircraft were brought into service this year –

two Boeing 747-400ERs, three Boeing 737-800s,

three Airbus A330-300s and seven Bombardier Dash 8-

Q300s. New and more efficient aircraft, including Airbus

A330s, will also be deployed on new international routes,

such as Australia to London via Hong Kong, Australia to

Mumbai and Australia to Shanghai.

The new $385 million Qantas International Business Class,

featuring the award-winning Skybed sleeper seat, was

launched in September 2003. Skybed is now available on

all services to London, all Boeing 747 and Airbus A330

services to Hong Kong and is being progressively

introduced on other services, including to Los Angeles.

The Group’s freight operations will grow, building on new

markets in China and Europe and the synergies with

Australian air Express and with Star Track Express, which

was acquired in December 2003 for $750 million in a

joint venture with Australia Post.

The Group’s new low cost domestic carrier, Jetstar,

will build on existing and new leisure routes.

Qantas has taken 49.99 per cent ownership of a new

low cost carrier based in Singapore. The airline plans to

begin operating before the end of 2004 with three single-

aisle Airbus A320 aircraft, flying to a range of Asian

cities within five hours of Singapore. The owners will

invest a total of S$100 million in the new airline, with

Qantas contributing S$50 million. This is a modest

investment for Qantas, but an excellent opportunity

to participate in the growing intra-Asia travel market.

Flexibility in both the international and domestic fleets will

enable the Group to reduce capacity quickly, and for little

cost, in case of a major downturn.

Margaret Jackson

Chairman

Geoff Dixon

Chief Executive Officer

TO OUR FELLOW SHAREHOLDERS

QANTAS ACHIEVED A RECORD

PROFIT IN 2003/04.

GOING FORWARD, QANTAS WILL

STRIVE FOR GREATER EFFICIENCY,

CONTINUE TO INVEST IN NEW

AIRCRAFT AND PRODUCT AND

GROW ITS OPERATIONS AND

JOB OPPORTUNITIES.

Report from the Chairman

and Chief Executive Officer