Qantas 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

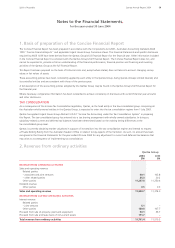

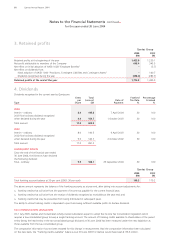

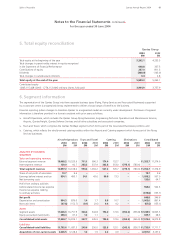

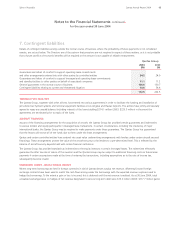

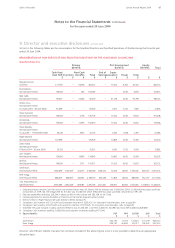

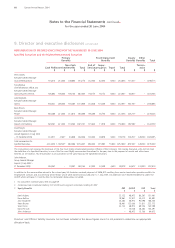

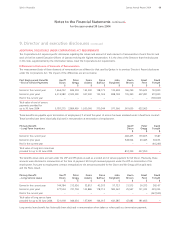

9. Director and executive disclosures continued

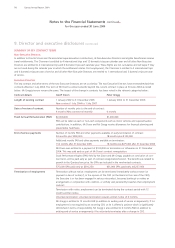

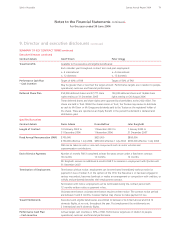

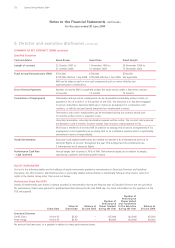

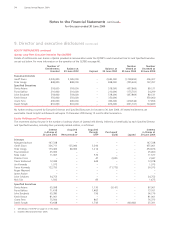

ELEMENTS OF REMUNERATION OF SPECIFIED DIRECTORS AND SPECIFIED EXECUTIVES continued

Description Rationale

PRIMARY BENEFITS

Fees

Non-Executive Director (NED) fees are determined within an

Fees and payments to NEDs reflect the demands and responsibilities

aggregate Directors’ fee pool limit. An annual pool of $1.5 million, which are

made of Directors and reflects the advice of independent

allocated between Directors’ Fees and Committee Fees was remuneration consultants to ensure NED fees and payments are

approved by shareholders on 17 October 2002. Shareholder appropriate. The level of NED fees are reviewed annually.

approval will be sought at the 2004 AGM to increase this pool.

Cash Fees are the fees remaining after salary sacrifice components

such as motor vehicles and superannuation have been deducted.

Effective 1 July 2003, each Director was paid an annual Fee of $100,000 and the Chairman $400,000. Committee fees were $20,000 per

Committee Membership and $30,000 per Committee Chairmanship. Effective 1 July 2004, the annual fee for each Committee Chairmanship

will increase to $40,000.

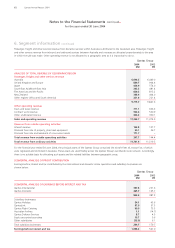

Fixed Annual Remuneration (FAR)

Guaranteed salary level from which superannuation and other FAR is set with reference to market data, reflecting the scope of

benefits are deducted through salary sacrifice. the role, the unique value of the role and the performance of the

person in the role. Total remuneration is reviewed annually and the

Cash FAR is the FAR remaining after salary sacrifice components policy is to reflect a middle of the market approach for the top 50

such as motor vehicles and superannuation have been deducted. ASX listed entities.

Performance Cash Plan (PCP)1– Cash Incentive

The cash incentive is set as a percentage of FAR and is payable on T

he performance condition of RoTGA being Earnings before

achievement of 90% of the target Return on Total Gross Assets

Depreciation, Rentals, Interest and Tax (EBDRIT) divided by Total

(RoTGA) and non-financial performance conditions relating

Gross Assets was chosen as it measures financial performance that

to customer, operational and people goals.

reflects an appropriate return on capital. Non-financial measures

ensure appropriate balance is reflected in the executive’s performance.

Long-Term Incentive, Share Based Plans

Stock Performance Rights (SPR) Plan – closed in 2004

The cash benefit payable to Executive Directors on termination This performance condition linked remuneration and growth in

after contract end date, or otherwise as determined by the Board.

shareholder value.

The benefit was related to growth in the Qantas share price.

The scheme was terminated early at 30 June 2004.

Long-Term Incentive Program (LTIP) – suspended 1999 and closed in 2004

The LTIP granted a notional entitlement to shares. Vesting was This performance condition linked remuneration and growth in

based on Qantas’ Relative Total Shareholder Return (TSR) compared shareholder value.

to ASX 100 entities and global airlines. The value on termination

of employment is based on the number of vested entitlements

and the share price.

Non-Cash benefits

Travel Entitlements

Directors and Specified Executives and their eligible beneficiaries Provides an effective form of remuneration as the value to the

are entitled to receive a number of international and domestic

individual is high and the cost to the company is minimal as the

flights annually at no cost.

only

cash outflow from the company is for the associated taxes

and the marginal cost of carrying the passenger.

Other Benefits

I

ncludes salary sacrifice components such as motor vehicles, Reflects market practice.

memberships of appropriate professional associations and the

accrual of statutory long service leave.

1 Refer footnote 1 on page 66.

Qantas Annual Report 2004 65Spirit of Australia

Notes to the Financial Statements continued

for the year ended 30 June 2004